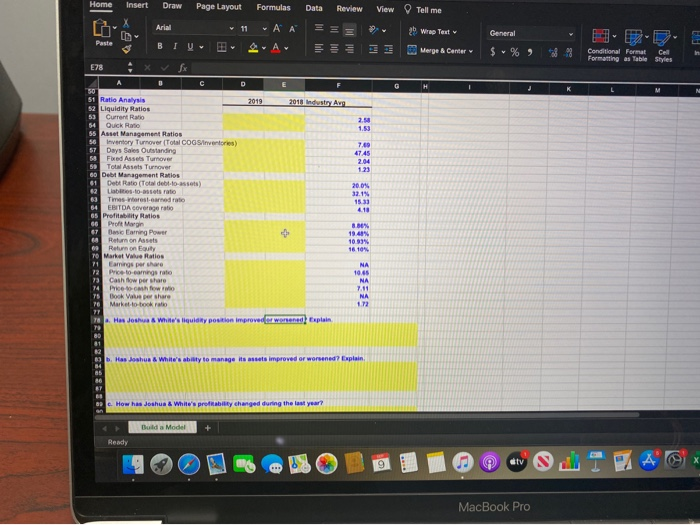

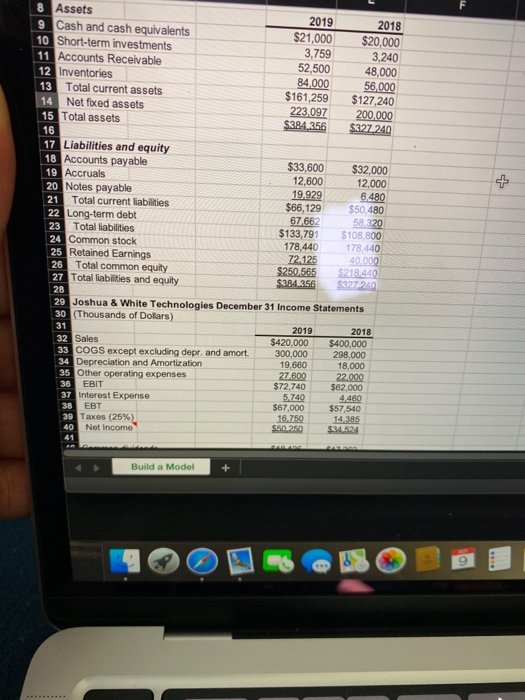

Home Insert Draw Page Layout Formulas Data Review View Tell me X Arial 11 v AA E 25 Wrap Text General Paste B TV a-A~ TA Merge & Center $% Conditional Format Cell Formatting as Table Styles E78 fx A C D G K N 2019 2018 Indust Avg 2.5 789 2.04 1.23 51 Ratio Analysis 52 Liquidity Ratios 53 Current Ratio 54 Quick Ratio 55 Asset Management Ratios 56 Inventory Turnover (Total COG Sinventories) Days Sales Outstanding 54 Fixed Assets Turnover 53 Total Assets Turnover 60 Debt Management Ratios 61 Debt Ratio (Total de to assets) 42 Listo-strato 63 Times Worst-earned rote 64 EBITDA coverage ratio 65 Profitability Ratios Proft Morgan 67 Basic Caring Power 6 Return on Assets 69 Return on Equity 70 Market Value Ratios 20.0 32.15 153 8.30 194 10.93 16 10% Earrings per the NA 10.66 NA Price-to-cominge ratio Cash per share Price ocash flow who Book Value por share Market to book al Has Joshua & White's liquidy position improved or worsened pain NA 172 19 Has Joshua & White's ability to manage its assets improved or worsened? Explain c. How has Joshua & White's profitability changed during the last year? Build a Model Ready A 9 tv 9 MacBook Pro + 8 Assets 2019 2018 9 Cash and cash equivalents $21,000 10 Short-term investments $20,000 3,759 11 Accounts Receivable 3,240 52,500 48,000 12 Inventories 84,000 56.000 13 Total current assets $161,259 $127,240 14 Net fixed assets 223,097 200.000 15 Total assets $384356 $327240 16 17 Liabilities and equity 18 Accounts payable $33,600 $32,000 19 Accruals 12,600 12,000 20 Notes payable 19.929 6480 21 Total current liabilities $66,129 $50,480 22 Long-term debt 67,662 58 320 23 Total liabilities $133,791 $108.800 24 Common stock 178,440 178,440 25 Retained Earnings 72.125 40,000 26 Total common equity $250.565 $218.440 27 Total liabilities and equity $384.356 $27240 28 29 Joshua & White Technologies December 31 Income Statements 30 (Thousands of Dollars) 31 2019 2018 32 Sales $420,000 $400,000 33 COGS except excluding depr. and amort. 300,000 298,000 34 Depreciation and Amortization 19,660 18,000 35 Other operating expenses 27 600 22.000 36 EBIT $72,740 $62,000 37 Interest Expense 5.740 4.469 38 EBT $67,000 $57,540 39 Taxos (25%) 16.750 14,385 40 Net Income $50.250 $34.524 Build a Model 18