Question

HiLens Corp. is evaluating a new project that has the same risk as that of the firm. HiLens currently has 8 million shares of

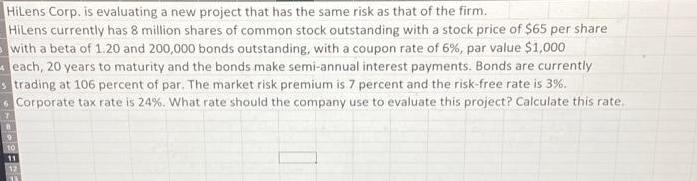

HiLens Corp. is evaluating a new project that has the same risk as that of the firm. HiLens currently has 8 million shares of common stock outstanding with a stock price of $65 per share with a beta of 1.20 and 200,000 bonds outstanding, with a coupon rate of 6%, par value $1,000 4each, 20 years to maturity and the bonds make semi-annual interest payments. Bonds are currently strading at 106 percent of par. The market risk premium is 7 percent and the risk-free rate is 3%. Corporate tax rate is 24%. What rate should the company use to evaluate this project? Calculate this rate. 11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the rate that HiLens Corp should use to evaluate the new project we need to determine t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Reporting Financial Statement Analysis And Valuation A Strategic Perspective

Authors: James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

9th Edition

1337614689, 1337614688, 9781337668262, 978-1337614689

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App