Answered step by step

Verified Expert Solution

Question

1 Approved Answer

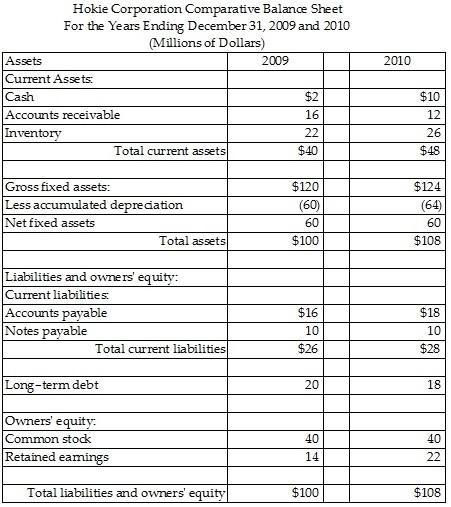

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders. Calculate the following

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

Calculate the following 2010 financial ratios of Aggie Corporation using the information given

| i. | current ratio |

| ii. | acid test ratio |

| iii. | debt ratio |

| iv. | return on total assets |

| v. | return on common equity |

Hokie Corporation Comparative Balance Sheet For the Years Ending December 31, 2009 and 2010 (Millions of Dollars) Assets Current Assets: Cash Accounts receivable Inventory Total current assets Gross fixed assets: Less accumulated depreciation Net fixed assets Total assets Liabilities and owners' equity: Current liabilities: Accounts payable Notes payable Long-term debt Owners' equity Common stock Retained eamings Total current liabilities Total liabilities and owners' equity 2009 $2 16 22 $40 $120 (60) 60 $100 $16 10 $26 20 40 14 $100 2010 $10 12 26 $48 $124 (64) 60 $108 $18 10 $28 18 40 22 $108

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To calculate the requested financial ratios for Aggie Corporation using the given information well u...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started