Answered step by step

Verified Expert Solution

Question

1 Approved Answer

*HINT: NO 1 CORRECT ANS IS (A) AND NO 2 CORRECT ANSWER IS (A) Help me find the way how to get the answers a

*HINT: NO 1 CORRECT ANS IS (A) AND NO 2 CORRECT ANSWER IS (A)

*HINT: NO 1 CORRECT ANS IS (A) AND NO 2 CORRECT ANSWER IS (A)

Help me find the way how to get the answers

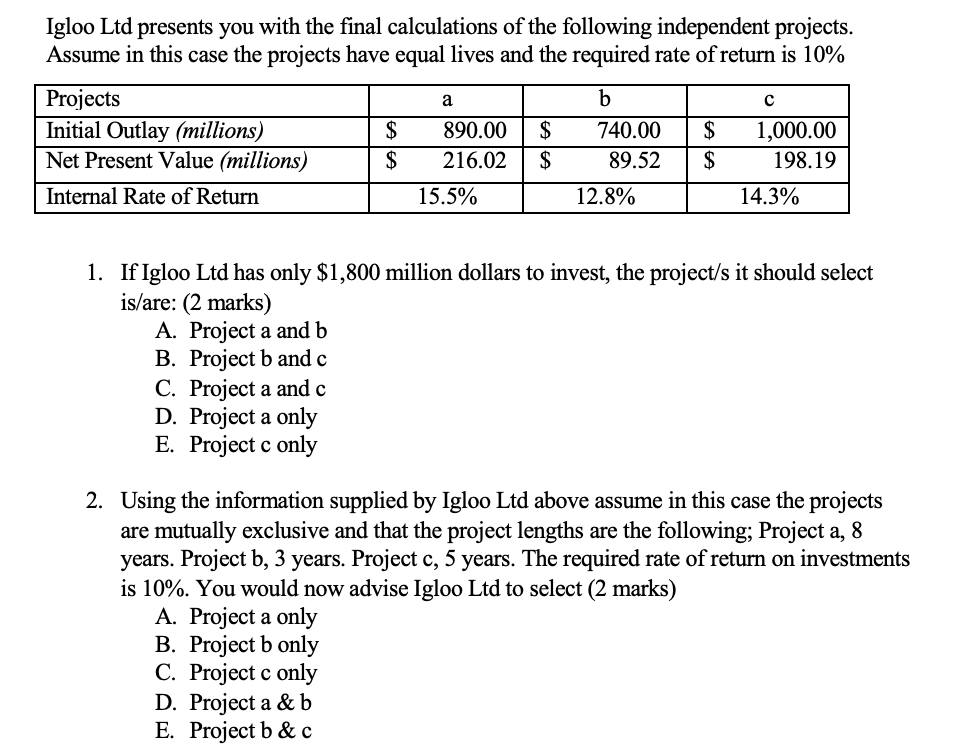

a Igloo Ltd presents you with the final calculations of the following independent projects. Assume in this case the projects have equal lives and the required rate of return is 10% Projects b Initial Outlay (millions) $ 890.00 $ 740.00 $ 1,000.00 Net Present Value (millions) $ 216.02 $ 89.52 $ 198.19 Internal Rate of Return 15.5% 12.8% 14.3% 1. If Igloo Ltd has only $1,800 million dollars to invest, the project/s it should select is/are: (2 marks) A. Project a and b B. Project b and c C. Project a and c D. Project a only E. Project c only 2. Using the information supplied by Igloo Ltd above assume in this case the projects are mutually exclusive and that the project lengths are the following; Project a, 8 years. Project b, 3 years. Project c, 5 years. The required rate of return on investments is 10%. You would now advise Igloo Ltd to select (2 marks) A. Project a only B. Project b only C. Project c only D. Project a &b E. Project b&cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started