Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Hints: Step 1: Find the PMT Step 2. Find the 1st year's interest Step 3: Subtract the interest from the payment; this is repayment of

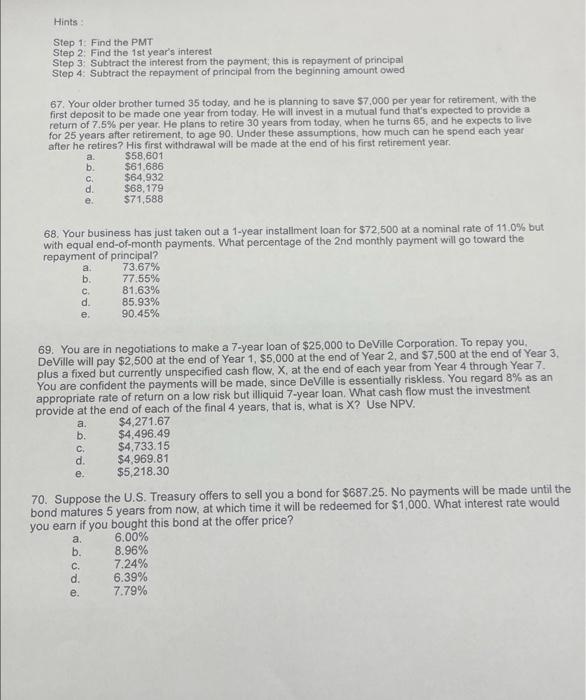

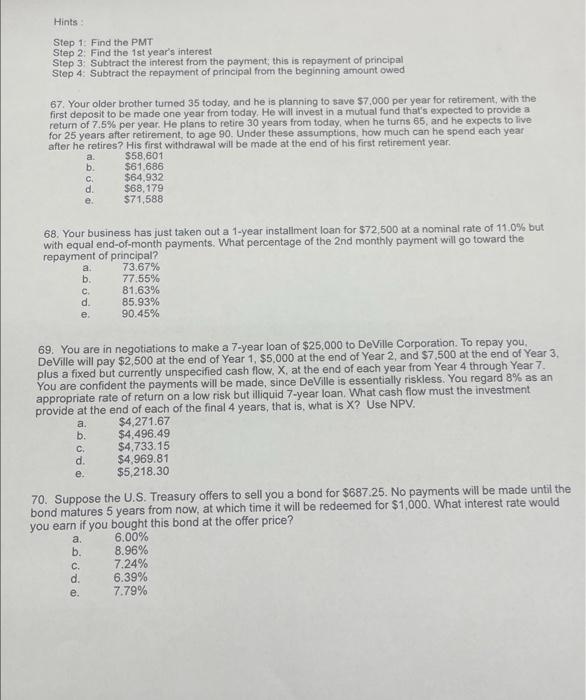

Hints: Step 1: Find the PMT Step 2. Find the 1st year's interest Step 3: Subtract the interest from the payment; this is repayment of principal Step 4: Subtract the repayment of principal from the beginning amount owed 67. Your older brother tumed 35 today, and he is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. He will invest in a mutual fund that's expected to provide a retum of 7.5% per year. He plans to retire 30 years from today, when he turns 65 , and he expects to live for 25 years after retirement, to age 90 . Under these assumptions, how much can the spend each year after he retires? His first withdrawal will be made at the end of his first retirement year. a.b.c.d.e.$58,601$61,686$64,932$68,179$71,588 68. Your business has just taken out a 1-year instaliment loan for $72,500 at a nominal rate of 11,0% but with equal end-of-month payments. What percentage of the 2 nd monthly payment will go toward the repayment of principal? a.b.c.d.e.73.67%77.55%81.63%85.93%90.45% 69. You are in negotiations to make a 7-year loan of $25,000 to Deville Corporation. To repay you, Deville will pay $2,500 at the end of Year 1,$5,000 at the end of Year 2 , and $7,500 at the end of Year 3. plus a fixed but currently unspecified cash flow. X, at the end of each year from Year 4 through Year 7. You are confident the payments will be made, since DeVille is essentially riskless. You regard 8% as an appropriate rate of retum on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? Use NPV. a.b.c.d.e.$4,271.67$4,496.49$4,733.15$4,969.81$5,218.30 70. Suppose the U.S. Treasury offers to sell you a bond for $687.25. No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price? a. 6.00% b. 8.96% c. 7.24% d. 6.39% e. 7.79%

Hints: Step 1: Find the PMT Step 2. Find the 1st year's interest Step 3: Subtract the interest from the payment; this is repayment of principal Step 4: Subtract the repayment of principal from the beginning amount owed 67. Your older brother tumed 35 today, and he is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. He will invest in a mutual fund that's expected to provide a retum of 7.5% per year. He plans to retire 30 years from today, when he turns 65 , and he expects to live for 25 years after retirement, to age 90 . Under these assumptions, how much can the spend each year after he retires? His first withdrawal will be made at the end of his first retirement year. a.b.c.d.e.$58,601$61,686$64,932$68,179$71,588 68. Your business has just taken out a 1-year instaliment loan for $72,500 at a nominal rate of 11,0% but with equal end-of-month payments. What percentage of the 2 nd monthly payment will go toward the repayment of principal? a.b.c.d.e.73.67%77.55%81.63%85.93%90.45% 69. You are in negotiations to make a 7-year loan of $25,000 to Deville Corporation. To repay you, Deville will pay $2,500 at the end of Year 1,$5,000 at the end of Year 2 , and $7,500 at the end of Year 3. plus a fixed but currently unspecified cash flow. X, at the end of each year from Year 4 through Year 7. You are confident the payments will be made, since DeVille is essentially riskless. You regard 8% as an appropriate rate of retum on a low risk but illiquid 7-year loan. What cash flow must the investment provide at the end of each of the final 4 years, that is, what is X? Use NPV. a.b.c.d.e.$4,271.67$4,496.49$4,733.15$4,969.81$5,218.30 70. Suppose the U.S. Treasury offers to sell you a bond for $687.25. No payments will be made until the bond matures 5 years from now, at which time it will be redeemed for $1,000. What interest rate would you earn if you bought this bond at the offer price? a. 6.00% b. 8.96% c. 7.24% d. 6.39% e. 7.79%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started