Answered step by step

Verified Expert Solution

Question

1 Approved Answer

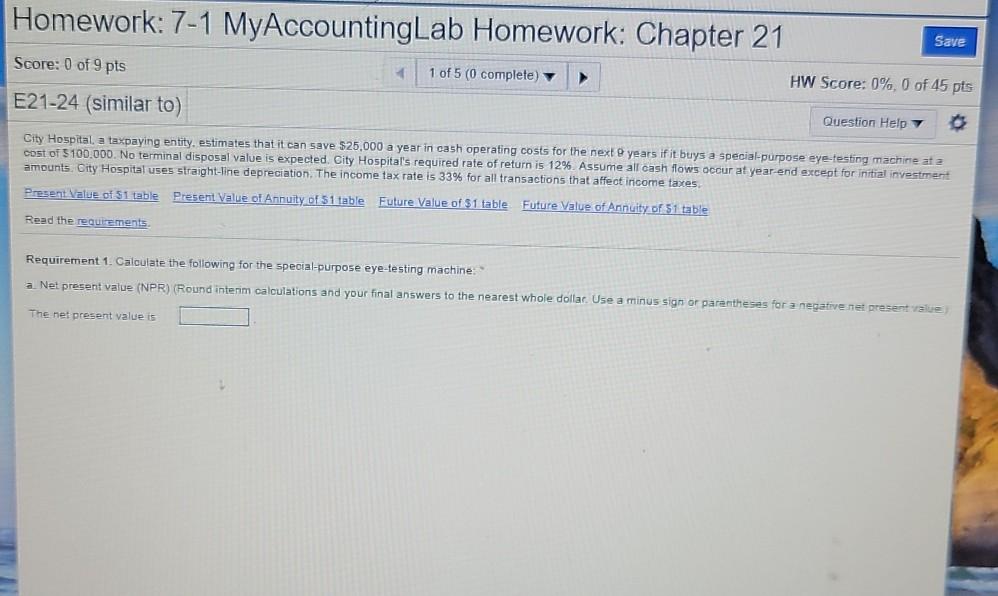

Homework: 7-1 MyAccountingLab Homework: Chapter 21 Save Score: 0 of 9 pts 1 of 5 (0 complete) HW Score: 0%, 0 of 45 pts E21-24

Homework: 7-1 MyAccountingLab Homework: Chapter 21 Save Score: 0 of 9 pts 1 of 5 (0 complete) HW Score: 0%, 0 of 45 pts E21-24 (similar to) Question Help City Hospital a taxpaying entity, estimates that it can save $25,000 a year in cash operating costs for the next years if it buys a special purpose eye-testing machine at a cost of $100.000. No terminal disposal value is expected. City Hospital's required rate of return is 12%. Assume all cash flows occur at year-end except for initial investment amounts. City Hospital uses straight-line depreciation. The income tax rate is 33% for all transactions that affect income taxes. Present Value of $1 table Present Value of Annuity of $1 table Future Value of $1 table Future Value of Annuity of 51 table Read the requirements Requirement 1 Calculate the following for the special-purpose eye-testing machine a Net present value (NPR) (Round interim calculations and your final answers to the nearest whole dollar. Use a minus sign or parentheses for a negative net presente The net present value is

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started