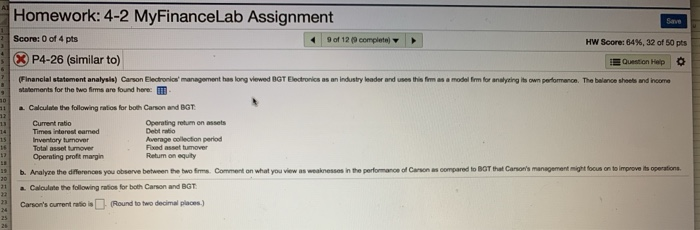

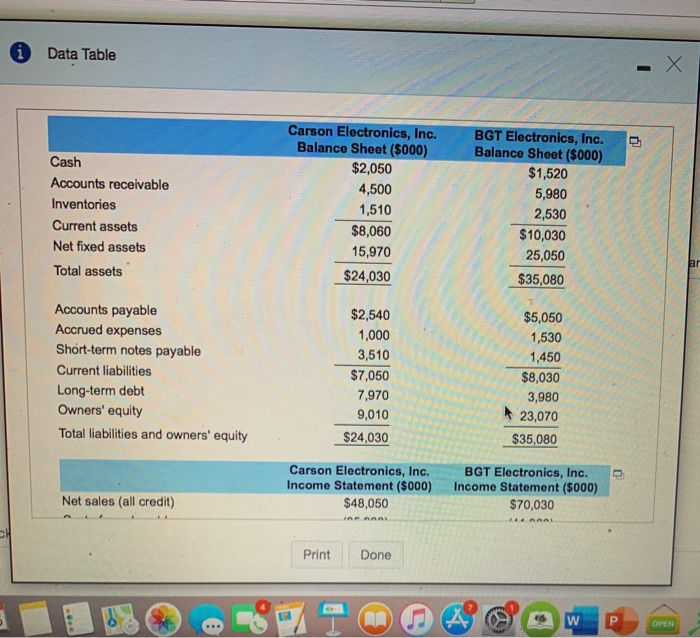

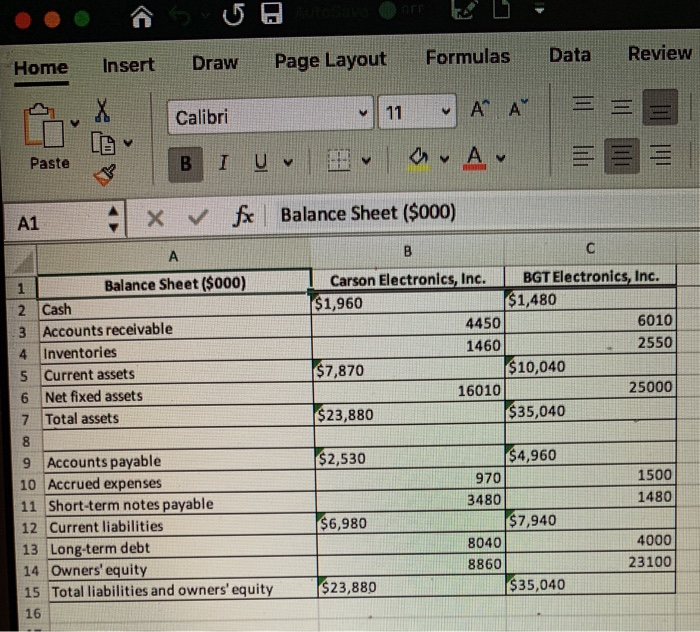

Homework: 4-2 MyFinanceLab Assignment Score: 0 of 4 pts 9 of 12 X P4-26 (similar to) completo) HW Score: 64%, 32 of 50 pts Question Help Financial statement analysia) Carson Electronics' management has long viewed DGT Electronics as an industry leader and use this firm as a model firm for analyzing its own performance. The balance sheets and income statements for the two firms are found here: a. Calculate the following ratios for both Carson and BGT: Current ratio Operating return on assets Times interesteamed Debt ratio Inventory turnover Average collection period Total asset tumover Fixed asset tumover Operating profit margin Return on equity FEFFERBERRRRAAR b. Analyze the differences you observe between the two mm. Comment on what you view as weaknesses in the performance of Carson as compared to BOT that Canon's management might focus on to improve its operations .. Calculate the following ratios for both Carson and BGT Carson's current ratio is Round to two decimal places) Data Table Cash Accounts receivable Inventories Current assets Net fixed assets Total assets Carson Electronics, Inc. Balance Sheet ($000) $2,050 4,500 1,510 $8,060 15,970 $24,030 BGT Electronics, Inc. Balance Sheet (5000) $1,520 5,980 2,530 $10,030 25,050 $35,080 Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $2,540 1,000 3,510 $7,050 7,970 9,010 $24,030 $5,050 1,530 1,450 $8,030 3,980 23,070 $35,080 Carson Electronics, Inc. Income Statement ($000) $48,050 BGT Electronics, Inc. Income Statement ($000) $70,030 Net sales (all credit) Print Done Home Insert Draw Page Layout Formulas Data Review A Calibri " 11 A BI U DOA Paste A1 fx Balance Sheet ($000) Balance Sheet ($000) 2 Cash 3 Accounts receivable 4 Inventories Inventories 5 Current assets 6 Net fixed assets 7 Total assets Carson Electronics, Inc. BGT Electronics, Inc. $1,960 $1,480 4450 6010 1460 2550 $7,870 $10,040 16010 25000 $23,880 $35,040 $2,530 $4,960 970 3480 1500 1480 9 Accounts payable 10 Accrued expenses 11 Short-term notes payable 12 Current liabilities 13 Long-term debt 14 Owners' equity 15 Total liabilities and owners' equity $6,980 $7,940 8040 8860 4000 23100 $23,880 $35,040 Homework: 4-2 MyFinanceLab Assignment Score: 0 of 4 pts 9 of 12 X P4-26 (similar to) completo) HW Score: 64%, 32 of 50 pts Question Help Financial statement analysia) Carson Electronics' management has long viewed DGT Electronics as an industry leader and use this firm as a model firm for analyzing its own performance. The balance sheets and income statements for the two firms are found here: a. Calculate the following ratios for both Carson and BGT: Current ratio Operating return on assets Times interesteamed Debt ratio Inventory turnover Average collection period Total asset tumover Fixed asset tumover Operating profit margin Return on equity FEFFERBERRRRAAR b. Analyze the differences you observe between the two mm. Comment on what you view as weaknesses in the performance of Carson as compared to BOT that Canon's management might focus on to improve its operations .. Calculate the following ratios for both Carson and BGT Carson's current ratio is Round to two decimal places) Data Table Cash Accounts receivable Inventories Current assets Net fixed assets Total assets Carson Electronics, Inc. Balance Sheet ($000) $2,050 4,500 1,510 $8,060 15,970 $24,030 BGT Electronics, Inc. Balance Sheet (5000) $1,520 5,980 2,530 $10,030 25,050 $35,080 Accounts payable Accrued expenses Short-term notes payable Current liabilities Long-term debt Owners' equity Total liabilities and owners' equity $2,540 1,000 3,510 $7,050 7,970 9,010 $24,030 $5,050 1,530 1,450 $8,030 3,980 23,070 $35,080 Carson Electronics, Inc. Income Statement ($000) $48,050 BGT Electronics, Inc. Income Statement ($000) $70,030 Net sales (all credit) Print Done Home Insert Draw Page Layout Formulas Data Review A Calibri " 11 A BI U DOA Paste A1 fx Balance Sheet ($000) Balance Sheet ($000) 2 Cash 3 Accounts receivable 4 Inventories Inventories 5 Current assets 6 Net fixed assets 7 Total assets Carson Electronics, Inc. BGT Electronics, Inc. $1,960 $1,480 4450 6010 1460 2550 $7,870 $10,040 16010 25000 $23,880 $35,040 $2,530 $4,960 970 3480 1500 1480 9 Accounts payable 10 Accrued expenses 11 Short-term notes payable 12 Current liabilities 13 Long-term debt 14 Owners' equity 15 Total liabilities and owners' equity $6,980 $7,940 8040 8860 4000 23100 $23,880 $35,040