Answered step by step

Verified Expert Solution

Question

1 Approved Answer

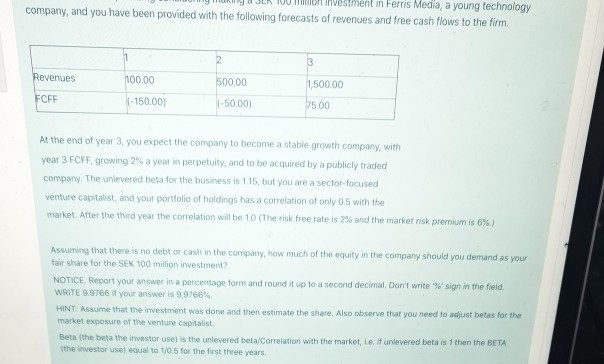

Ho investment in Ferris Media, a young technology company, and you have been provided with the following forecasts of revenues and free cash flows to

Ho investment in Ferris Media, a young technology company, and you have been provided with the following forecasts of revenues and free cash flows to the firm. 2 3 Revenues 100.00 500.00 1,500.00 FCEF 1-150.00) (-50.00) 75.00 At the end of year 3, you expect the company to become a stable growth company, with year 3 FCFF, growing 2% a year in perpetuity, and to be acquired by a publicly traded company. The unlevered beta for the business is 115, but you are a sector-focused venture capitalist, and your portfolio of holdings has a correlation of only 0.5 with the market. After the third year the correlation will be 10 (The risk free rate is 2% and the market risk premium is 6%) Assuming that there is no debt or cash in the company, how much of the equity in the company should you demand as your fair share for the SEK 100 million investment? NOTICE. Report your answer in a percentage form and round it up to a second decimal. Don't write sign in the field. WRITE 9.9766 if your answer is 9,9766% HINT. Assume that the investment was done and then estimate the share. Also observe that you need to adjust betas for the market exposure of the venture capitalist Beta (the beta the investor use) is the unlevered beta/Correlation with the market, le. If unlevered beta is 1 than the BETA (the investor use equal to 1/0.5 for the first three years Ho investment in Ferris Media, a young technology company, and you have been provided with the following forecasts of revenues and free cash flows to the firm. 2 3 Revenues 100.00 500.00 1,500.00 FCEF 1-150.00) (-50.00) 75.00 At the end of year 3, you expect the company to become a stable growth company, with year 3 FCFF, growing 2% a year in perpetuity, and to be acquired by a publicly traded company. The unlevered beta for the business is 115, but you are a sector-focused venture capitalist, and your portfolio of holdings has a correlation of only 0.5 with the market. After the third year the correlation will be 10 (The risk free rate is 2% and the market risk premium is 6%) Assuming that there is no debt or cash in the company, how much of the equity in the company should you demand as your fair share for the SEK 100 million investment? NOTICE. Report your answer in a percentage form and round it up to a second decimal. Don't write sign in the field. WRITE 9.9766 if your answer is 9,9766% HINT. Assume that the investment was done and then estimate the share. Also observe that you need to adjust betas for the market exposure of the venture capitalist Beta (the beta the investor use) is the unlevered beta/Correlation with the market, le. If unlevered beta is 1 than the BETA (the investor use equal to 1/0.5 for the first three years

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started