Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi! will you explain how you did this if u can, please and thank you! HOMEWORK #3 Due October 2, 5:00 pm 10 points Dr.

Hi! will you explain how you did this if u can, please and thank you!

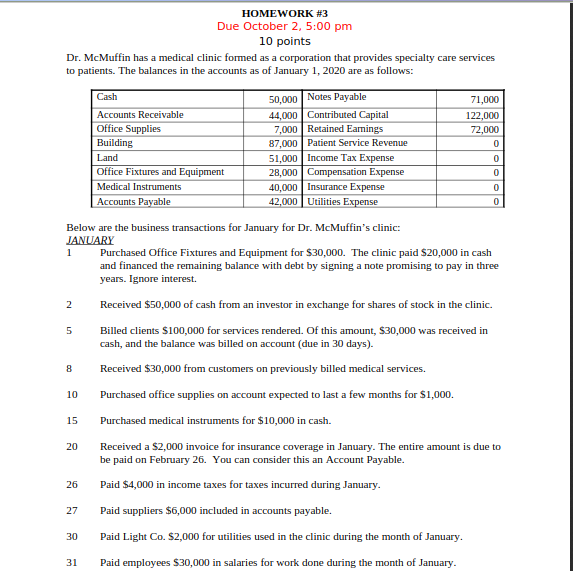

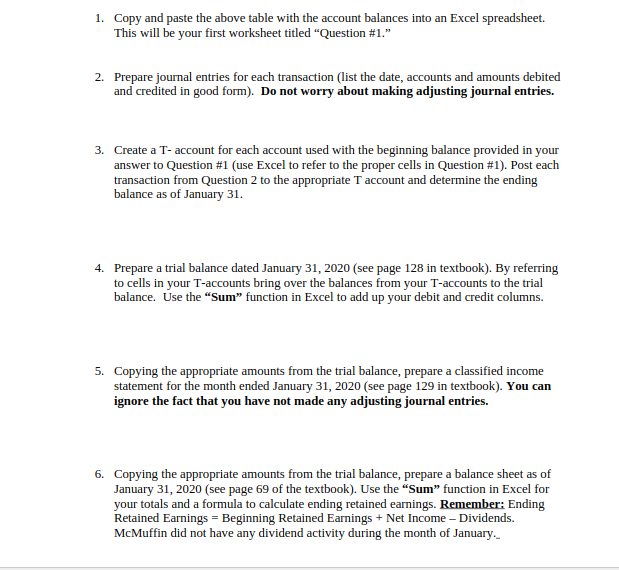

HOMEWORK #3 Due October 2, 5:00 pm 10 points Dr. McMuffin has a medical clinic formed as a corporation that provides specialty care services to patients. The balances in the accounts as of January 1, 2020 are as follows: Cash 50,000 Notes Payable 71,000 Accounts Receivable 44,000 Contributed Capital 122,000 Office Supplies 7,000 Retained Earnings 72,000 Building 87,000 Patient Service Revenue Land 51,000 Income Tax Expense Office Fixtures and Equipment 28,000 Compensation Expense 0 Medical Instruments 40,000 Insurance Expense 0 Accounts Payable 42,000 Utilities Expense 0 0 0 1 5 8 Below are the business transactions for January for Dr. McMuffin's clinic: JANUARY Purchased Office Fixtures and Equipment for $30,000. The clinic paid $20,000 in cash and financed the remaining balance with debt by signing a note promising to pay in three years. Ignore interest. 2 Received $50,000 of cash from an investor in exchange for shares of stock in the clinic. Billed clients $100,000 for services rendered. Of this amount, $30,000 was received in cash, and the balance was billed on account (due in 30 days). Received $30,000 from customers on previously billed medical services. 10 Purchased office supplies on account expected to last a few months for $1,000. Purchased medical instruments for $10,000 in cash. 20 Received a $2,000 invoice for insurance coverage in January. The entire amount is due to be paid on February 26. You can consider this an Account Payable. Paid $4,000 in income taxes for taxes incurred during January. 27 Paid suppliers $6,000 included in accounts payable. Paid Light Co. $2,000 for utilities used in the clinic during the month of January. Paid employees $30,000 in salaries for work done during the month of January 15 26 30 31 1. Copy and paste the above table with the account balances into an Excel spreadsheet. This will be your first worksheet titled "Question #1." 2. Prepare journal entries for each transaction (list the date, accounts and amounts debited and credited in good form). Do not worry about making adjusting journal entries. 3. Create a T-account for each account used with the beginning balance provided in your answer to Question #1 (use Excel to refer to the proper cells in Question #1). Post each transaction from Question 2 to the appropriate T account and determine the ending balance as of January 31. 4. Prepare a trial balance dated January 31, 2020 (see page 128 in textbook). By referring to cells in your T-accounts bring over the balances from your T-accounts to the trial balance. Use the "Sum function in Excel to add up your debit and credit columns. 5. Copying the appropriate amounts from the trial balance, prepare a classified income statement for the month ended January 31, 2020 (see page 129 in textbook). You can ignore the fact that you have not made any adjusting journal entries. 6. Copying the appropriate amounts from the trial balance, prepare a balance sheet as of January 31, 2020 (see page 69 of the textbook). Use the Sum function in Excel for your totals and a formula to calculate ending retained earnings. Remember: Ending Retained Earnings = Beginning Retained Earnings + Net Income - Dividends. McMuffin did not have any dividend activity during the month of JanuaryStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started