Answered step by step

Verified Expert Solution

Question

1 Approved Answer

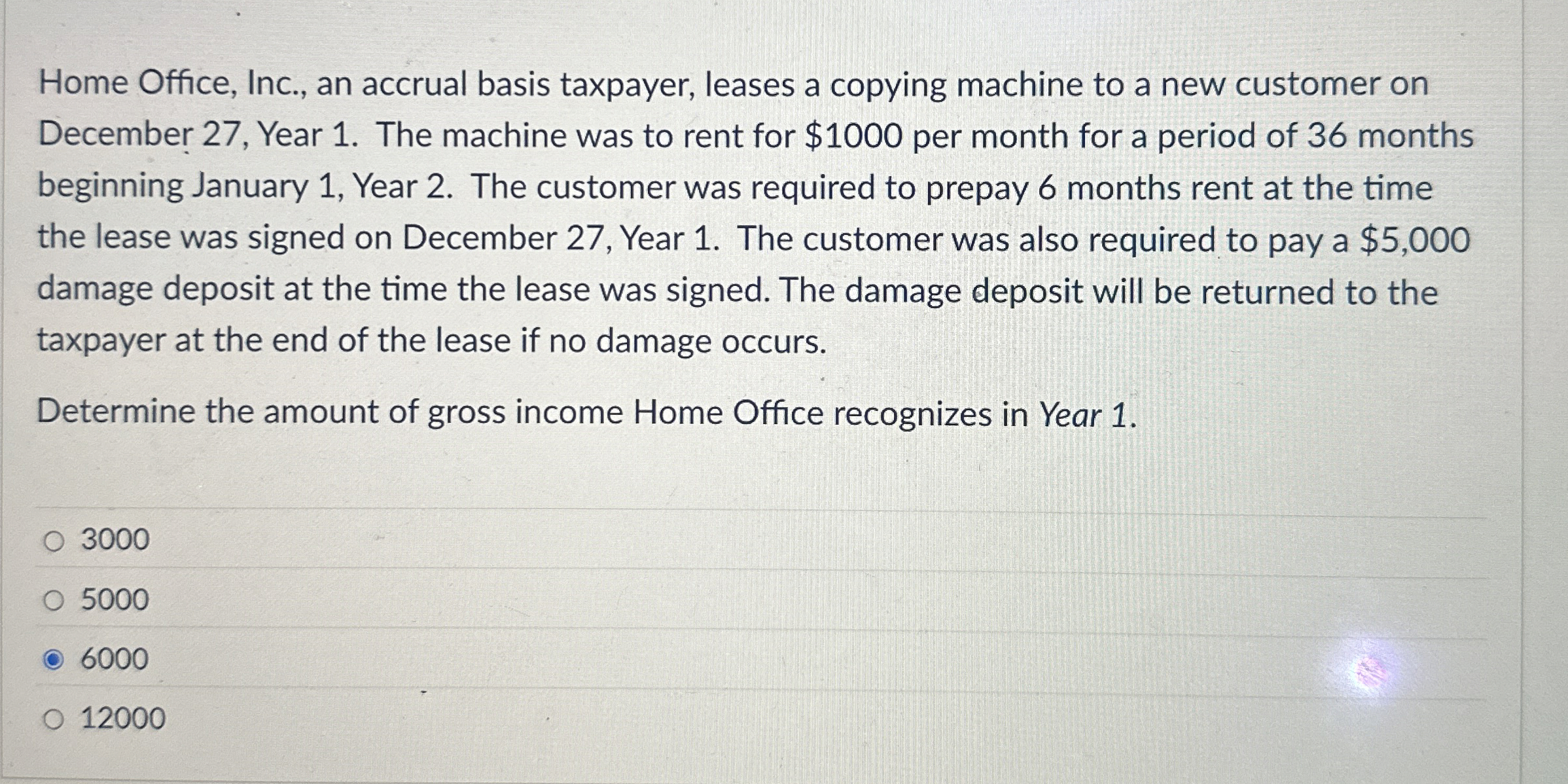

Home Office, Inc., an accrual basis taxpayer, leases a copying machine to a new customer on December 2 7 , Year 1 . The machine

Home Office, Inc., an accrual basis taxpayer, leases a copying machine to a new customer on

December Year The machine was to rent for $ per month for a period of months

beginning January Year The customer was required to prepay months rent at the time

the lease was signed on December Year The customer was also required to pay a $

damage deposit at the time the lease was signed. The damage deposit will be returned to the

taxpayer at the end of the lease if no damage occurs.

Determine the amount of gross income Home Office recognizes in Year

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started