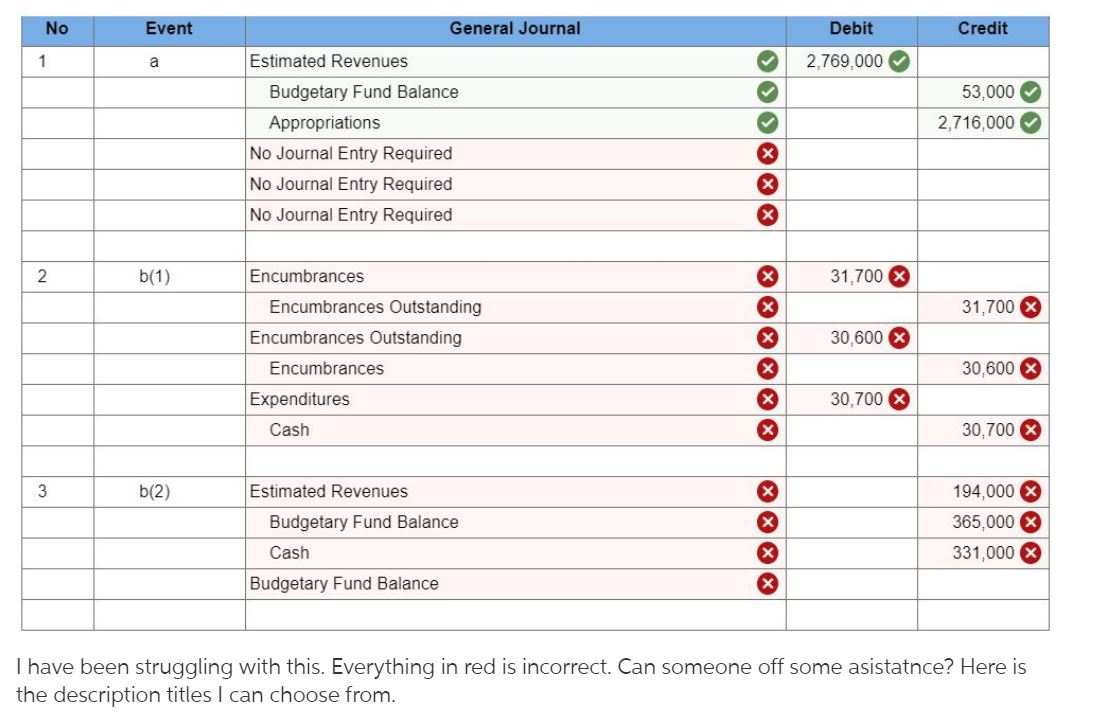

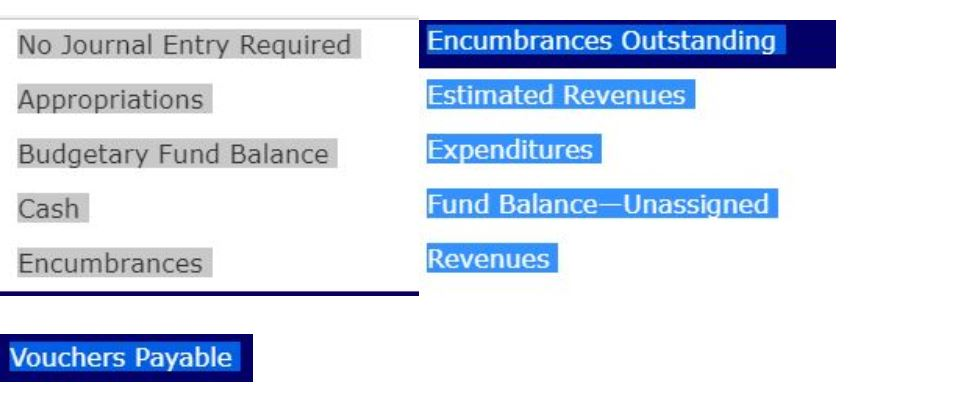

Highlighted in RED are the answers that I have wrong. Listed at the bottom are the descriptions to use. Please help!

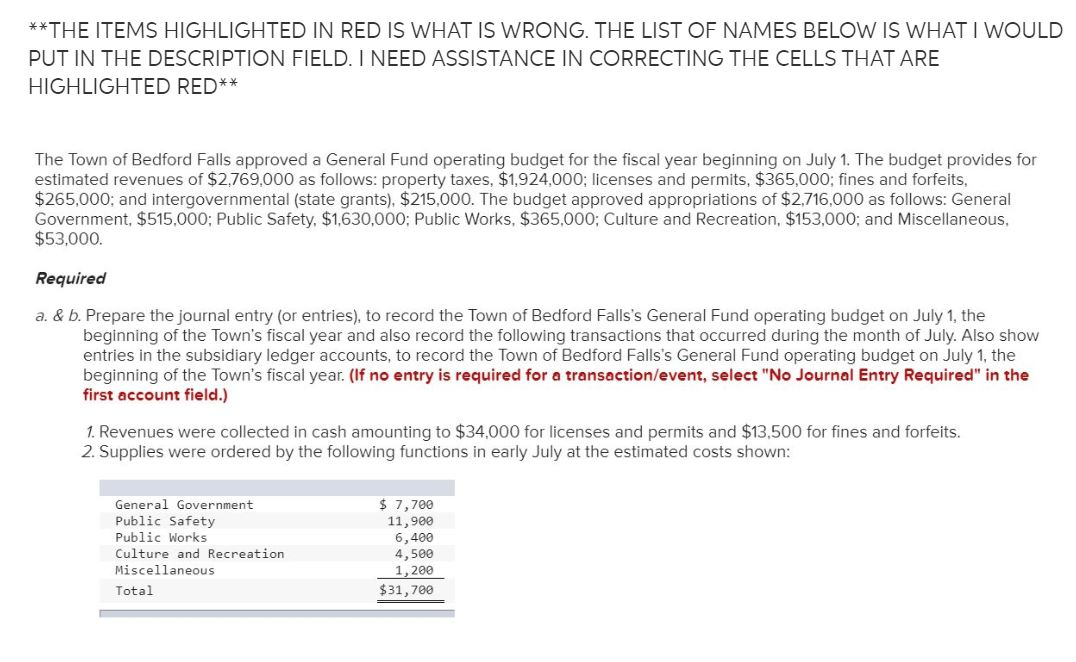

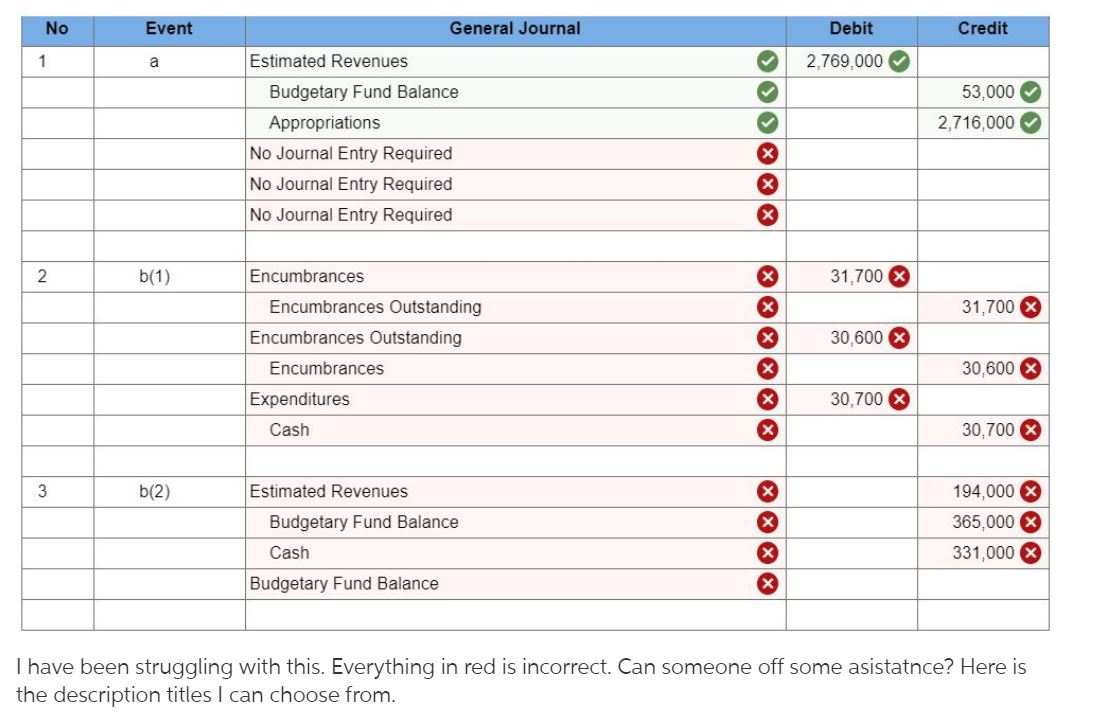

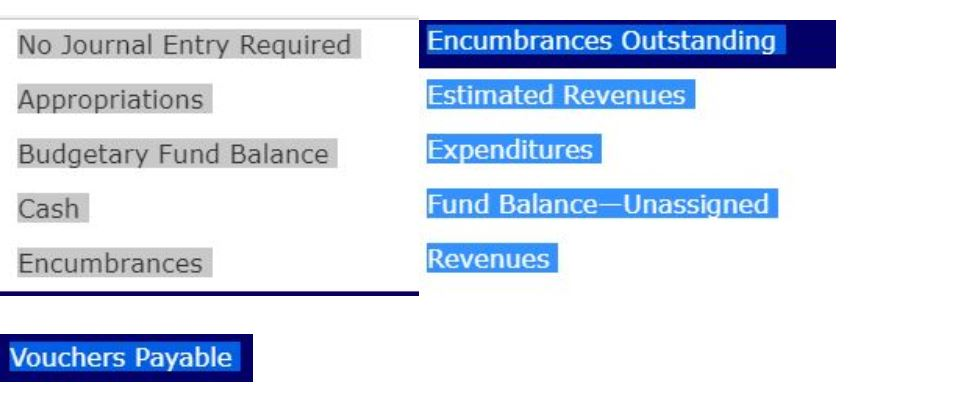

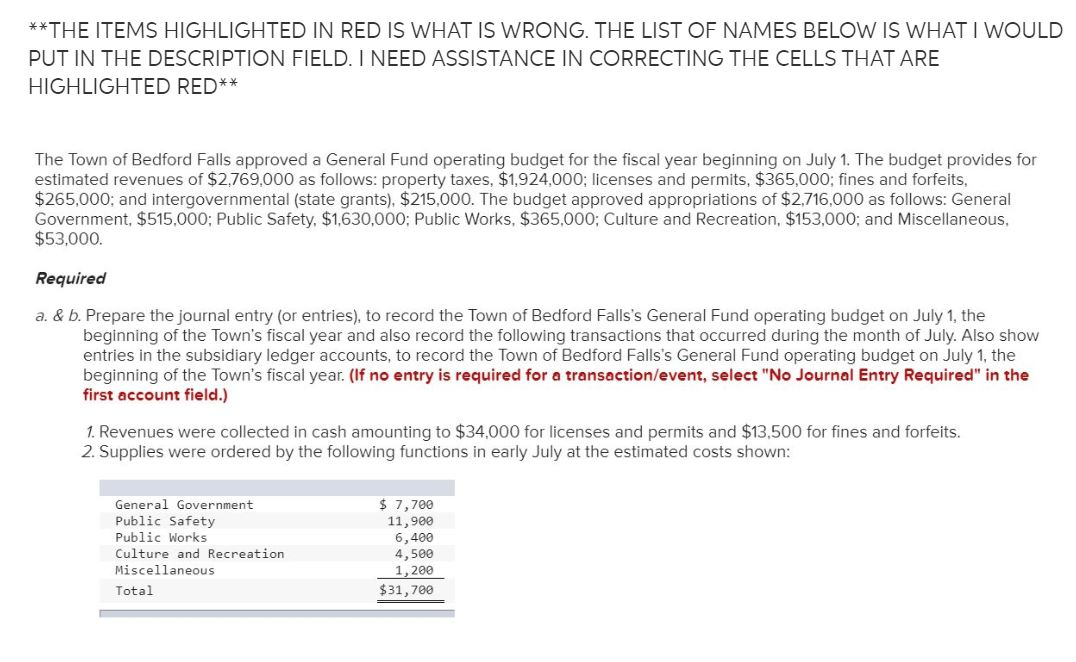

**THE ITEMS HIGHLIGHTED IN RED IS WHAT IS WRONG. THE LIST OF NAMES BELOW IS WHAT I WOULD PUT IN THE DESCRIPTION FIELD. I NEED ASSISTANCE IN CORRECTING THE CELLS THAT ARE HIGHLIGHTED RED** The Town of Bedford Falls approved a General Fund operating budget for the fiscal year beginning on July 1. The budget provides for estimated revenues of $2,769.000 as follows: property taxes, $1,924.000; licenses and permits, $365,000; fines and forfeits, $265,000: and intergovernmental (state grants), $215,000. The budget approved appropriations of $2,716,000 as follows: General Government, $515.000; Public Safety, $1,630,000; Public Works, $365.000; Culture and Recreation, $153,000; and Miscellaneous, $53,000. Required a. & b. Prepare the journal entry (or entries), to record the Town of Bedford Falls's General Fund operating budget on July 1, the beginning of the Town's fiscal year and also record the following transactions that occurred during the month of July. Also show entries in the subsidiary ledger accounts, to record the Town of Bedford Falls's General Fund operating budget on July 1, the beginning of the Town's fiscal year. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) 1. Revenues were collected in cash amounting to $34,000 for licenses and permits and $13,500 for fines and forfeits. 2. Supplies were ordered by the following functions in early July at the estimated costs shown: General Government Public Safety Public Works Culture and Recreation Miscellaneous Total $ 7,700 11,900 6,400 4,500 1,200 $31,700 No Event Credit Debit 2,769,000 General Journal Estimated Revenues Budgetary Fund Balance Appropriations No Journal Entry Required No Journal Entry Required No Journal Entry Required 53,000 2,716,000 b(1) Encumbrances 31,700 X 31,700 X 30,600 Encumbrances Outstanding Encumbrances Outstanding Encumbrances Expenditures Cash 30,600 30,700 X 30,700 b(2) Estimated Revenues Budgetary Fund Balance Cash Budgetary Fund Balance 194,000 365,000 X 331,000 I have been struggling with this. Everything in red is incorrect. Can someone off some asistatnce? Here is the description titles I can choose from. No Journal Entry Required Encumbrances Outstanding Estimated Revenues Appropriations Budgetary Fund Balance Cash Expenditures Fund Balance-Unassigned Encumbrances Revenues Vouchers Payable