Question

HK Limited has 100 employees. Each employee earns two weeks of paid vacation per year. Vacation time not taken in the year earned can be

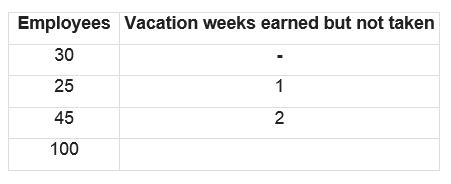

HK Limited has 100 employees. Each employee earns two weeks of paid vacation per year. Vacation time not taken in the year earned can be carried over to two calendar years. Paid leave is first taken out of the balance brought forward from the previous year and then out of the current year’s entitlement (a FIFO basis). During 2019, 30 employees took both weeks’ vacation, but at the end of the year, 70 employees had vacation time carryover as follows:

During 2019, the average salary for employees is $5,000 per week.

The profit sharing plan requires HK Ltd. to pay 2% of its net profit to its two directors, Mr. Yau Wen and Ms. Shally Tin. The net profit for 2019 is $3,500,000. Mr. Wen will receive the bonus six months after the end of 2019, whereas Ms. Tin would be paid on July 2021 since she joined the company in March of 2019.

HK Ltd. agrees to pay a fixed contribution of 5% of employees’ salary to a retirement plan, subject to a cap of $1,250 per month for each employee. The contribution is paid monthly on or before the 10th of the following month. Out of the 200 employees, 160 employees earn an average monthly salary of $20,000. The remaining employees earn more than $35,000 per month.

Required:

Classify the nature of the employee benefit(s) above and explain the accounting treatment (provide journal entries if necessary) in accordance with relevant Hong Kong Accounting Standard(s).

Step by Step Solution

3.36 Rating (140 Votes )

There are 3 Steps involved in it

Step: 1

answer 1 Paid vacations are expenses for the company Company needs to pay them for the leaves tacken ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started