Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Would you show me how to solve #4 problem? Thanks in advance! Use the following information for problems 3 and 4. Sales COGS Millhouse

Hi,

Would you show me how to solve #4 problem?

Thanks in advance!

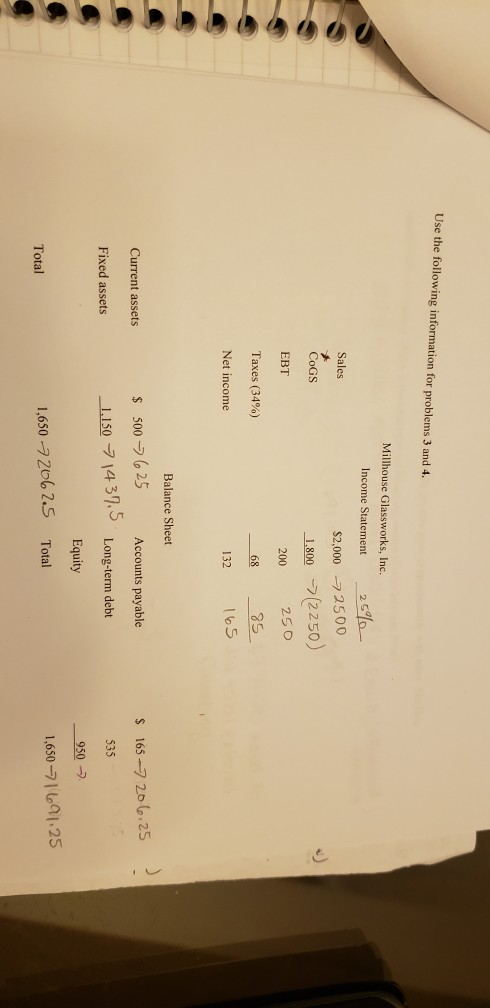

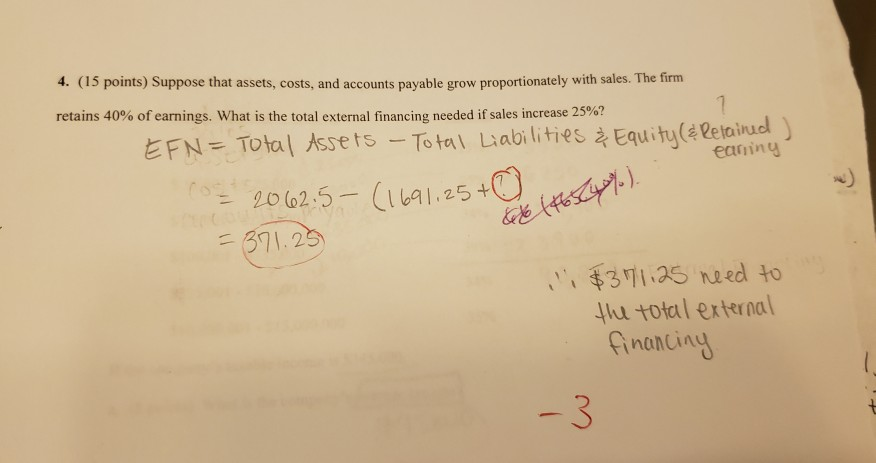

Use the following information for problems 3 and 4. Sales COGS Millhouse Glassworks, Inc. Income Statement 25940 $2,000 72500 1.800 > (2250) 200 250 68 85 132 165 EBT Taxes (34%) Net income Balance Sheet Current assets $ 165 -7 206.25 $ 500 625 1,150 -7 1437, Accounts payable Long-term debt Fixed assets 535 Equity 950 - 1,650 7691.25 Total 1,650-72062.5 Total 4. (15 points) Suppose that assets, costs, and accounts payable grow proportionately with sales. The tim 6614564%). retains 40% of earnings. What is the total external financing needed if sales increase 25%? EFN= Total Assets - Total Liabilities & Equity (& Retained ) earing = 2062.5- (1691,25+ ). = 371.25 1 $371,25 need to the total external financing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started