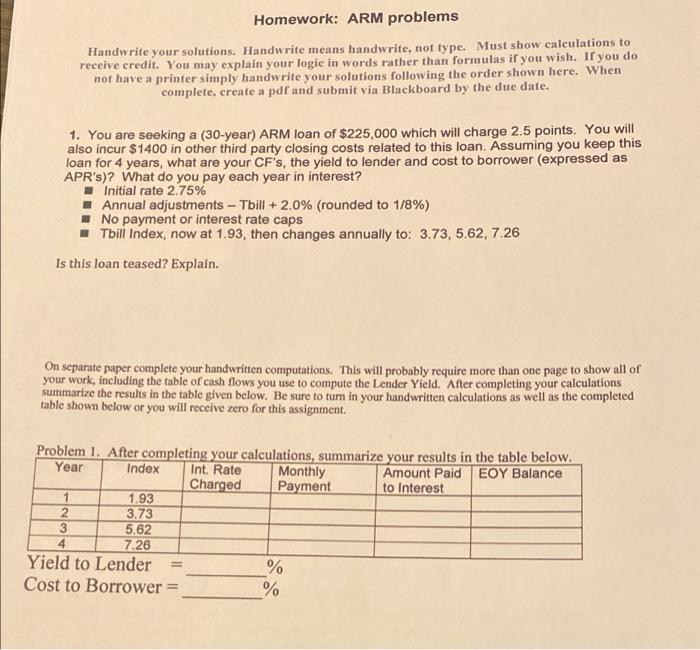

Homework: ARM problems Handwrite your solutions. Handwrite means handwrite, not type. Must show calculations to receive credit. You may explain your logie in words rather than formulas if you wish. If you do not have a printer simply handwrite your solutions following the order shown here. When complete, create a pdf and submit via Blackboard by the due date. 1. You are seeking a (30-year) ARM loan of $225,000 which will charge 2.5 points. You will also incur $1400 in other third party closing costs related to this loan. Assuming you keep this loan for 4 years, what are your CF's, the yield to lender and cost to borrower (expressed as APR's)? What do you pay each year in interest? Initial rate 2.75% Annual adjustments - Tbill + 2.0% (rounded to 1/8%) No payment or interest rate caps Tbili Index, now at 1.93, then changes annually to: 3.73, 5.62, 7.26 Is this loan teased? Explain. On separate paper complete your handwritten computations. This will probably require more than one page to show all of your work, including the table of cash flows you use to compute the Lender Yield. After completing your calculations summarize the results in the table given below. Be sure to turn in your handwritten calculations as well as the completed w table shown below or you will receive zero for this assignment. Problem 1. After completing your calculations, summarize your results in the table below. Year Index Int. Rate Monthly Amount Paid EOY Balance Charged Payment to Interest 1 1.93 2 3.73 3 5.62 4 7.26 Yield to Lender % Cost to Borrower = % Homework: ARM problems Handwrite your solutions. Handwrite means handwrite, not type. Must show calculations to receive credit. You may explain your logie in words rather than formulas if you wish. If you do not have a printer simply handwrite your solutions following the order shown here. When complete, create a pdf and submit via Blackboard by the due date. 1. You are seeking a (30-year) ARM loan of $225,000 which will charge 2.5 points. You will also incur $1400 in other third party closing costs related to this loan. Assuming you keep this loan for 4 years, what are your CF's, the yield to lender and cost to borrower (expressed as APR's)? What do you pay each year in interest? Initial rate 2.75% Annual adjustments - Tbill + 2.0% (rounded to 1/8%) No payment or interest rate caps Tbili Index, now at 1.93, then changes annually to: 3.73, 5.62, 7.26 Is this loan teased? Explain. On separate paper complete your handwritten computations. This will probably require more than one page to show all of your work, including the table of cash flows you use to compute the Lender Yield. After completing your calculations summarize the results in the table given below. Be sure to turn in your handwritten calculations as well as the completed w table shown below or you will receive zero for this assignment. Problem 1. After completing your calculations, summarize your results in the table below. Year Index Int. Rate Monthly Amount Paid EOY Balance Charged Payment to Interest 1 1.93 2 3.73 3 5.62 4 7.26 Yield to Lender % Cost to Borrower = %