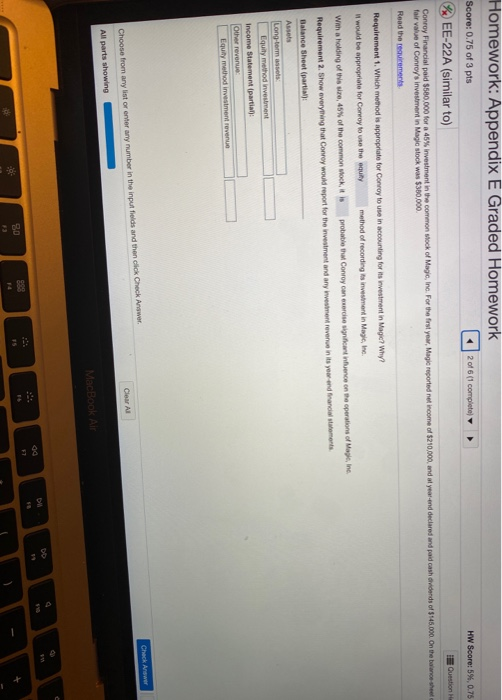

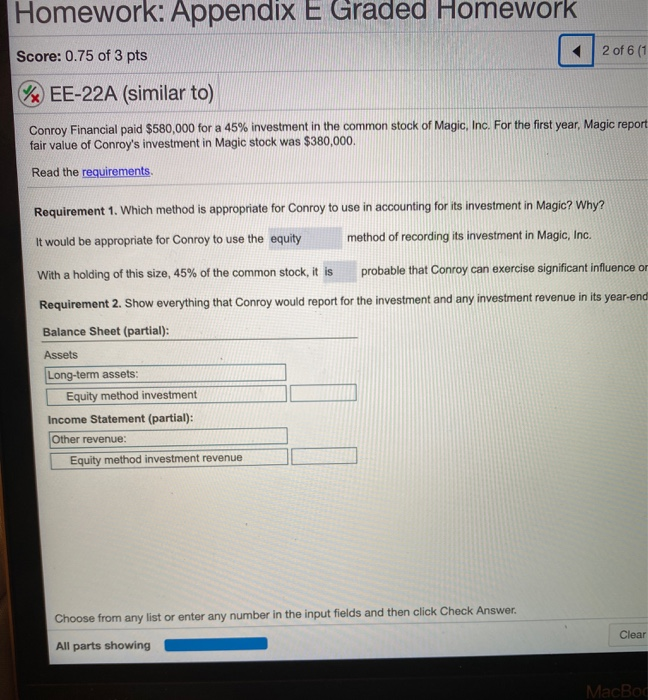

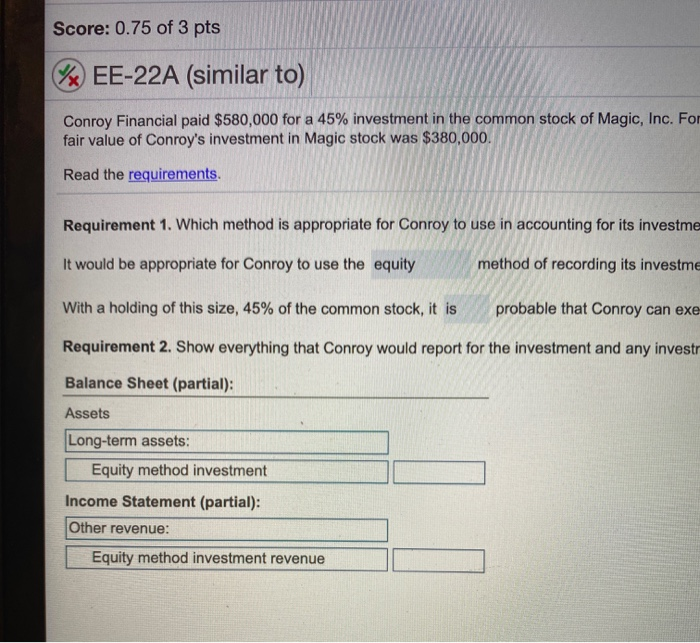

Homework: Appendix E Graded Homework Score: 0.75 of 3 pts | 2 of 6 (1 complete HW Score: 5%, 0.75 EE-22A (similar to) Question Conroy Financial paid $580,000 for a 45% investment in the common slock of Magic, Inc. For the first year, Magic reported net income of $210,000, and at year-end declared and paid cash dividends of $145.000. On the balance sheet fair value of Conroy's investment in Magia stock was $380,000 Read the resumets Requirement 1. Which method is appropriate for Conroy to use in accounting for its investment in Magic? Why? it would be appropriate for Convoy to use the equity method of recording to investment in Magic, Inc. With a holding of this size, 45% of the common ock, it is probable that Conroy concerte significant influence on the operations of Magic, in Requirement 2. Show everything that Conroy would report for the investment and any investment revenue in its year and financial statements Balance Sheet(partial Assets Long-term as Equity method investment Income Statement partial): Other revenue Equity method investment revenue Check Arsa Clear All Choose from any list or enter any number in the input fields and then click Check Answer All parts showing MacBook Air DO 80 - Homework: Appendix E Graded Homework Score: 0.75 of 3 pts 2 of 6 (1 x EE-22A (similar to) Conroy Financial paid $580,000 for a 45% investment in the common stock of Magic, Inc. For the first year, Magic report fair value of Conroy's investment in Magic stock was $380,000, Read the requirements Requirement 1. Which method is appropriate for Conroy to use in accounting for its investment in Magic? Why? It would be appropriate for Conroy to use the equity method of recording its investment in Magic, Inc. With a holding of this size, 45% of the common stock, it is probable that Conroy can exercise significant influence or Requirement 2. Show everything that Conroy would report for the investment and any investment revenue in its year-end Balance Sheet (partial): Assets Long-term assets: Equity method investment Income Statement (partial): Other revenue: Equity method investment revenue Choose from any list or enter any number in the input fields and then click Check Answer Clear All parts showing MacBod Save HW Score: 5%, 0.75 of 15 pts Question Help 0,000, and at year-end declared and paid cash dividends of $145,000. On the balance sheet date, the of Magic, Inc. ments Score: 0.75 of 3 pts 2x) EE-22A (similar to) Conroy Financial paid $580,000 for a 45% investment in the common stock of Magic, Inc. For fair value of Conroy's investment in Magic stock was $380,000. Read the requirements. Requirement 1. Which method is appropriate for Conroy to use in accounting for its investme It would be appropriate for Conroy to use the equity method of recording its investme With a holding of this size, 45% of the common stock, it is probable that Conroy can exe Requirement 2. Show everything that Conroy would report for the investment and any investr Balance Sheet (partial): Assets Long-term assets: Equity method investment Income Statement (partial): Other revenue: Equity method investment revenue