Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hi, Would you show me how to solve this problem uring a financial calculator please? I'm using BA 2 Plus from Texas Instruments. Thank you

Hi, Would you show me how to solve this problem uring a financial calculator please? I'm using BA 2 Plus from Texas Instruments. Thank you in advance!

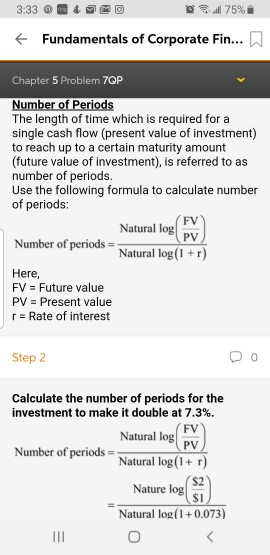

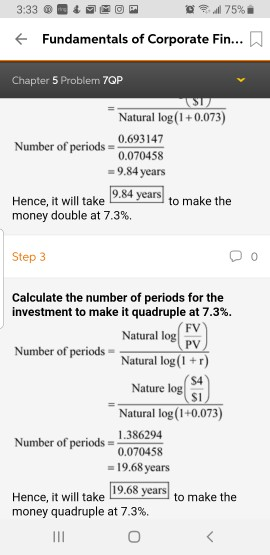

3:33 4 8.75% + Fundamentals of Corporate Fin... n Chapter 5 Problem 7QP Number of Periods The length of time which is required for a single cash flow (present value of investment) to reach up to a certain maturity amount (future value of investment), is referred to as number of periods. Use the following formula to calculate number of periods: Natural logo Number of periods = Natural log(1+r) Here, FV = Future value PV = Present value r = Rate of interest Step 2 DO Calculate the number of periods for the investment to make it double at 7.3%. Natural log Number of periods = Natural log(1 + r) Nature log Natural log(1 +0.073) 3:33 OOP 75% + Fundamentals of Corporate Fin... n Chapter 5 Problem 7QP Natural log(1 +0.073) 0.693147 Number of periods 0.070458 = 9.84 years Hence, it will take 7.0+ years to make the money double at 7.3%. Step 3 00 Calculate the number of periods for the investment to make it quadruple at 7.3%. Natural log PM Number of periods - Natural log(1+r Nature log Natural log(1+0.073) Number of periods - 1.386294 0.070458 = 19.68 years Hence, it will take 19.68 years to money quadruple at 7.3%. 111Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started