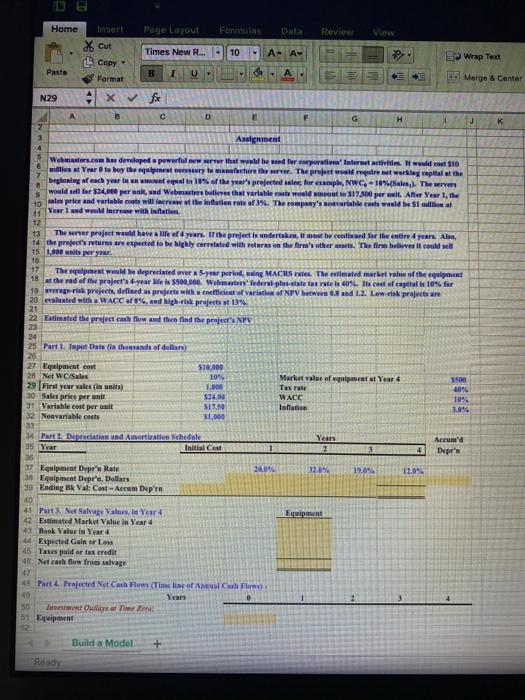

Home Insect Page Layout Formulas Dal Review View X Cut Times New R... - 10 A A 5 Wrap Tea Copy Paste B I U A- Format DIG Merge & Center N29 4 x fx c D E G H 1 J K 2 3 Assignment 4 5 Weber.com has developed a powerful that would be adfererer Interactivities. I was $10 6 millest Year to buy the per te facture ther. The project will require werking explait the 7 beginning of each year qual to 10% of the year's projected sales for example, NWC. -10%(Sales, The a would all for 534,00 per unit, and Webbleres that variable casta wode 1 317.800 per unit. Aber Year 1, the 10 ale price and variable costs will increw of the inflation rate of 3%. The company's morale che would be Simon 11 Year 1 and woners with inflation. 12 13 The ser project will have a life of years the project is undertakin, it be continued for the entire 4 years. Also, 14 the propertures are expected to be highly correlated with us on the firm's other. The firm believes it could 15 1,000 year. 16 17 The equipment would be depreciated over a year period, ndng MACRS rates. The estimated market value of the equipment 18 at the end of the project's t-year life is 500,000. Webtor federal phen-state tax rates 60%. Is cost of capital is 10% for 19 Bergerak projects, defined as projects with efficient of variation of NPV between 0.8 1.3. Low risk project 20 nated with a WACC 48%, and high-risk prajets st 13% 21 22 Estimated the project cash flow and then find the project NPY 24 25 Part Taper Data in thousands of dollars 28 27 Equipment cost $10.000 28 Net WC/Sales 1046 Market value of equipment at Year 4 5500 29 First year sale in units) 1.000 Text 40% 30 Sales price per unit 534.00 WACC 10% 31 Variable costruit $19.99 Inline 2016 32 Nonvariable costs $1,000 33 34 Part Depreciation and Amortation Schedule Years Arad 35 Year Initial Cou 1 2 3 4 Depre 37 Equipment Depe's Rate 20.0% 120%. 29.8% 12.09 38 Equipment Depra, Dollars 39 Ending Bk Val Cost Accam Depirn 40 41 Part Net Nape Vales, Is Year 4 Equipment 42 Estimated Market Value in Year 43 Book Value in Year 4 44. Expected Gainer Loss 45 Teen paid or tax credit 46 Net cash flow free salvage 45 Part 4. Projected Net Cash Flow (Timeline of Anth Flowe. Year 0 Inwen Outlet Time 51 Equipment 1 Build a Mod + Ready Home Insect Page Layout Formulas Dal Review View X Cut Times New R... - 10 A A 5 Wrap Tea Copy Paste B I U A- Format DIG Merge & Center N29 4 x fx c D E G H 1 J K 2 3 Assignment 4 5 Weber.com has developed a powerful that would be adfererer Interactivities. I was $10 6 millest Year to buy the per te facture ther. The project will require werking explait the 7 beginning of each year qual to 10% of the year's projected sales for example, NWC. -10%(Sales, The a would all for 534,00 per unit, and Webbleres that variable casta wode 1 317.800 per unit. Aber Year 1, the 10 ale price and variable costs will increw of the inflation rate of 3%. The company's morale che would be Simon 11 Year 1 and woners with inflation. 12 13 The ser project will have a life of years the project is undertakin, it be continued for the entire 4 years. Also, 14 the propertures are expected to be highly correlated with us on the firm's other. The firm believes it could 15 1,000 year. 16 17 The equipment would be depreciated over a year period, ndng MACRS rates. The estimated market value of the equipment 18 at the end of the project's t-year life is 500,000. Webtor federal phen-state tax rates 60%. Is cost of capital is 10% for 19 Bergerak projects, defined as projects with efficient of variation of NPV between 0.8 1.3. Low risk project 20 nated with a WACC 48%, and high-risk prajets st 13% 21 22 Estimated the project cash flow and then find the project NPY 24 25 Part Taper Data in thousands of dollars 28 27 Equipment cost $10.000 28 Net WC/Sales 1046 Market value of equipment at Year 4 5500 29 First year sale in units) 1.000 Text 40% 30 Sales price per unit 534.00 WACC 10% 31 Variable costruit $19.99 Inline 2016 32 Nonvariable costs $1,000 33 34 Part Depreciation and Amortation Schedule Years Arad 35 Year Initial Cou 1 2 3 4 Depre 37 Equipment Depe's Rate 20.0% 120%. 29.8% 12.09 38 Equipment Depra, Dollars 39 Ending Bk Val Cost Accam Depirn 40 41 Part Net Nape Vales, Is Year 4 Equipment 42 Estimated Market Value in Year 43 Book Value in Year 4 44. Expected Gainer Loss 45 Teen paid or tax credit 46 Net cash flow free salvage 45 Part 4. Projected Net Cash Flow (Timeline of Anth Flowe. Year 0 Inwen Outlet Time 51 Equipment 1 Build a Mod + Ready