Answered step by step

Verified Expert Solution

Question

1 Approved Answer

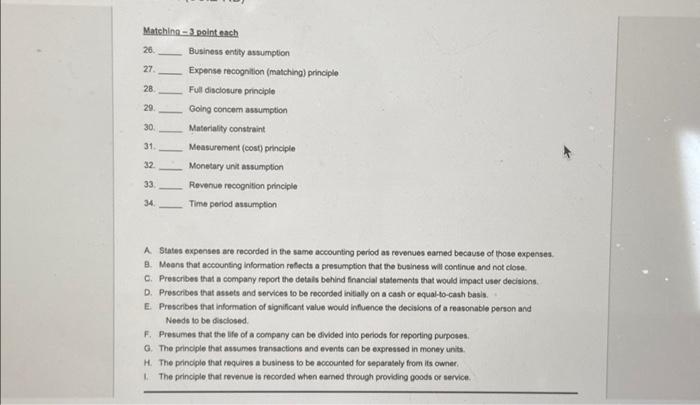

Matching-3 point each 26. 27. 28. 29. 30. 31. 32. 33. 34. Business entity assumption Expense recognition (matching) principle Full disclosure principle Going concern assumption

Matching-3 point each 26. 27. 28. 29. 30. 31. 32. 33. 34. Business entity assumption Expense recognition (matching) principle Full disclosure principle Going concern assumption Materiality constraint Measurement (cost) principle Monetary unit assumption Revenue recognition principle Time period assumption A. States expenses are recorded in the same accounting period as revenues earned because of those expenses. B. Means that accounting information reflects a presumption that the business will continue and not close. C. Prescribes that a company report the details behind financial statements that would impact user decisions. D. Prescribes that assets and services to be recorded initially on a cash or equal-to-cash basis. E. Prescribes that information of significant value would influence the decisions of a reasonable person and Needs to be disclosed. F. Presumes that the life of a company can be divided into periods for reporting purposes. G. The principle that assumes transactions and events can be expressed in money units. H. The principle that requires a business to be accounted for separately from its owner. 1. The principle that revenue is recorded when earned through providing goods or service.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started