Answered step by step

Verified Expert Solution

Question

1 Approved Answer

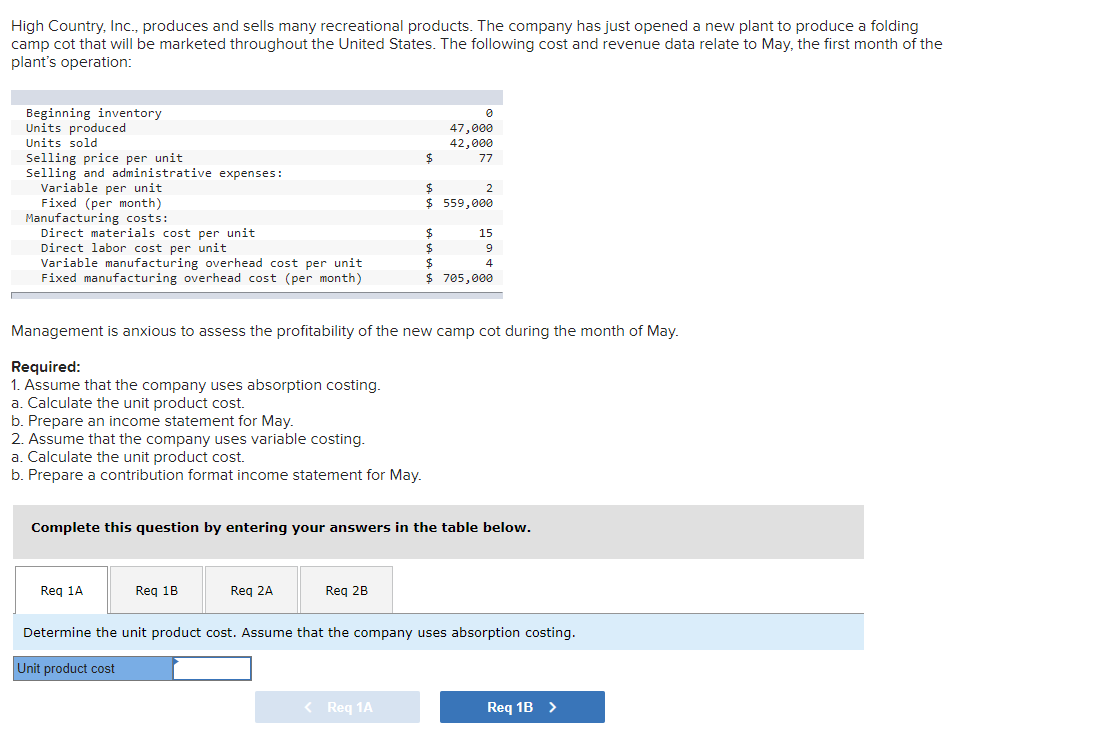

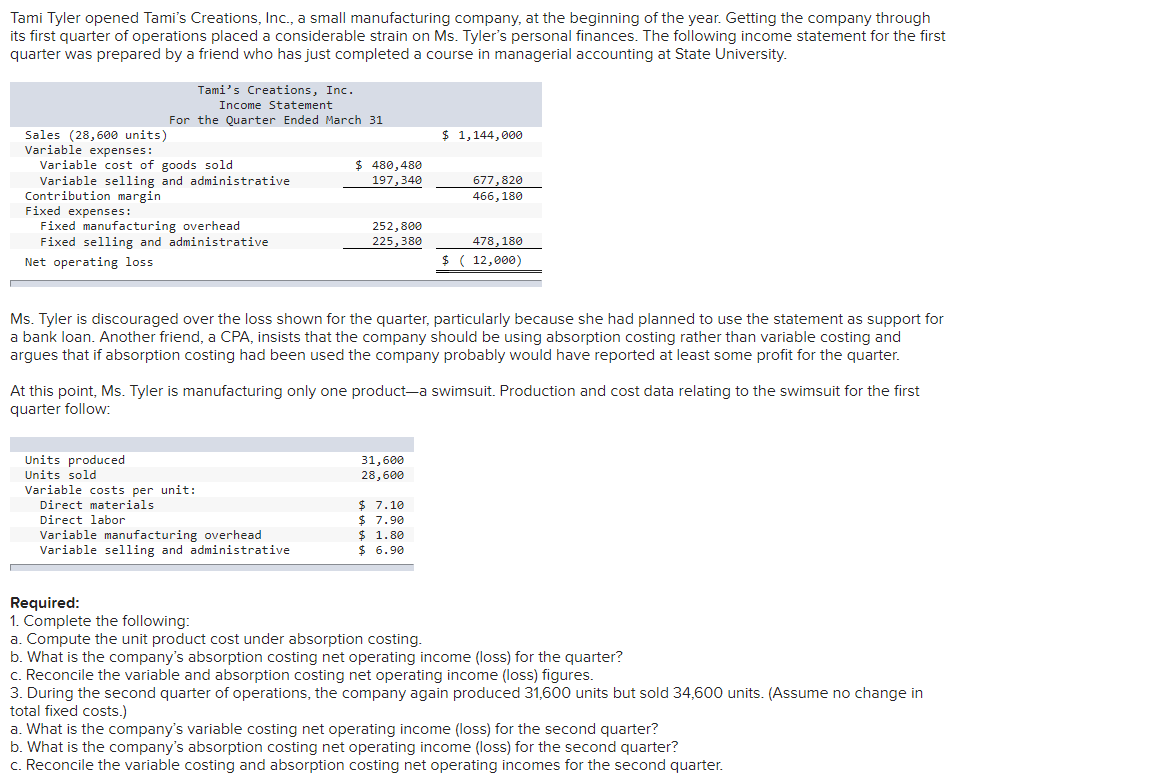

High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that

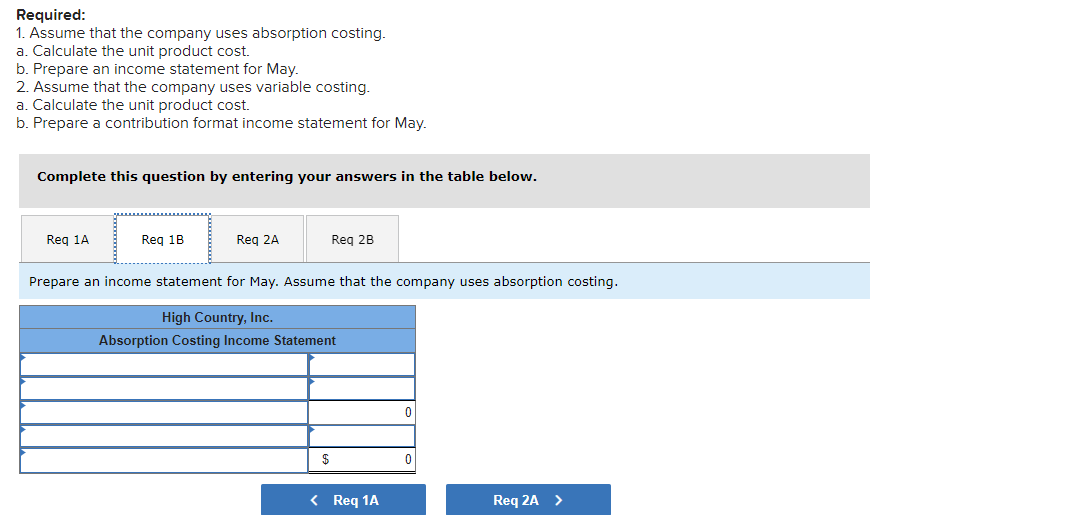

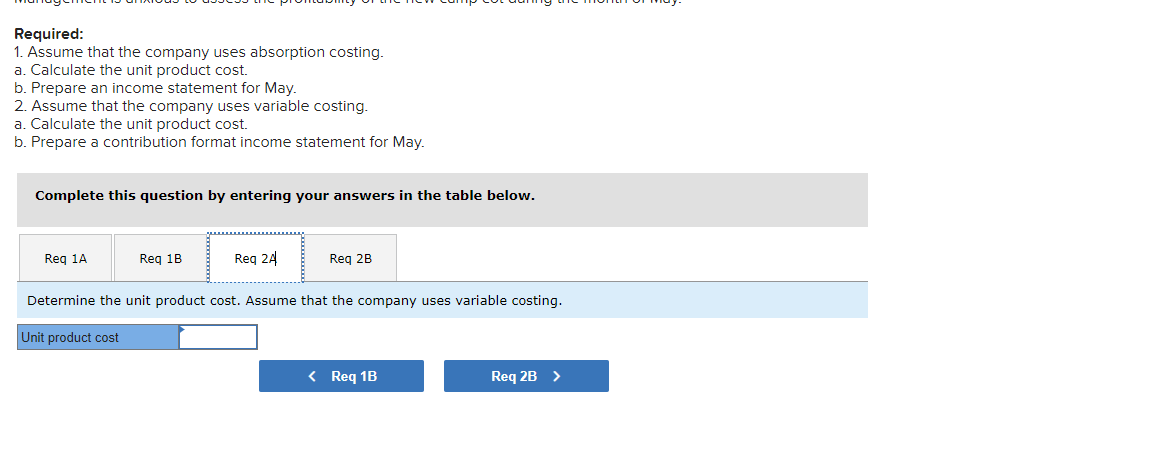

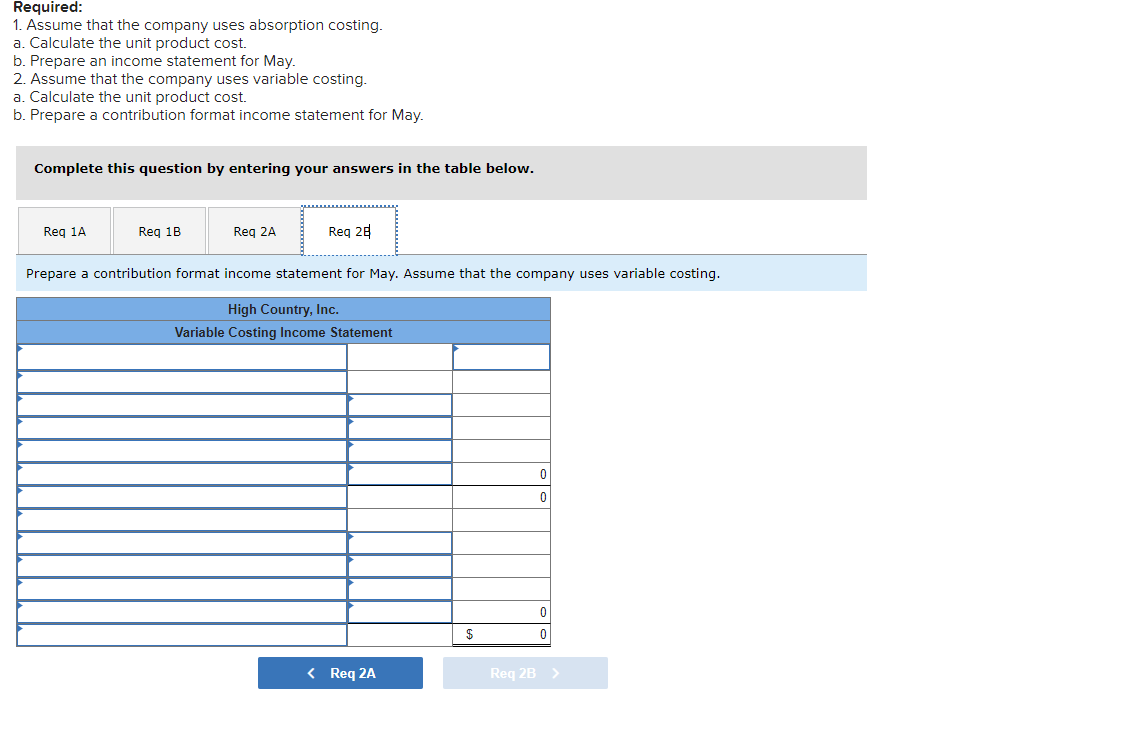

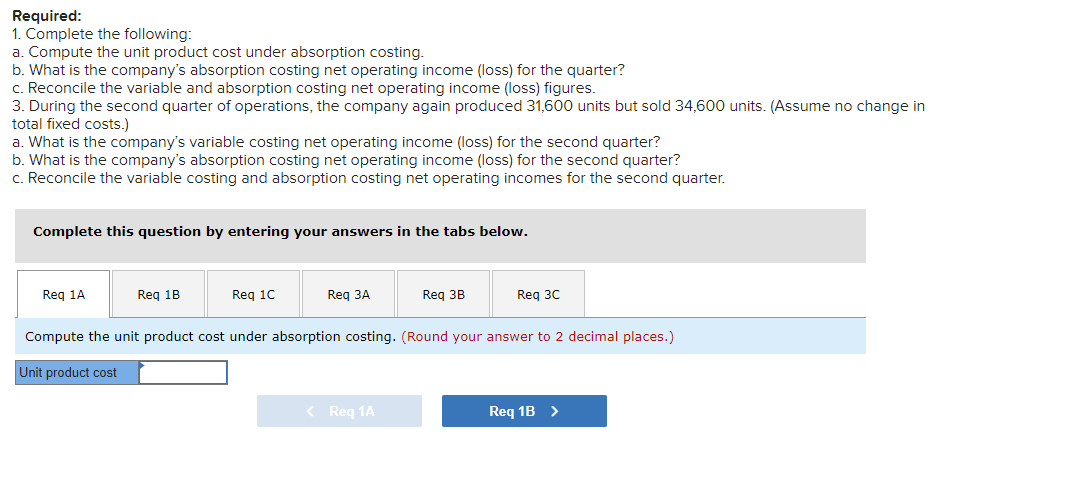

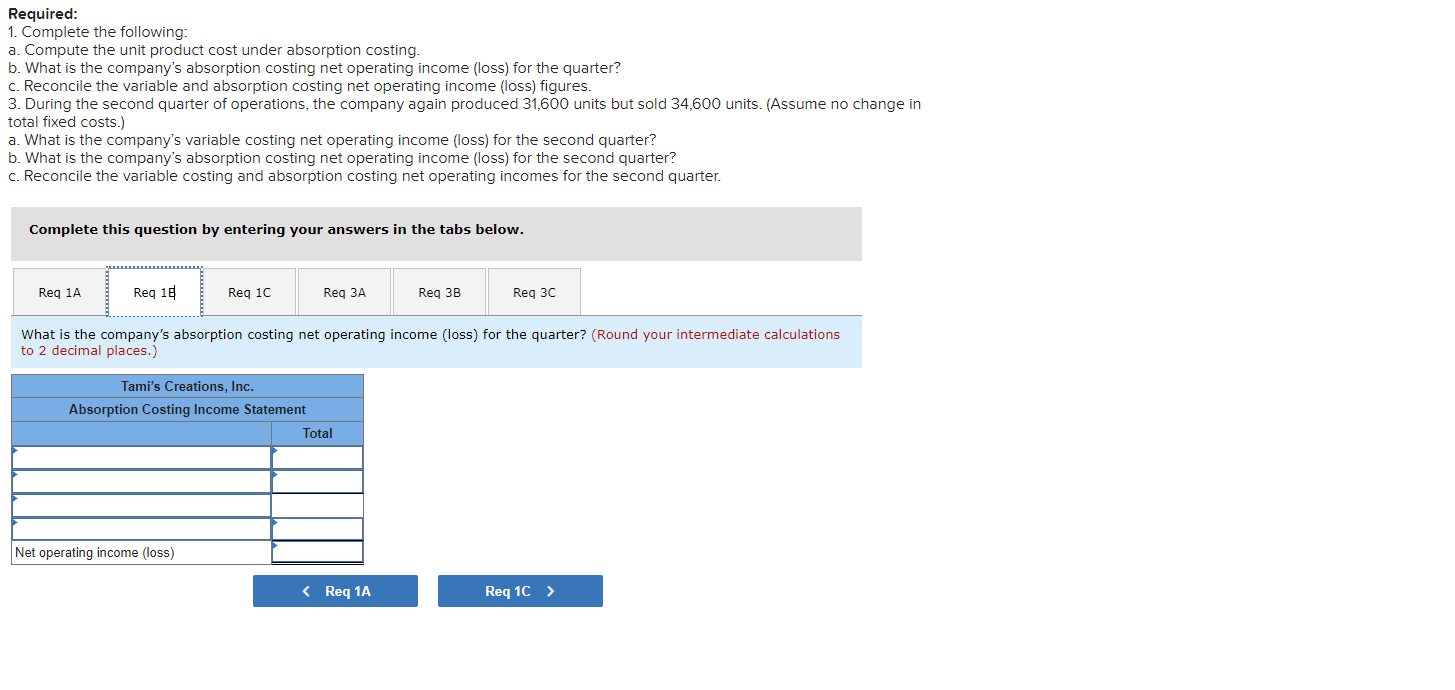

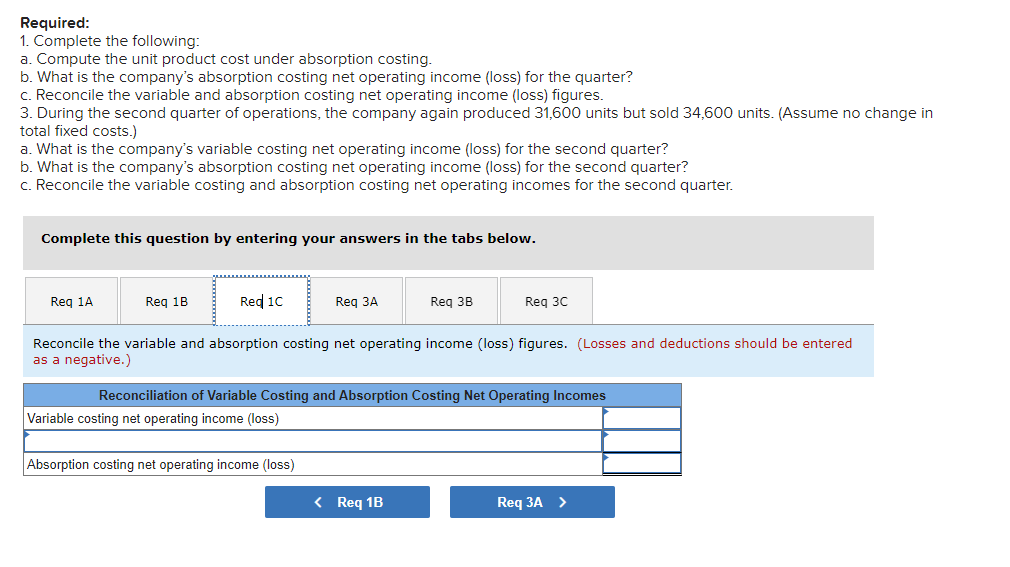

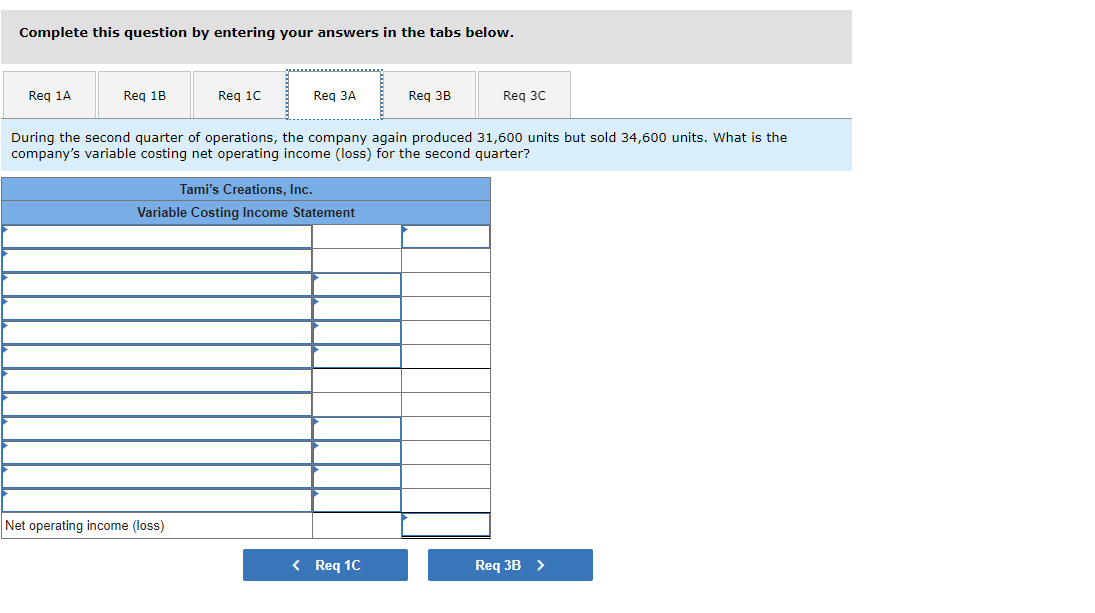

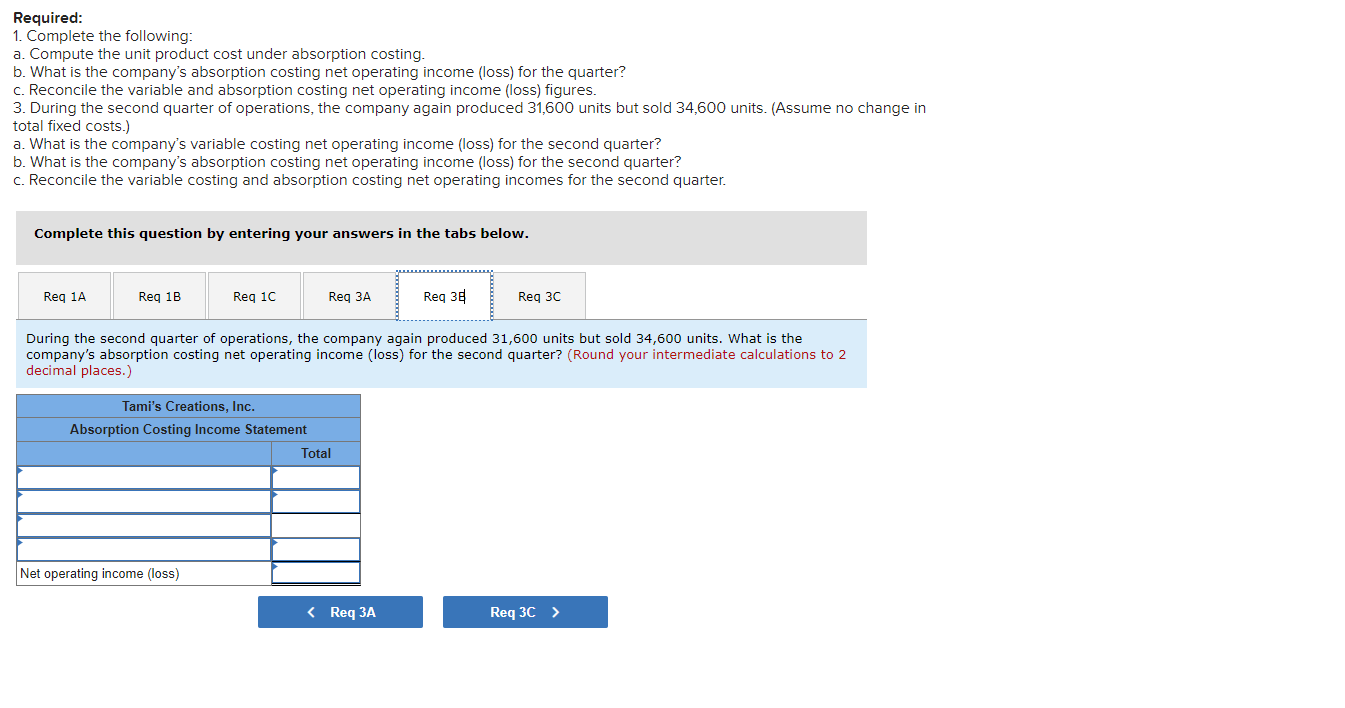

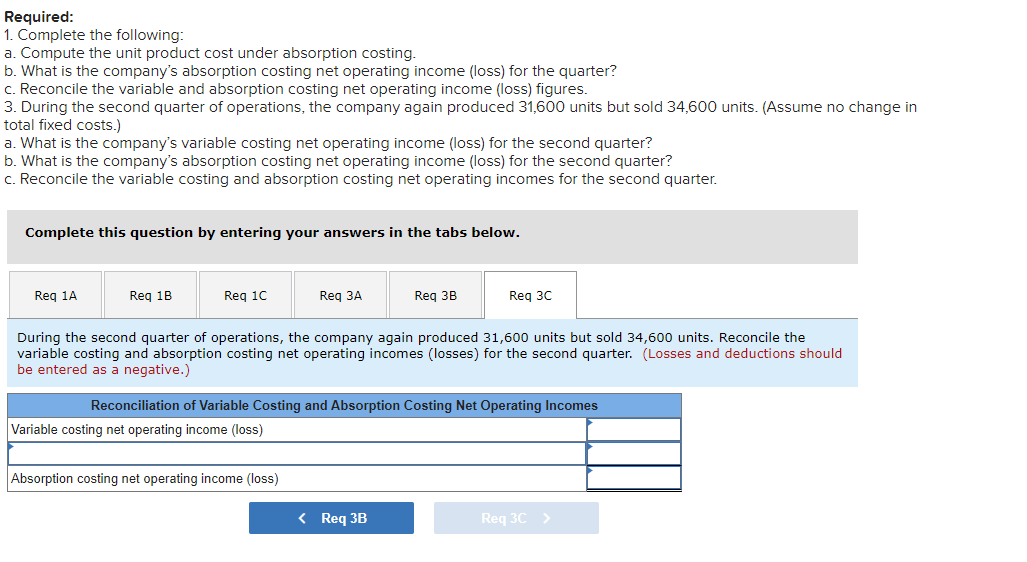

High Country, Inc., produces and sells many recreational products. The company has just opened a new plant to produce a folding camp cot that will be marketed throughout the United States. The following cost and revenue data relate to May, the first month of the plant's operation: Beginning inventory Units produced Units sold Selling price per unit Selling and administrative expenses: Variable per unit Fixed (per month) Manufacturing costs: Direct materials cost per unit Direct labor cost per unit Variable manufacturing overhead cost per unit Fixed manufacturing overhead cost (per month) $ 0 47,000 42,000 77 2 $ 559,000 $ 15 $ 9 $ 4 $ 705,000 Management is anxious to assess the profitability of the new camp cot during the month of May. Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Req 1B Req 2A Req 2B Determine the unit product cost. Assume that the company uses absorption costing. Unit product cost < Req 1A Req 1B > Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Req 1B Req 2A Req 2B Prepare an income statement for May. Assume that the company uses absorption costing. High Country, Inc. Absorption Costing Income Statement $ < Req 1A Req 2A > Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Req 1B Req 24 Req 2B Determine the unit product cost. Assume that the company uses variable costing. Unit product cost < Req 1B Req 2B > Required: 1. Assume that the company uses absorption costing. a. Calculate the unit product cost. b. Prepare an income statement for May. 2. Assume that the company uses variable costing. a. Calculate the unit product cost. b. Prepare a contribution format income statement for May. Complete this question by entering your answers in the table below. Req 1A Req 1B Req 2A Req 2B Prepare a contribution format income statement for May. Assume that the company uses variable costing. High Country, Inc. Variable Costing Income Statement < Req 2A 0 0 0 $ 0 Req 2B > Tami Tyler opened Tami's Creations, Inc., a small manufacturing company, at the beginning of the year. Getting the company through its first quarter of operations placed a considerable strain on Ms. Tyler's personal finances. The following income statement for the first quarter was prepared by a friend who has just completed a course in managerial accounting at State University. Sales (28,600 units) Variable expenses: Tami's Creations, Inc. Income Statement For the Quarter Ended March 31 Variable cost of goods sold Variable selling and administrative Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative Net operating loss $ 1,144,000 $ 480,480 197,340 677,820 466,180 252,800 225,380 478,180 $ ( 12,000) Ms. Tyler is discouraged over the loss shown for the quarter, particularly because she had planned to use the statement as support for a bank loan. Another friend, a CPA, insists that the company should be using absorption costing rather than variable costing and argues that if absorption costing had been used the company probably would have reported at least some profit for the quarter. At this point, Ms. Tyler is manufacturing only one product-a swimsuit. Production and cost data relating to the swimsuit for the first quarter follow: Units produced Units sold Variable costs per unit: Direct materials Direct labor Variable manufacturing overhead Variable selling and administrative Required: 1. Complete the following: 31,600 28,600 $ 7.10 $ 7.90 $ 1.80 $ 6.90 a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 3A Req 3B Req 3C Compute the unit product cost under absorption costing. (Round your answer to 2 decimal places.) Unit product cost < Req 1A Req 1B > Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 3A Req 3B Req 3C What is the company's absorption costing net operating income (loss) for the quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Absorption Costing Income Statement Total Net operating income (loss) < Req 1A Req 1C > Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Red 1C Req 3A Req 3B Req 3C Reconcile the variable and absorption costing net operating income (loss) figures. (Losses and deductions should be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss) < Req 1B Req 3A > Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 3A Req 3B Req 3C During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. What is the company's variable costing net operating income (loss) for the second quarter? Tami's Creations, Inc. Variable Costing Income Statement Net operating income (loss) < Req 1C Req 3B > Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 3A Req 3B Req 3C During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. What is the company's absorption costing net operating income (loss) for the second quarter? (Round your intermediate calculations to 2 decimal places.) Tami's Creations, Inc. Absorption Costing Income Statement Total Net operating income (loss) < Req 3A Req 3C > Required: 1. Complete the following: a. Compute the unit product cost under absorption costing. b. What is the company's absorption costing net operating income (loss) for the quarter? c. Reconcile the variable and absorption costing net operating income (loss) figures. 3. During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. (Assume no change in total fixed costs.) a. What is the company's variable costing net operating income (loss) for the second quarter? b. What is the company's absorption costing net operating income (loss) for the second quarter? c. Reconcile the variable costing and absorption costing net operating incomes for the second quarter. Complete this question by entering your answers in the tabs below. Req 1A Req 1B Req 1C Req 3A Req 3B Req 3C During the second quarter of operations, the company again produced 31,600 units but sold 34,600 units. Reconcile the variable costing and absorption costing net operating incomes (losses) for the second quarter. (Losses and deductions should be entered as a negative.) Reconciliation of Variable Costing and Absorption Costing Net Operating Incomes Variable costing net operating income (loss) Absorption costing net operating income (loss) < Req 3B Req 3C >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started