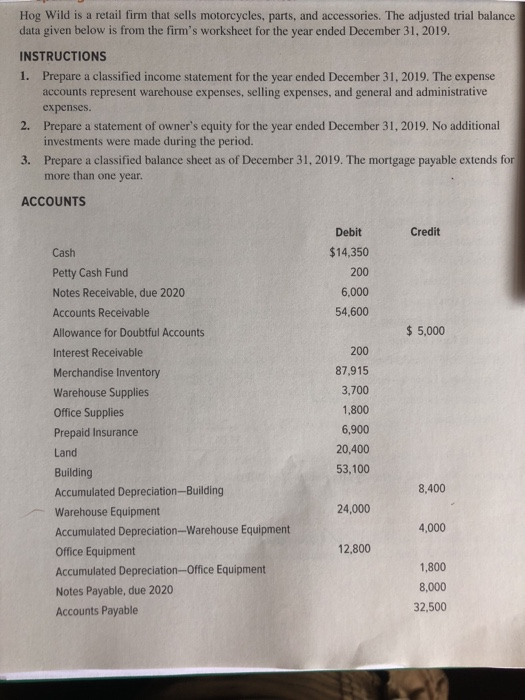

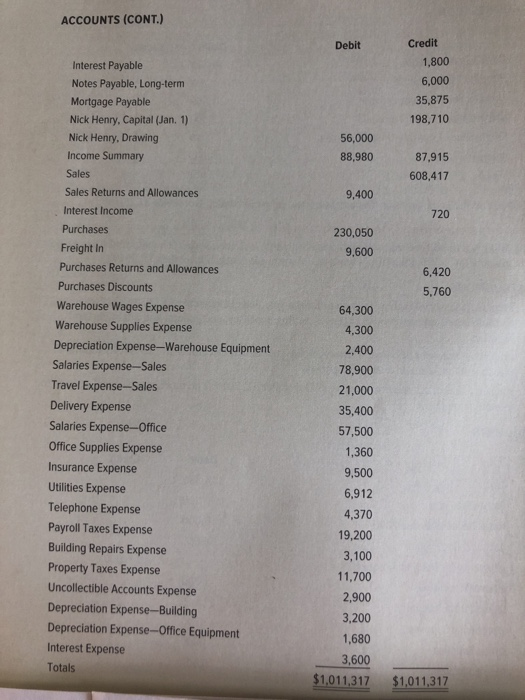

Hog Wild is a retail firm that sells motorcycles, parts, and accessories. The adjusted trial balance data given below is from the firm's worksheet for the year ended December 31, 2019. INSTRUCTIONS 1. Prepare a classified income statement for the year ended December 31, 2019. The expense accounts represent warehouse expenses, selling expenses, and general and administrative expenses. 2. Prepare a statement of owner's equity for the year ended December 31, 2019. No additional investments were made during the period. 3. Prepare a classified balance sheet as of December 31, 2019. The mortgage payable extends for more than one year. ACCOUNTS Credit Debit $14,350 200 6,000 54,600 $5,000 Cash Petty Cash Fund Notes Receivable, due 2020 Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Merchandise Inventory Warehouse Supplies Office Supplies Prepaid Insurance Land Building Accumulated Depreciation-Building Warehouse Equipment Accumulated Depreciation--Warehouse Equipment Office Equipment Accumulated Depreciation-Office Equipment Notes Payable, due 2020 Accounts Payable 200 87,915 3,700 1,800 6,900 20,400 53,100 8,400 24,000 4,000 12,800 1,800 8,000 32,500 ACCOUNTS (CONT.) Debit Credit 1,800 6,000 35,875 198,710 56,000 88,980 87,915 608,417 9,400 720 230,050 9,600 6,420 5.760 Interest Payable Notes Payable, Long-term Mortgage Payable Nick Henry, Capital (Jan. 1) Nick Henry, Drawing Income Summary Sales Sales Returns and Allowances Interest Income Purchases Freight in Purchases Returns and Allowances Purchases Discounts Warehouse Wages Expense Warehouse Supplies Expense Depreciation Expense-Warehouse Equipment Salaries Expense-Sales Travel Expense-Sales Delivery Expense Salaries Expense-Office Office Supplies Expense Insurance Expense Utilities Expense Telephone Expense Payroll Taxes Expense Building Repairs Expense Property Taxes Expense Uncollectible Accounts Expense Depreciation Expense-Building Depreciation Expense-Office Equipment Interest Expense Totals 64,300 4,300 2,400 78,900 21,000 35,400 57,500 1,360 9,500 6,912 4,370 19,200 3,100 11,700 2,900 3,200 1,680 3,600 $1,011,317 $1,011,317