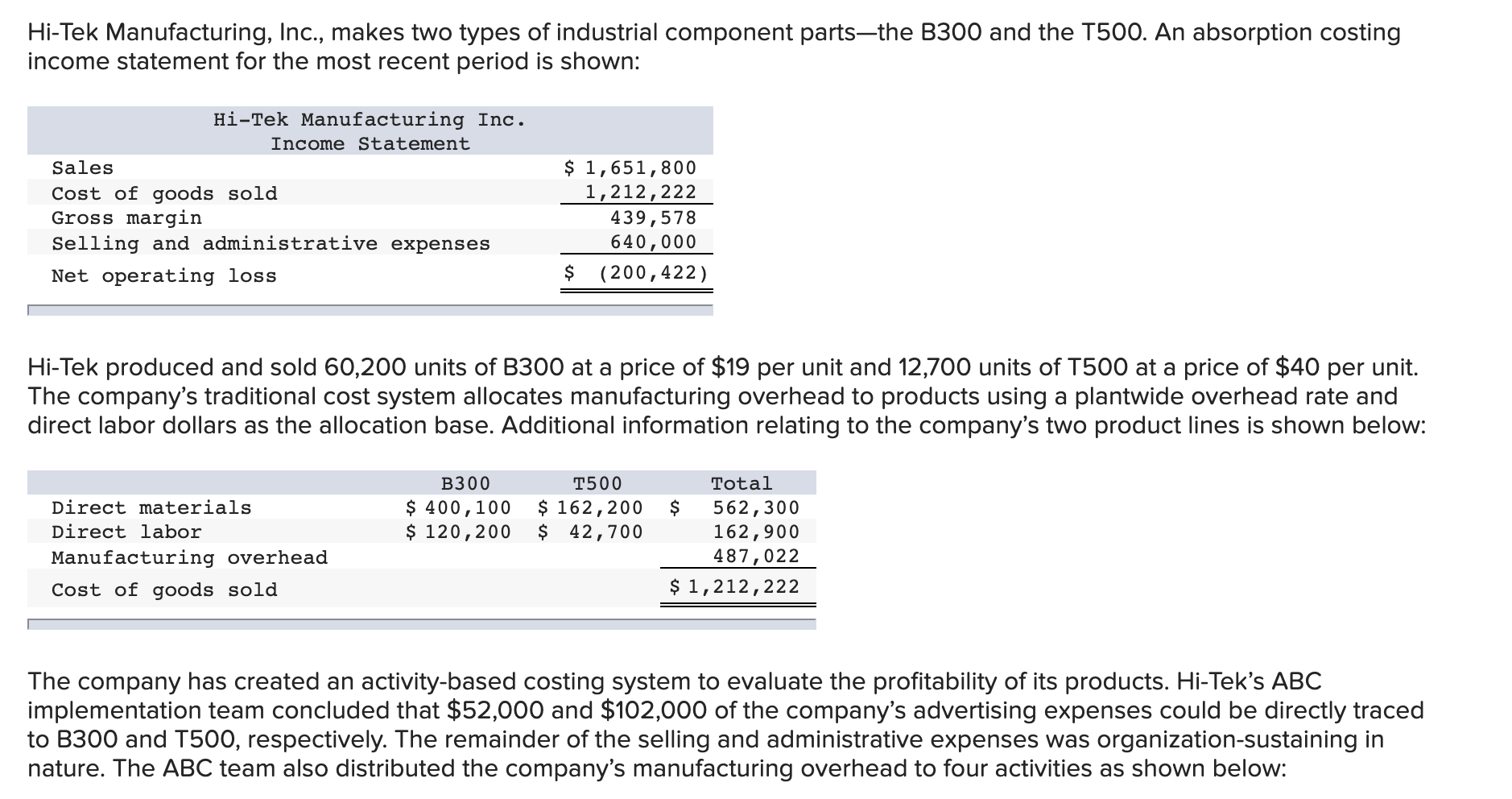

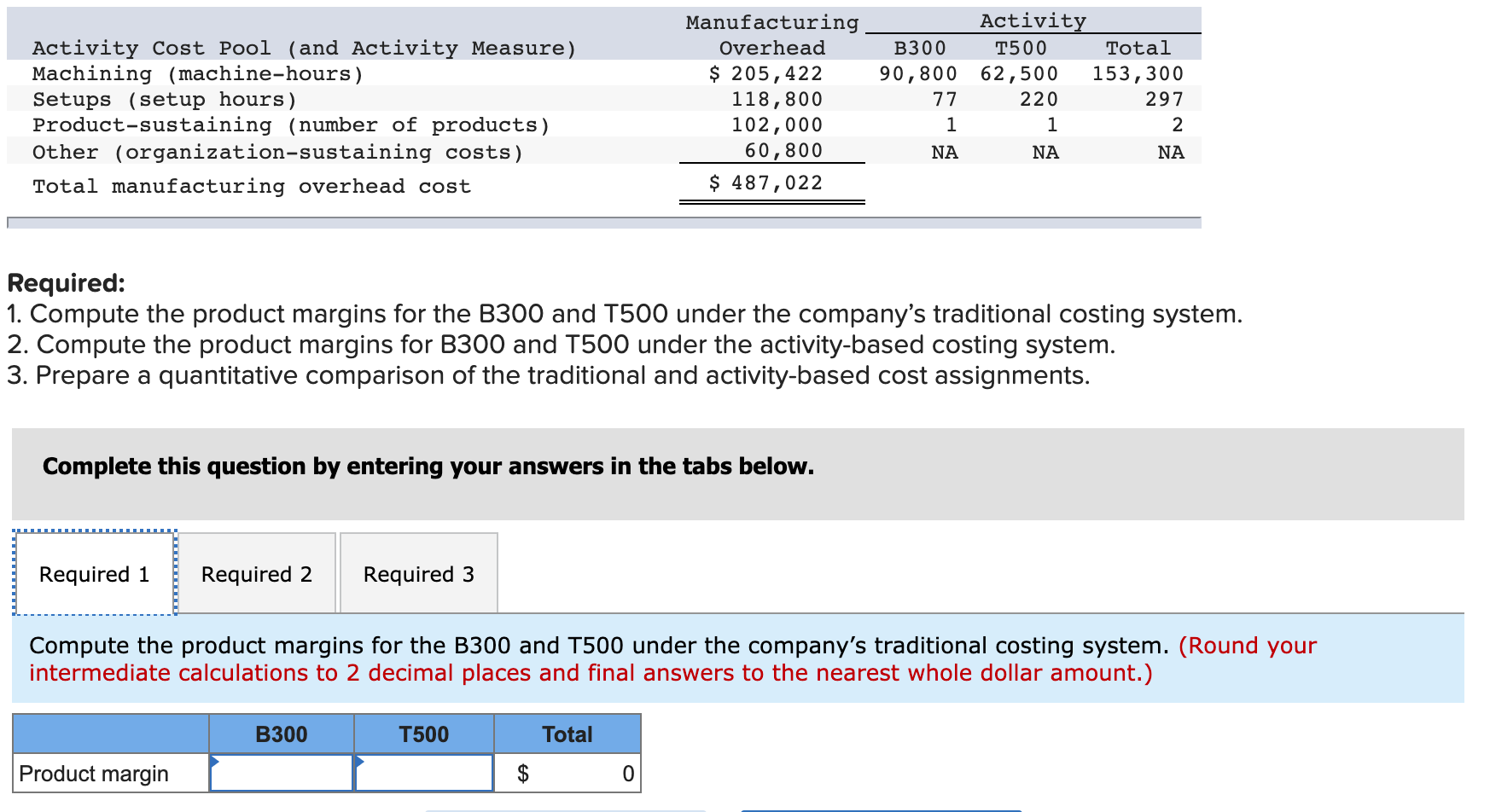

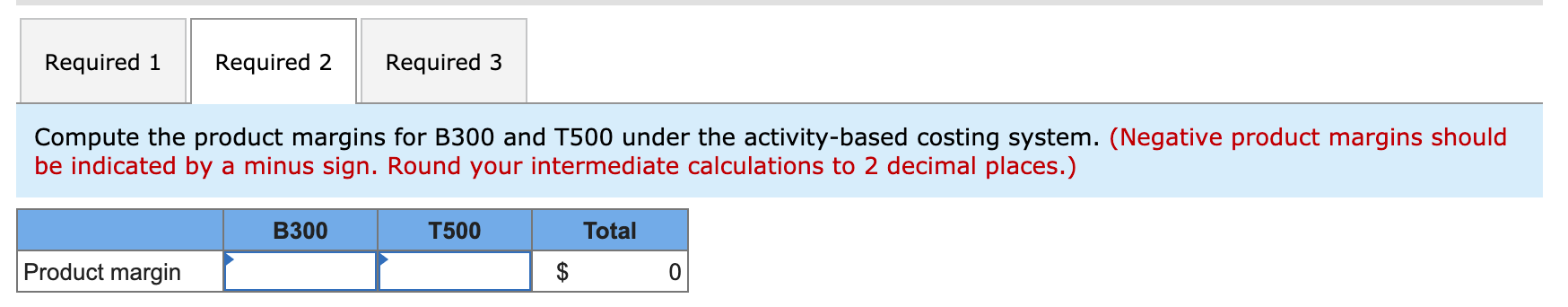

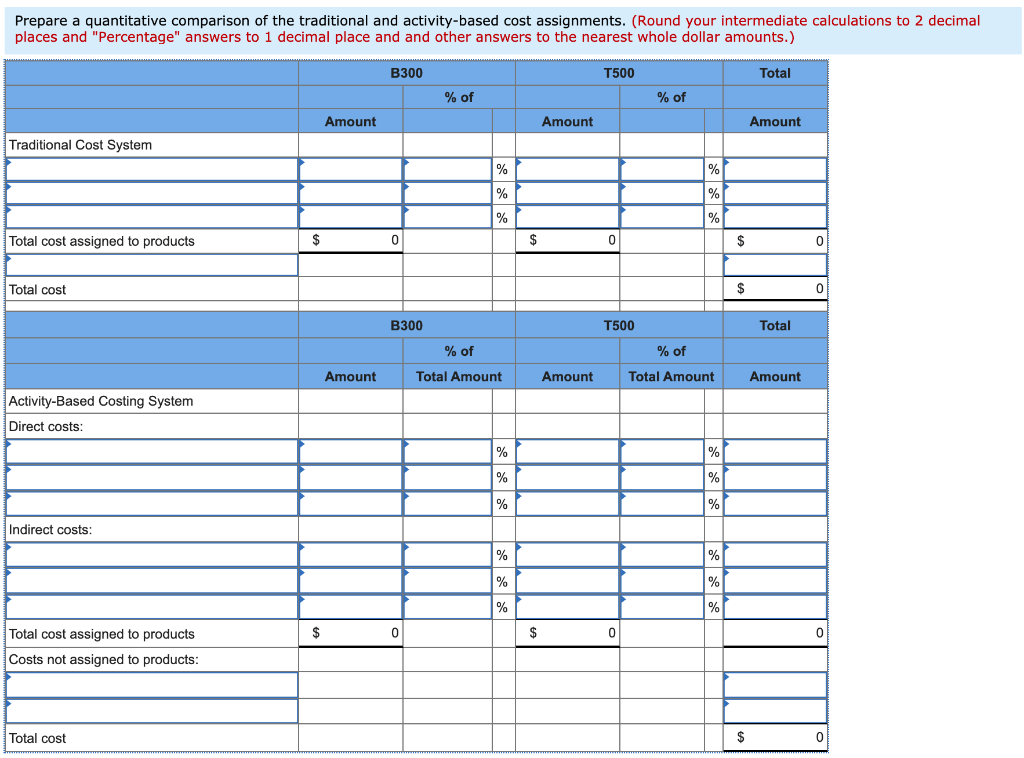

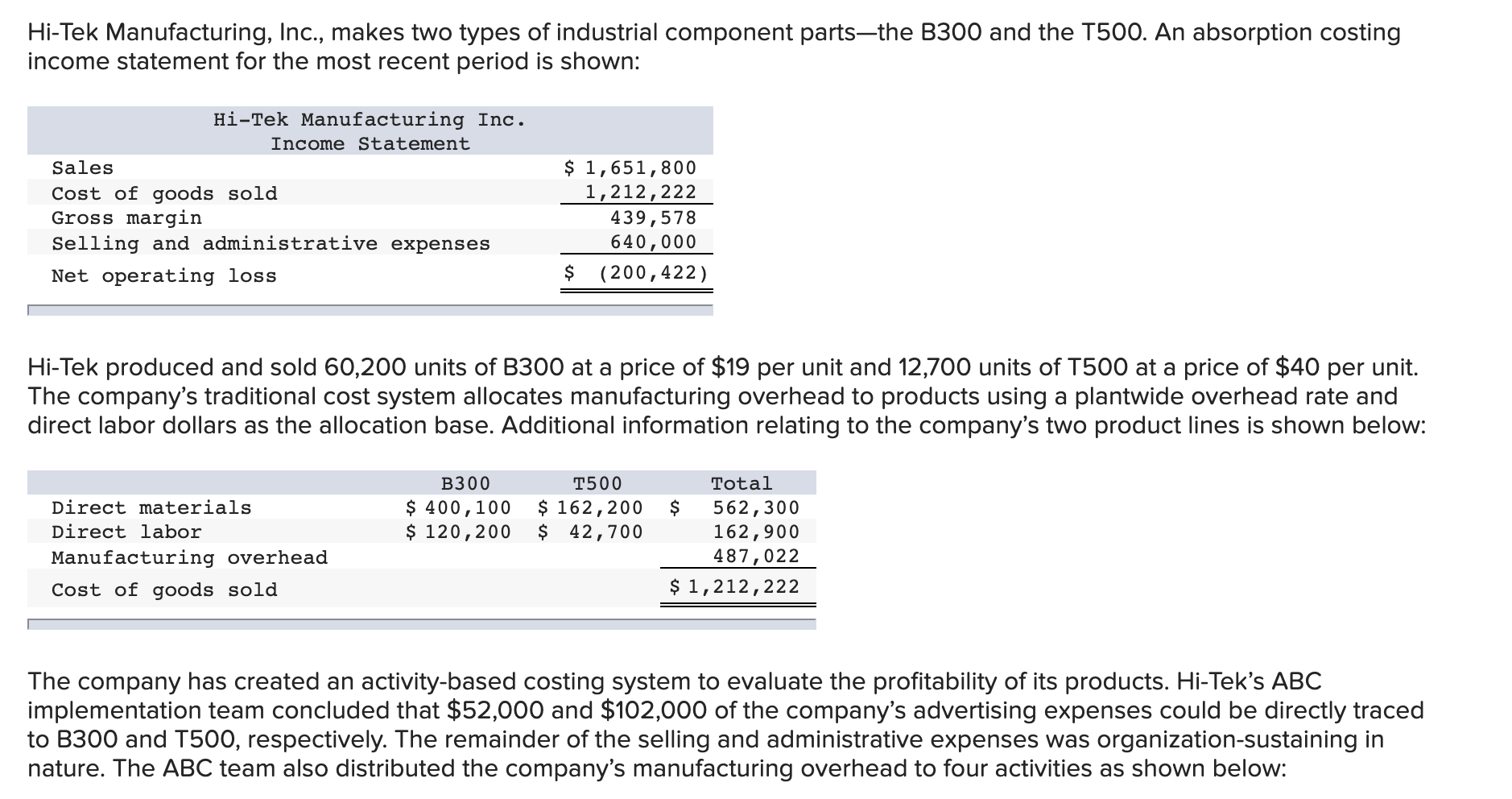

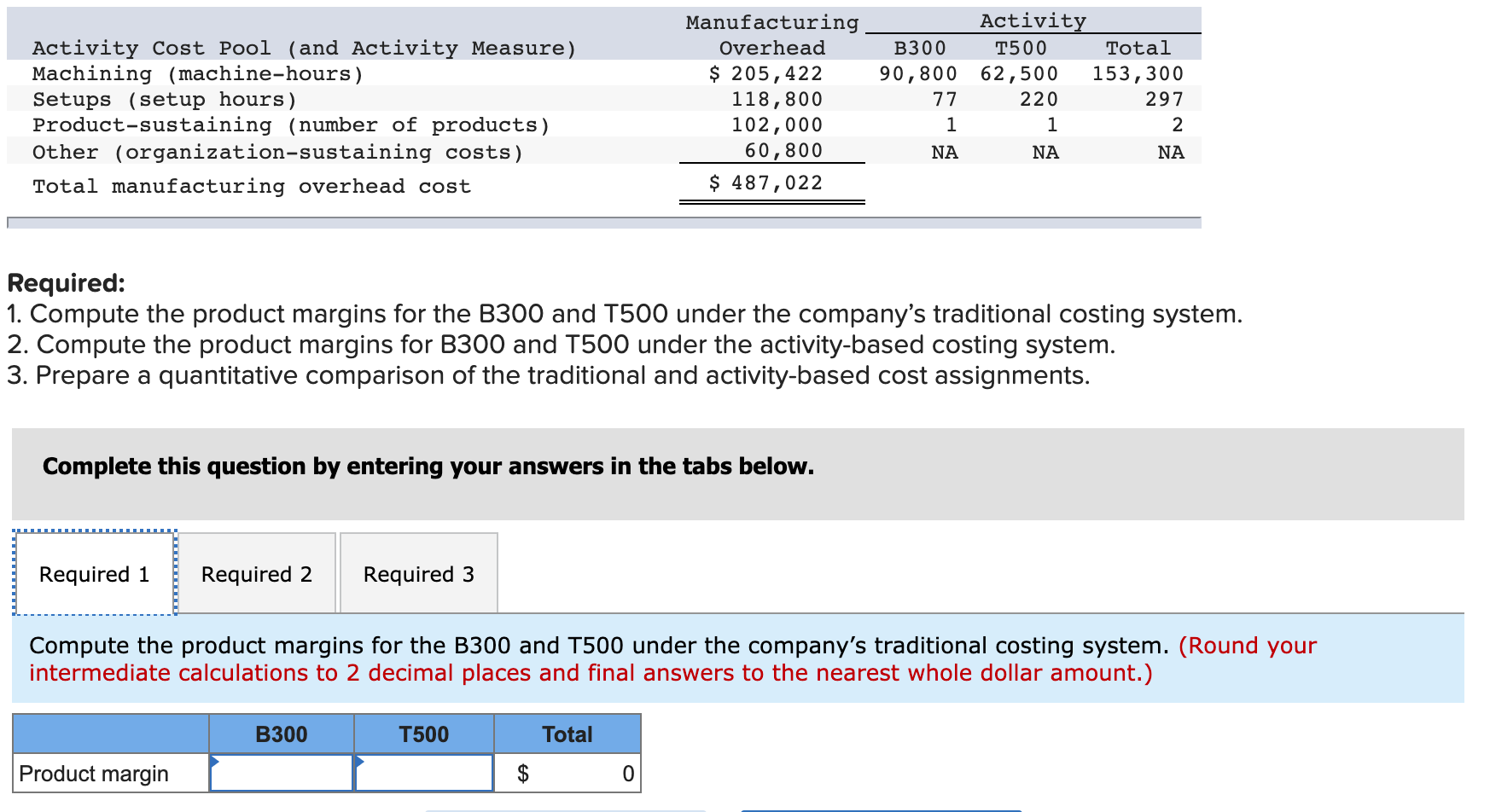

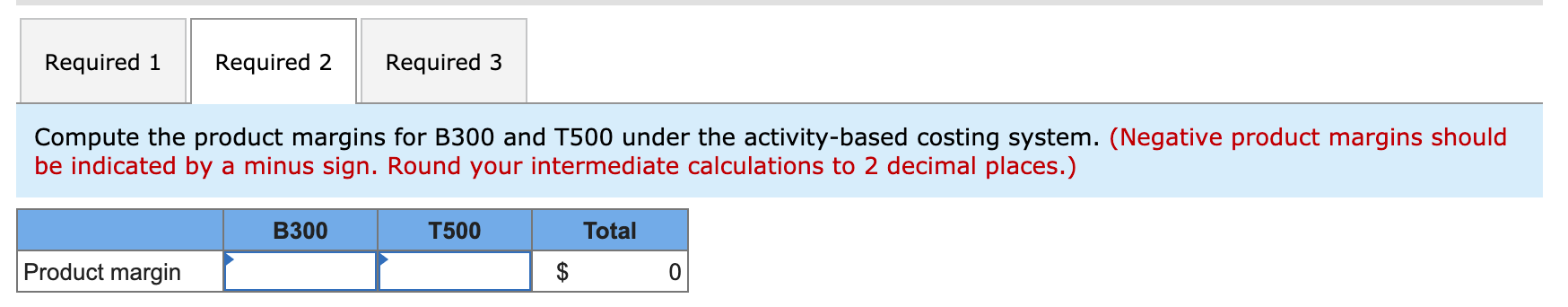

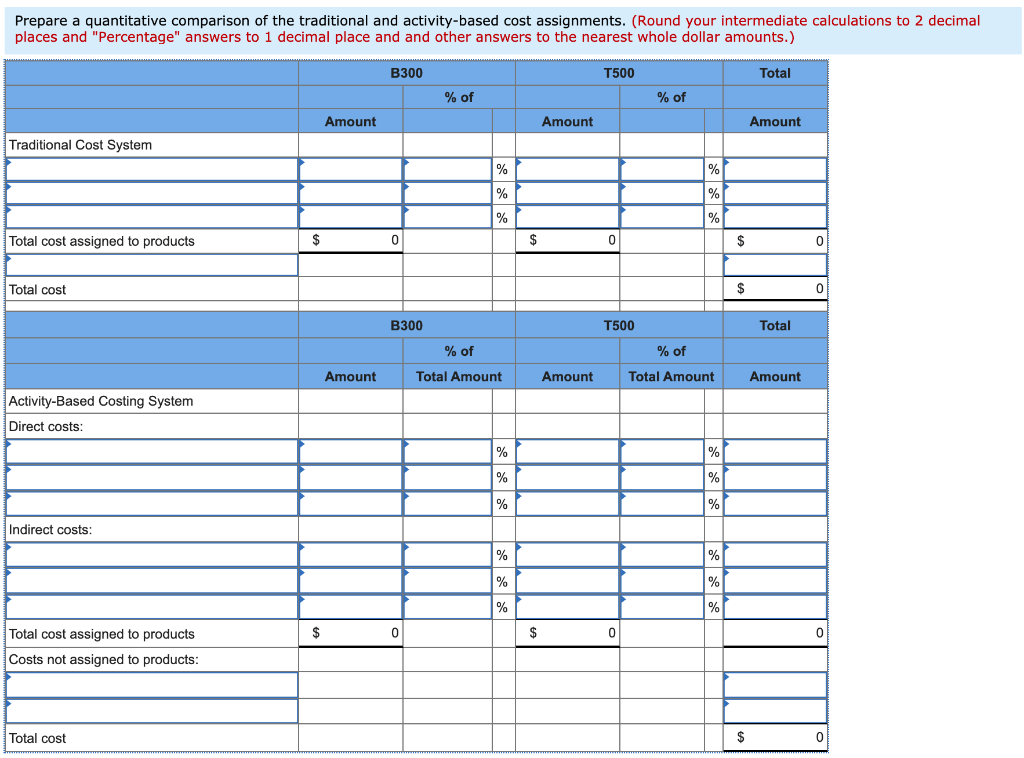

Hi-Tek Manufacturing, Inc., makes two types of industrial component partsthe B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc. Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses $ 1,651,800 1,212,222 439,578 640,000 $ (200,422) Net operating loss Hi-Tek produced and sold 60,200 units of B300 at a price of $19 per unit and 12,700 units of T500 at a price of $40 per unit. The company's traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company's two product lines is shown below: T500 Total B300 $ 400,100 $ 120,200 Direct materials Direct labor $ $ 162,200 $ 42,700 562,300 162,900 487,022 Manufacturing overhead Cost of goods sold $ 1,212,222 The company has created an activity-based costing system to evaluate the profitability of its products. Hi-Tek's ABC implementation team concluded that $52,000 and $102,000 of the company's advertising expenses could be directly traced to B300 and T500, respectively. The remainder of the selling and administrative expenses was organization-sustaining in nature. The ABC team also distributed the company's manufacturing overhead to four activities as shown below: B300 Manufacturing Overhead $ 205, 422 118,800 102,000 60,800 $ 487,022 Activity T500 Total 62,500 153,300 220 297 Activity Cost Pool (and Activity Measure) Machining (machine-hours) Setups (setup hours) Product-sustaining (number of products) Other (organization-sustaining costs) Total manufacturing overhead cost 90,800 77 1 1 2 NA NA NA Required: 1. Compute the product margins for the B300 and T500 under the company's traditional costing system. 2. Compute the product margins for B300 and T500 under the activity-based costing system. 3. Prepare a quantitative comparison of the traditional and activity-based cost assignments. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the product margins for the B300 and T500 under the company's traditional costing system. (Round your intermediate calculations to 2 decimal places and final answers to the nearest whole dollar amount.) B300 T500 Total Product margin $ 0 Required 1 Required 2 Required 3 Compute the product margins for B300 and T500 under the activity-based costing system. (Negative product margins should be indicated by a minus sign. Round your intermediate calculations to 2 decimal places.) B300 T500 Total Product margin $ 0 Prepare a quantitative comparison of the traditional and activity-based cost assignments. (Round your intermediate calculations to 2 decimal places and "Percentage" answers to 1 decimal place and and other answers to the nearest whole dollar amounts.) B300 T500 Total % of % of Amount Amount Amount Traditional Cost System % % % % % % Total cost assigned to products $ 0 $ 0 $ 0 Total cost $ B300 T500 Total % of % of Amount Total Amount Amount Total Amount Amount Activity-Based Costing System Direct costs: % % % % %1 % Indirect costs: % % % % % % $ 0 $ 0 0 Total cost assigned to products Costs not assigned to products: Total cost $