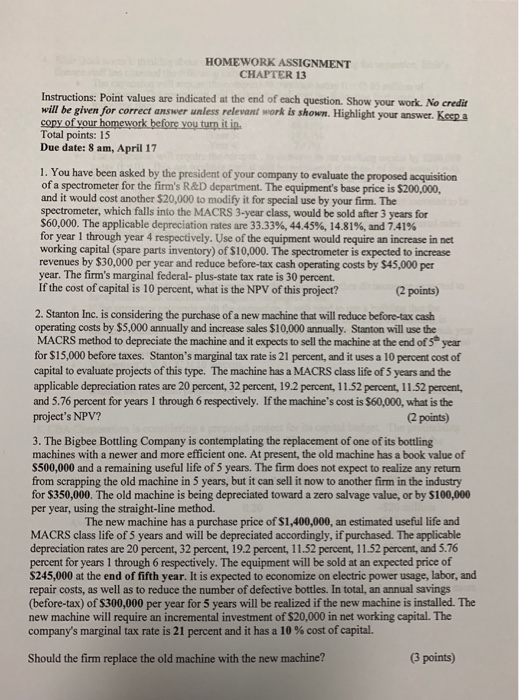

HOMEWORK ASSIGNMENT CHAPTER 13 Instructions: Point values are indicated at the end of each question. Show your work. No credit will be given for correct answer unless relevant work is shown. Highlight your answer. Kesp a copy of your homework before you turn it in Total points: 15 Due date: 8 am, April 17 1. You have been asked by the president of your company to evaluate the proposed acquisition of a spectrometer for the firm's R&D department. The equipment's base price is $200,000, and it would cost another $20,000 to modify it for special use by your firm. The spectrometer, which falls into the MACRS 3-year class, would be sold after 3 years for $60,000. The applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41% for year 1 through year 4 respectively. Use of the equipment would require an increase in net working capital (spare parts inventory) of $10,000. The spectrometer is expected to increase revenues by $30,000 per year and reduce before-tax cash operating costs by $45,000 per year. The firm's marginal federal- plus-state tax rate is 30 percent. If the cost of capital is 10 percent, what is the NPV of this project? 2 points) 2. Stanton Inc. is considering the purchase of a new machine that will reduce before-tax cash operating costs by $5,000 annually and increase sales $10,000 annually. Stanton will use the MACRS method to depreciate the machine and it expects to sell the machine at the end of S" year for $15,000 before taxes. Stanton's marginal tax rate is 21 percent, and it uses a 10 percent cost of capital to evaluate projects of this type. The machine has a MACRS class life of 5 years and the applicable depreciation rates are 20 percent, 32 percent, 19.2 percent, 11.52 percent, 11.52 percent, and 5.76 percent for years 1 through 6 respectively. If the machine's cost is $60,000, what is the project's NPV? (2 points) 3. The Bigbee Bottling Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. At present, the old machine has a book value of S500,000 and a remaining useful life of 5 years. The firm does not expect to realize any retunm from scrapping the old machine in 5 years, but it can sell it now to another firm in the industry for $350,000. The old machine is being depreciated toward a zero salvage value, or by $100,000 per year, using the straight-line method. The new machine has a purchase price of $1,400,000, an estimated useful life and MACRS class life of 5 years and will be depreciated accordingly, if purchased. The applicable depreciation rates are 20 percent, 32 percent, 19.2 percent, 11.52 percent, 11.52 percent, and 5.76 percent for years 1 through 6 respectively. The equipment will be sold at an expected price of S245,000 at the end of fifth year. It is expected to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective bottles. In total, an annual savings (before-tax) of $300,000 per year for 5 years will be realized if the new machine is installed. The new machine will require an incremental investment of $20,000 in net working capital. The company's marginal tax rate is 21 percent and it has a 10 % cost of capital. Should the firm replace the old machine with the new machine? 3 points) HOMEWORK ASSIGNMENT CHAPTER 13 Instructions: Point values are indicated at the end of each question. Show your work. No credit will be given for correct answer unless relevant work is shown. Highlight your answer. Kesp a copy of your homework before you turn it in Total points: 15 Due date: 8 am, April 17 1. You have been asked by the president of your company to evaluate the proposed acquisition of a spectrometer for the firm's R&D department. The equipment's base price is $200,000, and it would cost another $20,000 to modify it for special use by your firm. The spectrometer, which falls into the MACRS 3-year class, would be sold after 3 years for $60,000. The applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41% for year 1 through year 4 respectively. Use of the equipment would require an increase in net working capital (spare parts inventory) of $10,000. The spectrometer is expected to increase revenues by $30,000 per year and reduce before-tax cash operating costs by $45,000 per year. The firm's marginal federal- plus-state tax rate is 30 percent. If the cost of capital is 10 percent, what is the NPV of this project? 2 points) 2. Stanton Inc. is considering the purchase of a new machine that will reduce before-tax cash operating costs by $5,000 annually and increase sales $10,000 annually. Stanton will use the MACRS method to depreciate the machine and it expects to sell the machine at the end of S" year for $15,000 before taxes. Stanton's marginal tax rate is 21 percent, and it uses a 10 percent cost of capital to evaluate projects of this type. The machine has a MACRS class life of 5 years and the applicable depreciation rates are 20 percent, 32 percent, 19.2 percent, 11.52 percent, 11.52 percent, and 5.76 percent for years 1 through 6 respectively. If the machine's cost is $60,000, what is the project's NPV? (2 points) 3. The Bigbee Bottling Company is contemplating the replacement of one of its bottling machines with a newer and more efficient one. At present, the old machine has a book value of S500,000 and a remaining useful life of 5 years. The firm does not expect to realize any retunm from scrapping the old machine in 5 years, but it can sell it now to another firm in the industry for $350,000. The old machine is being depreciated toward a zero salvage value, or by $100,000 per year, using the straight-line method. The new machine has a purchase price of $1,400,000, an estimated useful life and MACRS class life of 5 years and will be depreciated accordingly, if purchased. The applicable depreciation rates are 20 percent, 32 percent, 19.2 percent, 11.52 percent, 11.52 percent, and 5.76 percent for years 1 through 6 respectively. The equipment will be sold at an expected price of S245,000 at the end of fifth year. It is expected to economize on electric power usage, labor, and repair costs, as well as to reduce the number of defective bottles. In total, an annual savings (before-tax) of $300,000 per year for 5 years will be realized if the new machine is installed. The new machine will require an incremental investment of $20,000 in net working capital. The company's marginal tax rate is 21 percent and it has a 10 % cost of capital. Should the firm replace the old machine with the new machine? 3 points)