Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hilma Ltd is considering the launch of a new product x , for which an investment in plant and machinery of N $ 3 0

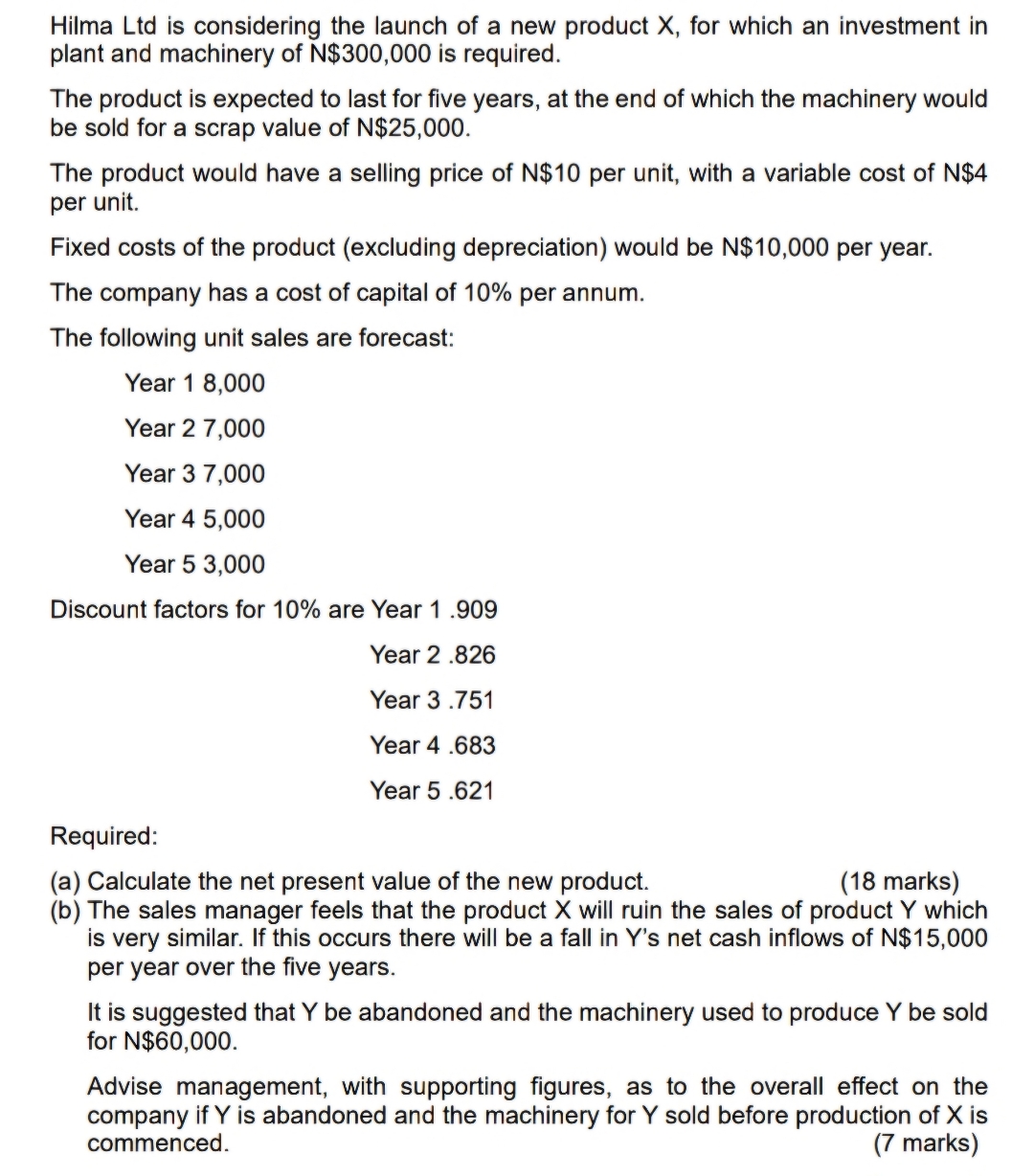

Hilma Ltd is considering the launch of a new product for which an investment in

plant and machinery of $ is required.

The product is expected to last for five years, at the end of which the machinery would

be sold for a scrap value of $

The product would have a selling price of $ per unit, with a variable cost of $

per unit.

Fixed costs of the product excluding depreciation would be $ per year.

The company has a cost of capital of per annum.

The following unit sales are forecast:

Year

Year

Year

Year

Year

Discount factors for are Year

Year

Year

Year

Year

Required:

a Calculate the net present value of the new product.

marks

b The sales manager feels that the product will ruin the sales of product which

is very similar. If this occurs there will be a fall in Ys net cash inflows of $

per year over the five years.

It is suggested that be abandoned and the machinery used to produce be sold

for $

Advise management, with supporting figures, as to the overall effect on the

company if is abandoned and the machinery for sold before production of is

commenced.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started