- HO-3/ H0-6/ H0-4/ HO-2/ H0-8/ HO-1

- HO-3/ H0-6/ H0-4/ HO-2/ HO-8/ HO-1

- will not be reimbursed/ will be remibursed up to

20% of thr personal property insurance/ will be remibursed up to 40% of thr personal property insurance/ were not eligible for

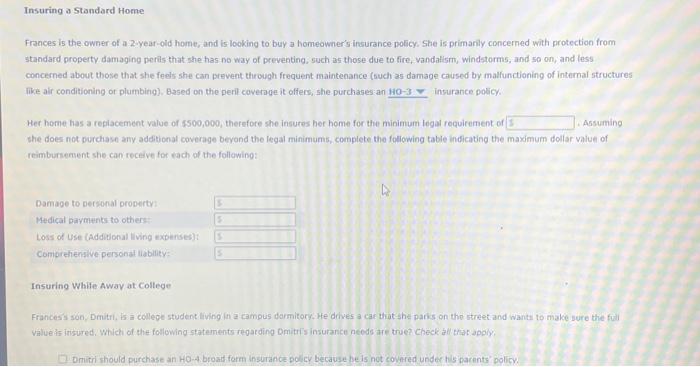

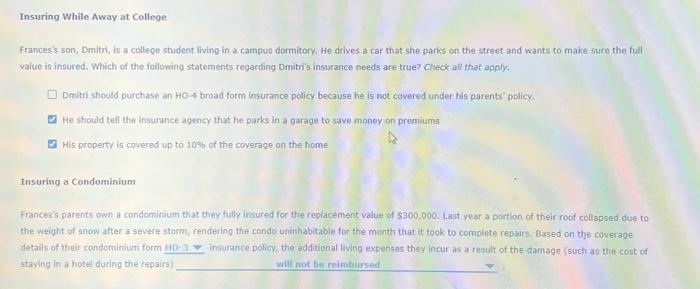

Insuring a Standard Home Frances is the owner of a 2 year-old home, and is looking to buy a homeowner's insurance policy, She is primanily concerned with protection from standard property damaging perits that she has no way of preventing, such as those due to fire, vandalism, windstorms, and so on, and less concerned about those that she feels she can prevent through frequent maintenance (such as damage caused by malfunctioning of internal structures rike alr conditioning of plumbing). Based on the peril coverage it offers, she purchases:an insurance poscy. Her home has a repiacement value of $500,000, therefore she insures her home for the minimum logal requirement of . Assuming she does not burchase any additional coverage beyond the legal minimums, complete the following table indicating the maximum dollar value of reimburtersent she can receive for each of the following: Insuring While Away at Coltege Francesis son, Dritri, is a college student living in a campus darmitory. He dowec a cas that-shic paris on tho itreet and wanta to make jure the full Value is irisured, Which of the following statements regatding Dmittis insurance necds are true? check atl that apoly? Dmitil should purchase an HO-4 beoath form insurance poley because be is not covared undec hils pacents' policy. Frances's son, Dmitri. Is-a college student living in a campus dormitory, He drives a car that she parks on the street and wants to make-sufe the full value is insured. Which of the following statements regarding Dmitris insurance needs are true? Check all that apply. Dmitri should purchase an HO-4 broad form insurance policy because he is not covered winder his parents' policy. He should tell the insurance agency that he parks in a garage to save moncy on premilums His property is covered up to-10\% of the coverage on the home Insuring a Condominium Frances's parents own a condominium that they fully insured for the replacement value of $300,000. Last year a portion of their roof collapsed due to the welght of snow after a severe stomm, rendering the condo uninhabitable for the month that it took to complete repairs, Based on the coverage details of their condominium form HO3 incurance policy, the additional iiving expenses they incur as a result of the damage (such as the cost of stayng in a hotel dring the repairs) will not be reimbirsed