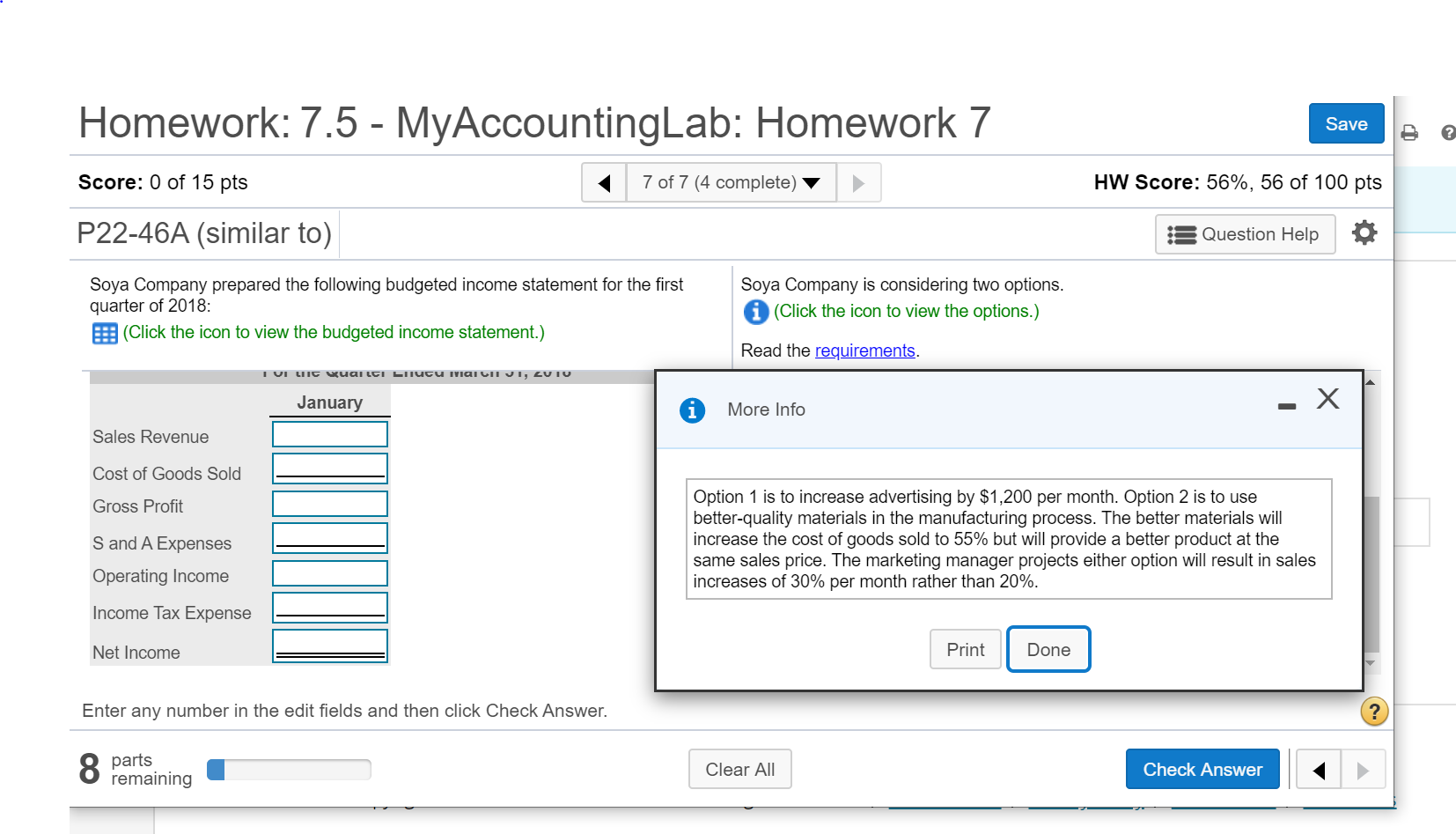

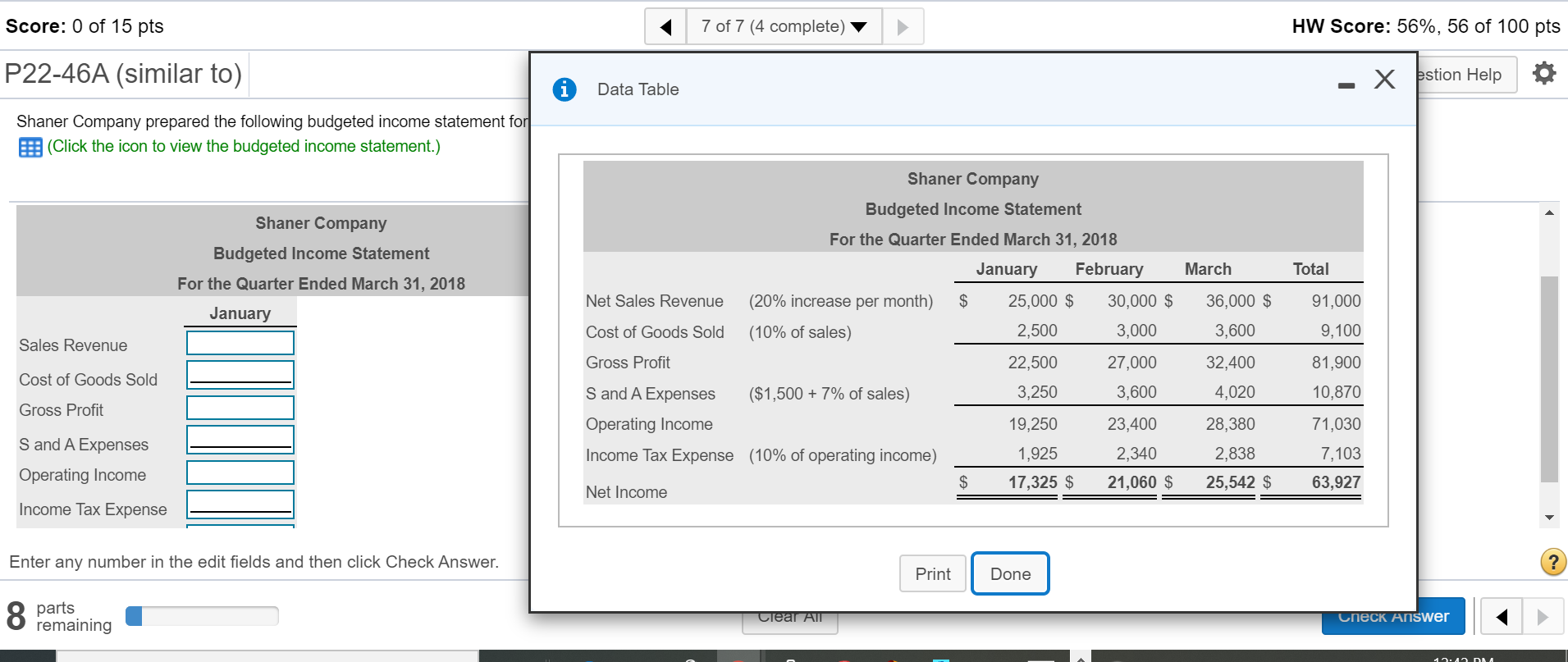

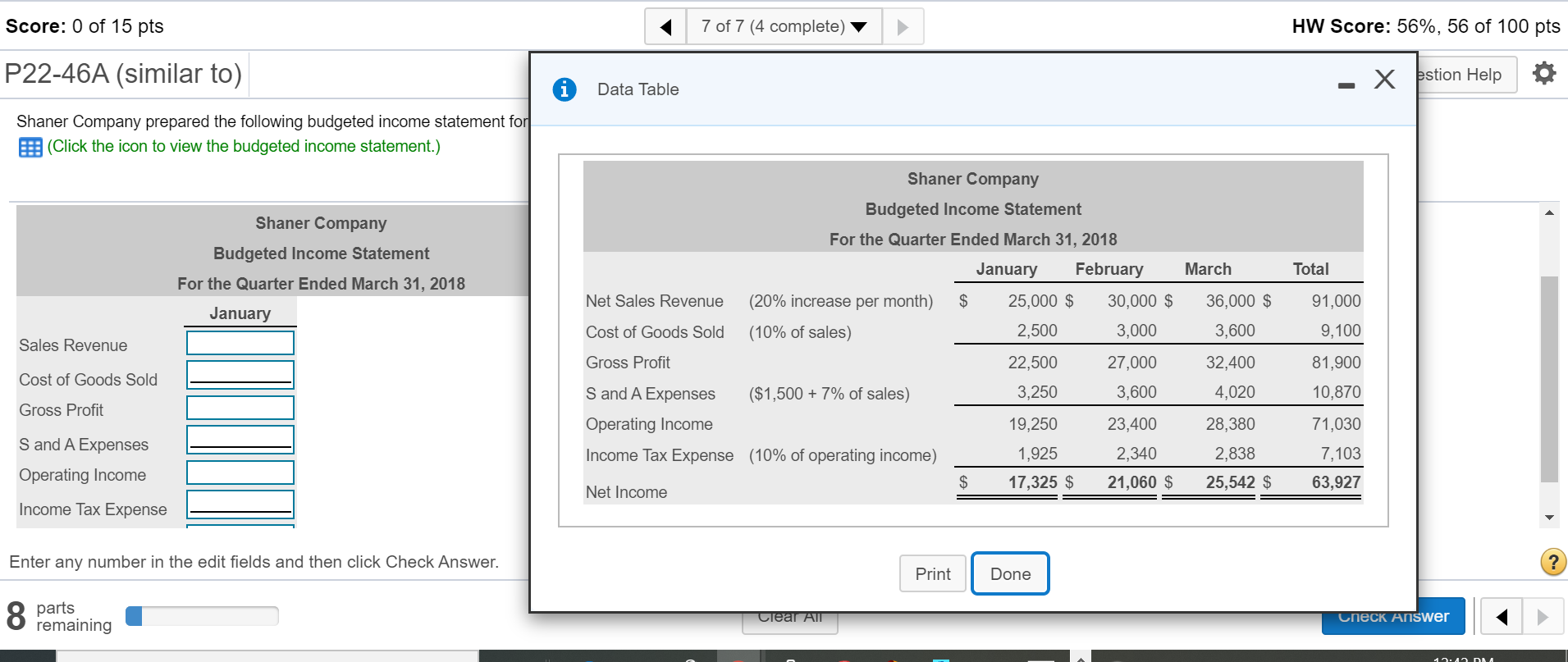

Homework: 7.5 - MyAccountingLab: Homework 7 Save Score: 0 of 15 pts 7 of 7 (4 complete) HW Score: 56%, 56 of 100 pts P22-46A (similar to) s Question Help Soya Company prepared the following budgeted income statement for the first quarter of 2018: (Click the icon to view the budgeted income statement.) Soya Company is considering two options. (Click the icon to view the options.) Read the requirements. I UI LIIC Vuai LCI LITUCU NICIUNT UT, ZU TU January A More Info - X Sales Revenue Cost of Goods Sold Gross Profit S and A Expenses Operating Income Option 1 is to increase advertising by $1,200 per month. Option 2 is to use better-quality materials in the manufacturing process. The better materials will increase the cost of goods sold to 55% but will provide a better product at the same sales price. The marketing manager projects either option will result in sales increases of 30% per month rather than 20%. Income Tax Expense Net Income Print Done Enter any number in the edit fields and then click Check Answer. 2 parts remaining Clear All Check Answer Score: 0 of 15 pts 7 of 7 (4 complete) HW Score: 56%, 56 of 100 pts P22-46A (similar to) Data Table - X pstion Help Shaner Company prepared the following budgeted income statement for (Click the icon to view the budgeted income statement.) Shaner Company Budgeted Income Statement For the Quarter Ended March 31, 2018 Total 91,000 9,100 Shaner Company Budgeted Income Statement For the Quarter Ended March 31, 2018 January February Net Sales Revenue (20% increase per month) $ 25,000 $ 30,000 $ Cost of Goods Sold (10% of sales) 2,500 3,000 Gross Profit 22,500 27,000 7000 S and A Expenses ($1,500 + 7% of sales) 3,250 3,600 Operating Income 19,250 23,400 Income Tax Expense (10% of operating income) 1,925 2,340 $ 17,325 $ 21,060 $ Net Income January Sales Revenue Cost of Goods Sold Gross Profit March 36,000 $ 3,600 32.400 32,400 4,020 28,380 2 ,838 25,542 $ 81,900 10,870 71,030 S and A Expenses Operating Income Income Tax Expense 7,103 63,927 Enter any number in the edit fields and then click Check Answer. Print Done 2 parts remaining Clear All Check Answer 1 ADNA