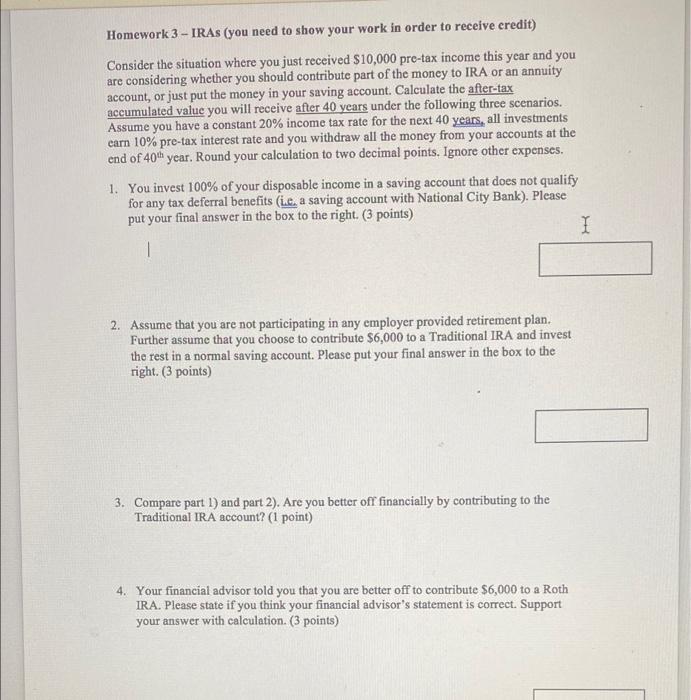

Homework 3 - IRAs (you need to show your work in order to receive credit) Consider the situation where you just received $10,000 pro-tax income this year and you are considering whether you should contribute part of the money to IRA or an annuity account, or just put the money in your saving account. Calculate the after-tax accumulated value you will receive after 40 years under the following three scenarios. Assume you have a constant 20% income tax rate for the next 40 years, all investments carn 10% pre-tax interest rate and you withdraw all the money from your accounts at the end of 40th year. Round your calculation to two decimal points. Ignore other expenses. 1. You invest 100% of your disposable income in a saving account that does not qualify for any tax deferral benefits (ie, a saving account with National City Bank). Please put your final answer in the box to the right. (3 points) I a 2. Assume that you are not participating in any employer provided retirement plan. Further assume that you choose to contribute $6,000 to a Traditional IRA and invest the rest in a normal saving account. Please put your final answer in the box to the right. (3 points) 3. Compare part 1) and part 2). Are you better off financially by contributing to the Traditional IRA account? (1 point) 4. Your financial advisor told you that you are better off to contribute $6,000 to a Roth IRA. Please state if you think your financial advisor's statement is correct. Support your answer with calculation. (3 points) Homework 3 - IRAs (you need to show your work in order to receive credit) Consider the situation where you just received $10,000 pro-tax income this year and you are considering whether you should contribute part of the money to IRA or an annuity account, or just put the money in your saving account. Calculate the after-tax accumulated value you will receive after 40 years under the following three scenarios. Assume you have a constant 20% income tax rate for the next 40 years, all investments carn 10% pre-tax interest rate and you withdraw all the money from your accounts at the end of 40th year. Round your calculation to two decimal points. Ignore other expenses. 1. You invest 100% of your disposable income in a saving account that does not qualify for any tax deferral benefits (ie, a saving account with National City Bank). Please put your final answer in the box to the right. (3 points) I a 2. Assume that you are not participating in any employer provided retirement plan. Further assume that you choose to contribute $6,000 to a Traditional IRA and invest the rest in a normal saving account. Please put your final answer in the box to the right. (3 points) 3. Compare part 1) and part 2). Are you better off financially by contributing to the Traditional IRA account? (1 point) 4. Your financial advisor told you that you are better off to contribute $6,000 to a Roth IRA. Please state if you think your financial advisor's statement is correct. Support your answer with calculation. (3 points)