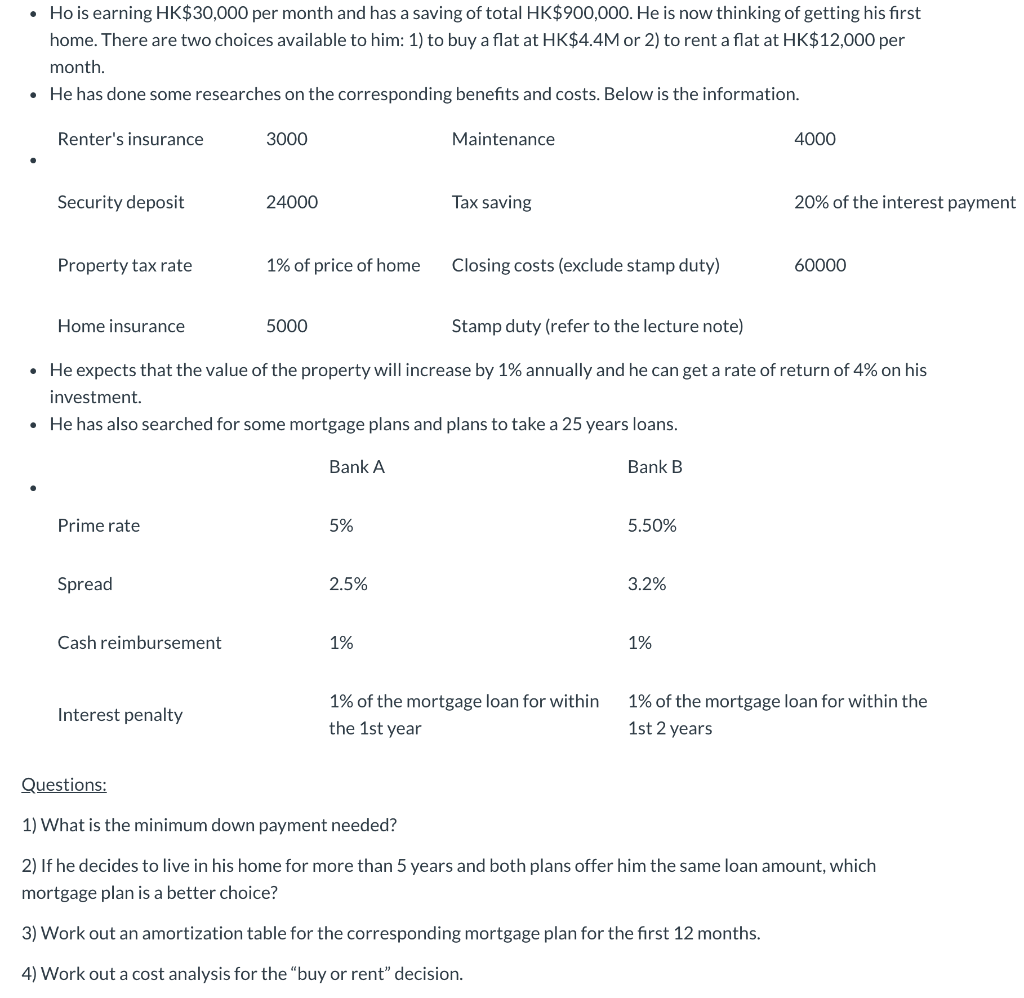

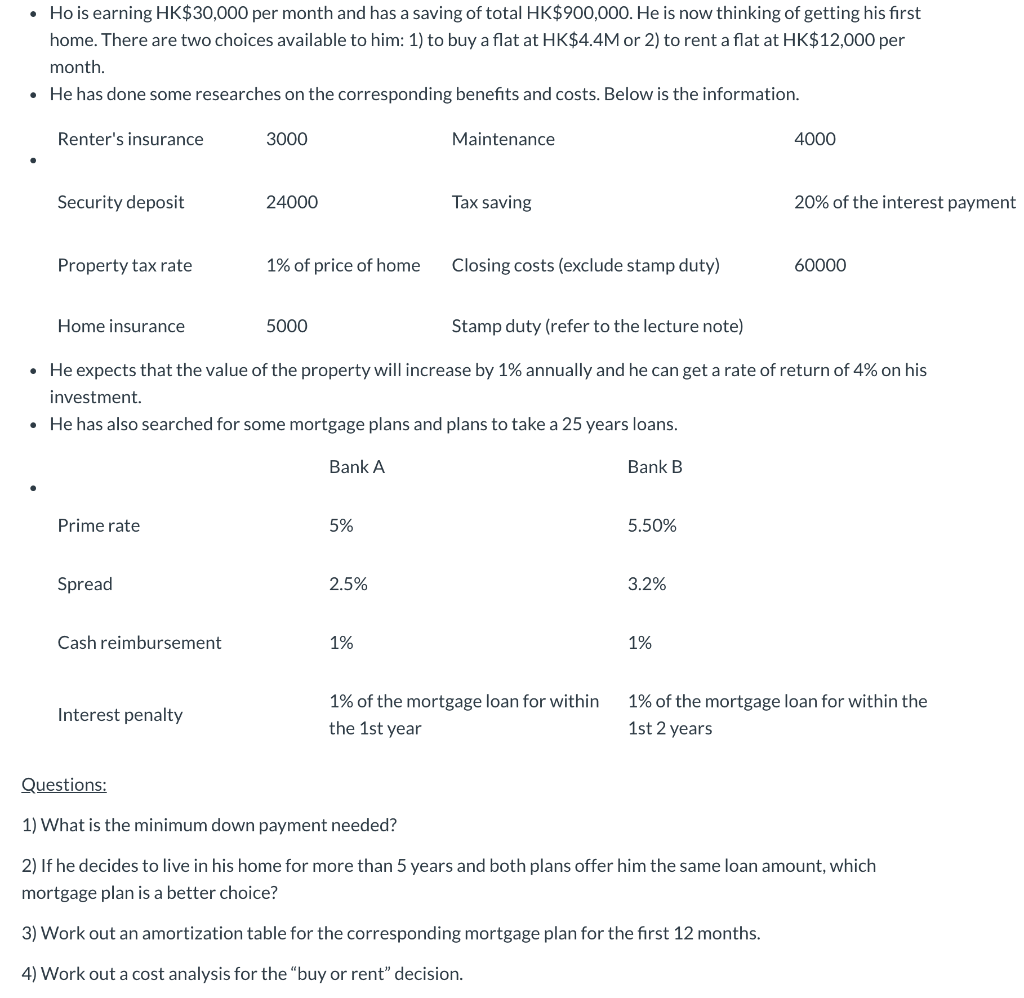

Ho is earning HK$30,000 per month and has a saving of total HK$900,000. He is now thinking of getting his first home. There are two choices available to him: 1) to buy a flat at HK$4.4M or 2) to rent a flat at HK$12,000 per month. He has done some researches on the corresponding benefits and costs. Below is the information. Renter's insurance 3000 Maintenance 4000 Security deposit 24000 Tax saving 20% of the interest payment Property tax rate 1% of price of home Closing costs (exclude stamp duty) 60000 Home insurance 5000 Stamp duty (refer to the lecture note) He expects that the value of the property will increase by 1% annually and he can get a rate of return of 4% on his investment He has also searched for some mortgage plans and plans to take a 25 years loans. Bank A Bank B Prime rate 5% 5.50% Spread 2.5% 3.2% Cash reimbursement 1% 1% Interest penalty 1% of the mortgage loan for within the 1st year 1% of the mortgage loan for within the 1st 2 years Questions: 1) What is the minimum down payment needed? 2) If he decides to live in his home for more than 5 years and both plans offer him the same loan amount, which mortgage plan is a better choice? 3) Work out an amortization table for the corresponding mortgage plan for the first 12 months. 4) Work out a cost analysis for the "buy or rent" decision. Ho is earning HK$30,000 per month and has a saving of total HK$900,000. He is now thinking of getting his first home. There are two choices available to him: 1) to buy a flat at HK$4.4M or 2) to rent a flat at HK$12,000 per month. He has done some researches on the corresponding benefits and costs. Below is the information. Renter's insurance 3000 Maintenance 4000 Security deposit 24000 Tax saving 20% of the interest payment Property tax rate 1% of price of home Closing costs (exclude stamp duty) 60000 Home insurance 5000 Stamp duty (refer to the lecture note) He expects that the value of the property will increase by 1% annually and he can get a rate of return of 4% on his investment He has also searched for some mortgage plans and plans to take a 25 years loans. Bank A Bank B Prime rate 5% 5.50% Spread 2.5% 3.2% Cash reimbursement 1% 1% Interest penalty 1% of the mortgage loan for within the 1st year 1% of the mortgage loan for within the 1st 2 years Questions: 1) What is the minimum down payment needed? 2) If he decides to live in his home for more than 5 years and both plans offer him the same loan amount, which mortgage plan is a better choice? 3) Work out an amortization table for the corresponding mortgage plan for the first 12 months. 4) Work out a cost analysis for the "buy or rent" decision