Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hint: The choices are as follows: Sales Beg. Bal Recovery Collections End. Bal Write Off Bad Debts Account Titles and Explanation Debit Credit Accounts Receivable

Hint: The choices are as follows:

Sales

Beg. Bal

Recovery

Collections

End. Bal

Write Off

Bad Debts

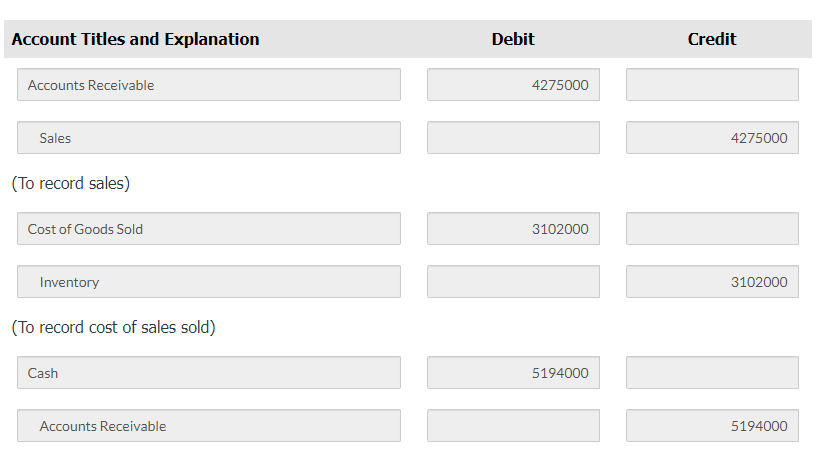

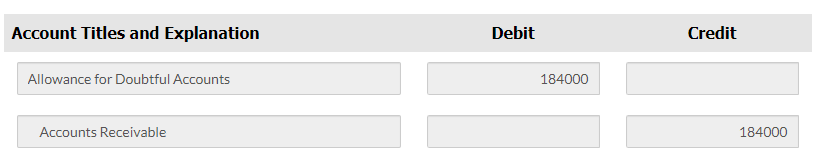

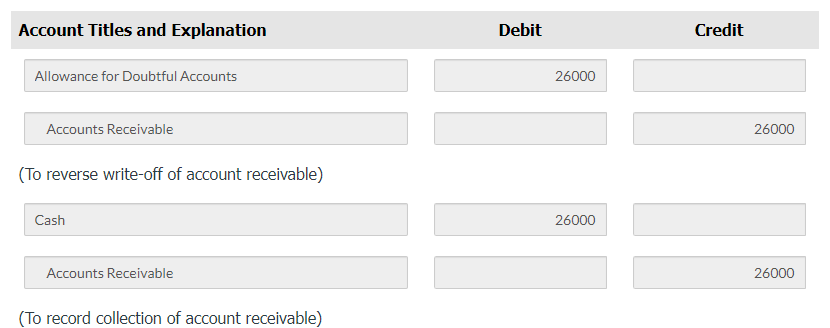

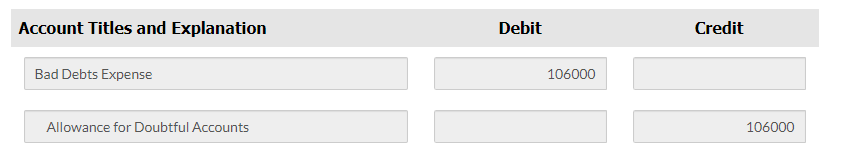

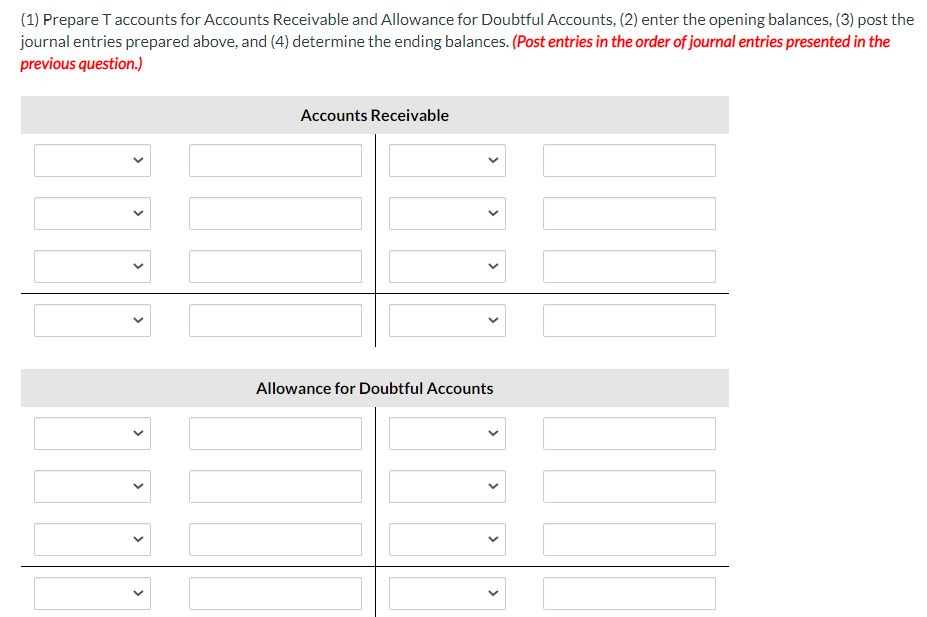

Account Titles and Explanation Debit Credit Accounts Receivable 4275000 Sales (To record sales) Cost of Goods Sold 3102000 Inventory (To record cost of sales sold) Cash 5194000 Accounts Receivable 5194000 Account Titles and Explanation Debit Credit Allowance for Doubtful Accounts 184000 Accounts Receivable 184000 Account Titles and Explanation Debit Credit Allowance for Doubtful Accounts 26000 Accounts Receivable (To reverse write-off of account receivable) Cash 26000 Accounts Receivable (To record collection of account receivable) Account Titles and Explanation Debit Credit Bad Debts Expense 106000 Allowance for Doubtful Accounts (1) Prepare T accounts for Accounts Receivable and Allowance for Doubtful Accounts, (2) enter the opening balances, (3) post the journal entries prepared above, and (4) determine the ending balances. (Post entries in the order of journal entries presented in the previous question.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started