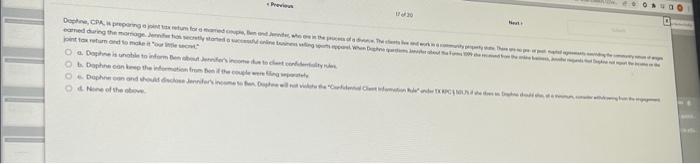

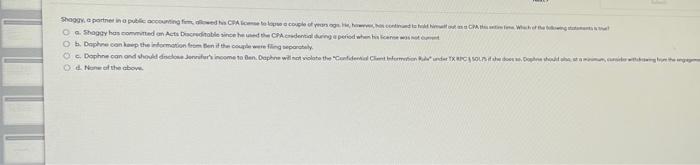

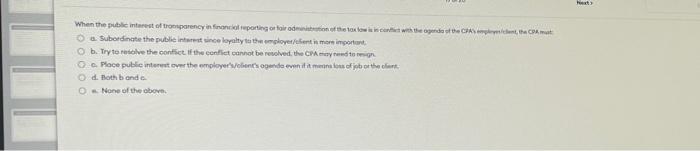

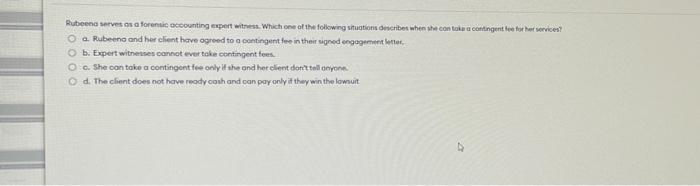

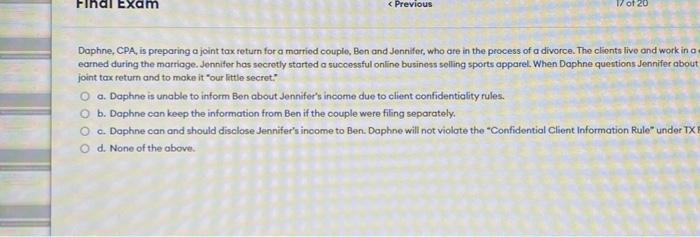

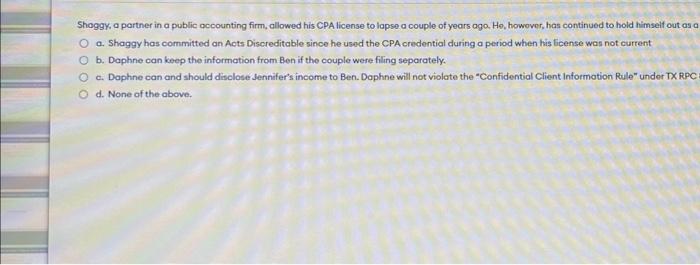

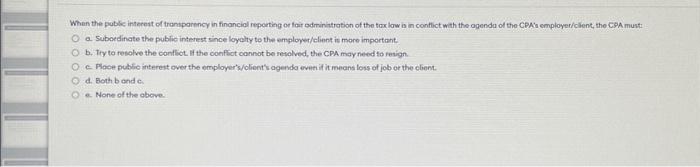

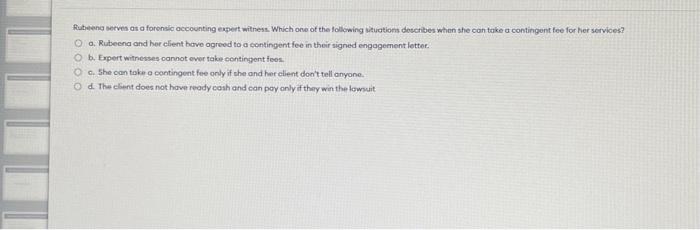

Histit it. Fine of the otsut. 4. Nanwe the thoven. 1. Poth bi and e. A. Hone of the obeve. Rubeend serves as a forentic actoounting eapert witress. Which one of 1he folkwing situations deveribes when shet con tai a cortingent ten for ther sericest a. Pubeeno and her chent have ogreed to a cantingent fee in their ugnod engogement keter. E. Expert witnetses pannot ever take contingent tees. 6. She can toke a contingent fee only it the and her elient donttel denpone. d. The client does not haye ready oash and can pay only it they win the lownurt. Daphne, CPA, is preparing a joint tax return for a marriod couple, Ben and Jennifer, who are in the process of a divorce. The clionts live and work in o earned during the marrioge. Jennifer has socrotly started a successful online business selling sports apparel. When Daphne questions Jennifer abou joint tax return and to make it "our little secret." a. Daphne is unable to inform Ben about Jennifer's income due to client confidentiolity fules. b. Daphne can keep the information from Ben if the couple were filing separately. c. Daphne can and should disclose Jennifer's inoome to Ben. Daphne will not violate the "Confidentiol Client information Rule" under TX d. None of the obove. er, who are in the process of a divorce. The clients Iive and work in a community property state. Thare are no pre-or post-nuptial agreements overiding the comimunity neture of woges finess selling sports apparol. When Dophne questions Jennifer about the Forens 1099 she rocelved from the online business, Jonnifer tequests that Daphne not report the income on the confidentiality rules porately. Inot violate the "Confidential Client information Rule" under TX RPC s 501J5 I she does so; Daphne should also, at a minimum, eonsider withdrowing from the engagement. Shoggy, a partner in a public acoounting firm, allowed his CPA license to lapse a couple of years aga. Ho, howover, has continued to hold himself out as a a. Shaggy has committed an Acts Discreditable since he used the CPA credential during a period when his license was not aurtent b. Daphne can keep the information from Ben if the couple were filing separately. c. Daphne can and should disclose Jennifer's income to Ben. Daphne will not violate the "Confidential Client Informotion Rule" under TX RpC d. None af the above. se to lapee a couple of yuars oga. He, however, hes cantinued ta hold himsest out as a CAA thin entine time. Which of the following stotanments hi true? d the CPA credentiol during a period when his license wos not current ere fiting separately Daphne will not violote the "Confidential Client information fule" under TX/RPC 5501.75 if the does so, Dephne ahould also at a minimum, oonider withdrowing from the engogement. Whan the putble interest of traniparency in financial repertieg or fair odrinitration of the tor law in in conflict with the agenda of the CPAis employerficlent, the CSA munt a. Suboedinate the public interest since loyolty to the employer/client is more important. b. Tiy to resolve the conflict If the conflict oonnot be renolved, the CPA may need to resign. E. Plece pubbie interest over the employer's/olient's agenda eweri it it means loss of job or the client. d. Both b and e. e. None of the obcve. Aubeeng serves as a forensic accounting expert withess. Which one of the follewing witugtions dewctibes whan she con take a contingent fee for her services? a. Rubeena and her client have agreed to a eontingent fee in their signed engagement lettee. b. Expert witnesses cannot evor take contingent fees 6. She can toke a contingent fee orly if che and her elient don't tell anyone. d. The client does not hawe ready cosh and can poy anly if thery win the lowourt