Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hill Industries had sales in 2019 of $7,520,000 and gross profit of $1,233,000. Management is considering two alternative budget plans to increase its gross profit

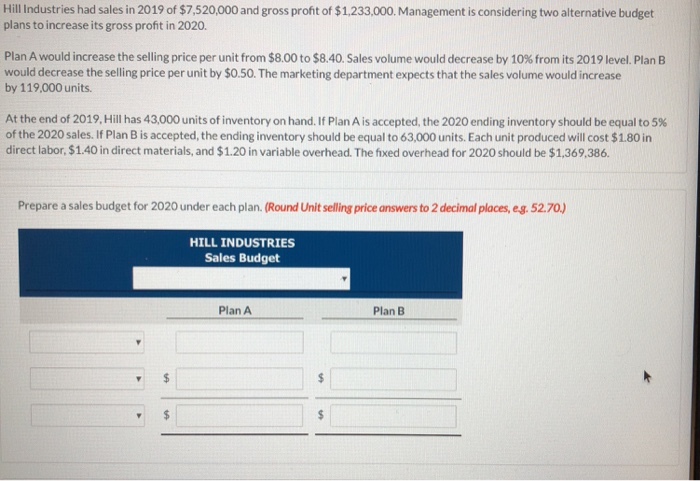

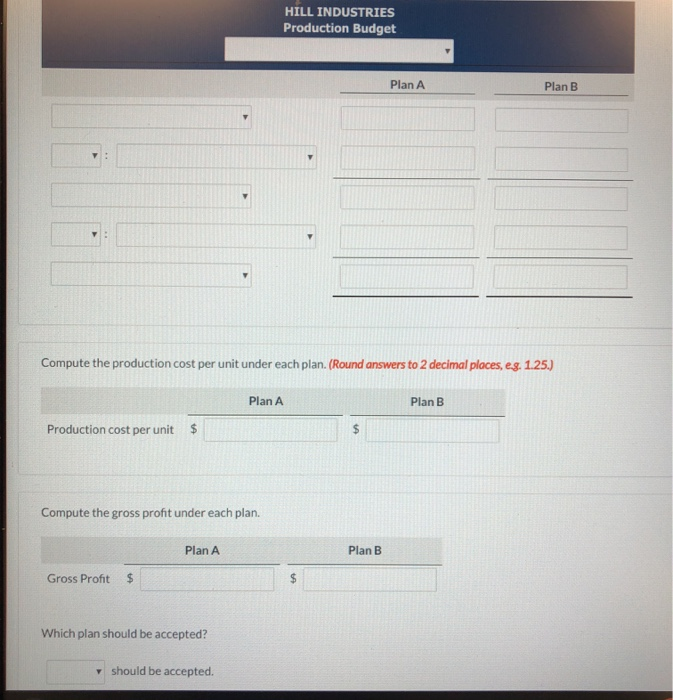

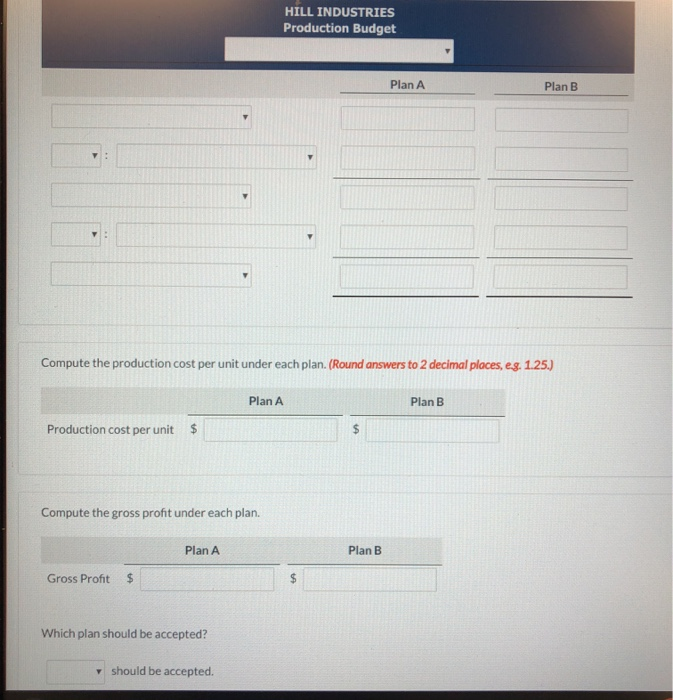

Hill Industries had sales in 2019 of $7,520,000 and gross profit of $1,233,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 119,000 units. At the end of 2019, Hill has 43,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 63,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,369,386. Prepare a sales budget for 2020 under each plan. (Round Unit selling price answers to 2 decimal places, eg. 52.70.) HILL INDUSTRIES Sales Budget Plan A Plan B HILL INDUSTRIES Production Budget Plan A Plan B Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) Plan A Plan B Production cost per unit $ Compute the gross profit under each plan. Plan A Plan B Gross Profit $ Which plan should be accepted? should be accepted

Hill Industries had sales in 2019 of $7,520,000 and gross profit of $1,233,000. Management is considering two alternative budget plans to increase its gross profit in 2020. Plan A would increase the selling price per unit from $8.00 to $8.40. Sales volume would decrease by 10% from its 2019 level. Plan B would decrease the selling price per unit by $0.50. The marketing department expects that the sales volume would increase by 119,000 units. At the end of 2019, Hill has 43,000 units of inventory on hand. If Plan A is accepted, the 2020 ending inventory should be equal to 5% of the 2020 sales. If Plan B is accepted, the ending inventory should be equal to 63,000 units. Each unit produced will cost $1.80 in direct labor, $1.40 in direct materials, and $1.20 in variable overhead. The fixed overhead for 2020 should be $1,369,386. Prepare a sales budget for 2020 under each plan. (Round Unit selling price answers to 2 decimal places, eg. 52.70.) HILL INDUSTRIES Sales Budget Plan A Plan B HILL INDUSTRIES Production Budget Plan A Plan B Compute the production cost per unit under each plan. (Round answers to 2 decimal places, e.g. 1.25.) Plan A Plan B Production cost per unit $ Compute the gross profit under each plan. Plan A Plan B Gross Profit $ Which plan should be accepted? should be accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started