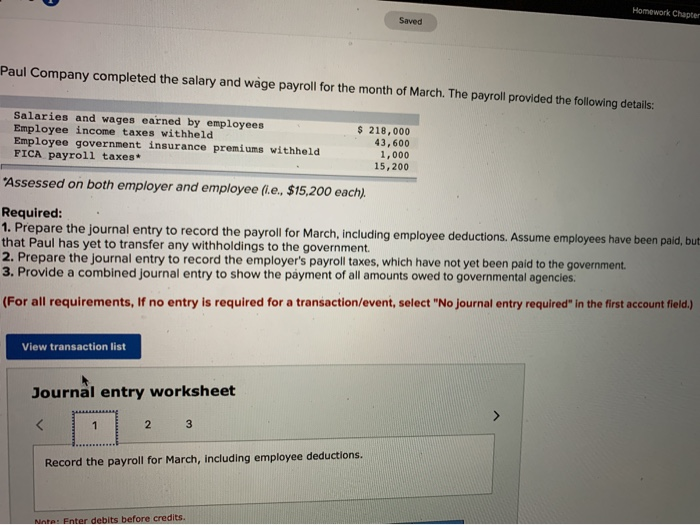

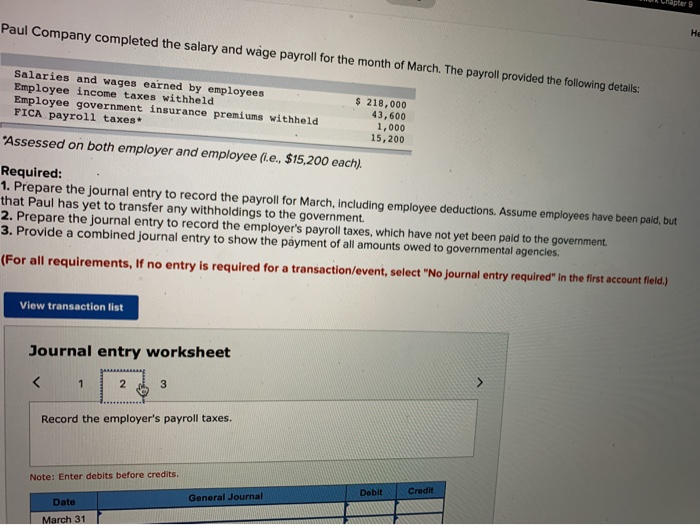

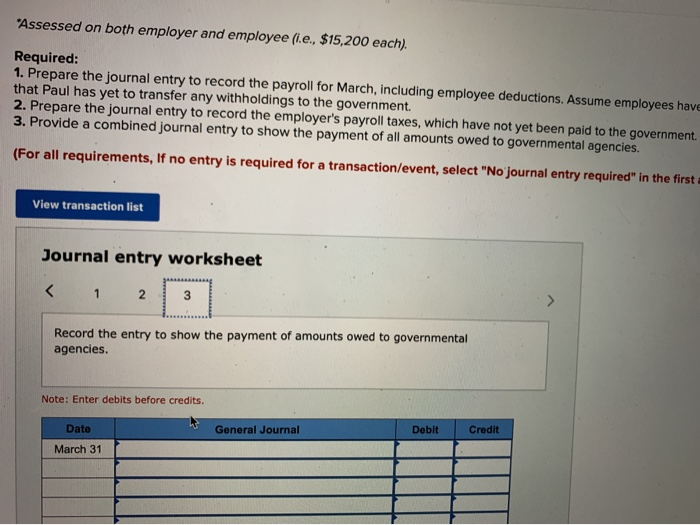

Homework Chapter Saved Paul Company completed the salary and wage payroll for the month of March. The payroll provided the following details: Salaries and wages earned by employees Employee income taxes withheld Employee government insurance premiums withheld FICA payroll taxes $ 218,000 43,600 1,000 15,200 "Assessed on both employer and employee (.e., $15,200 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Paul has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the payroll for March, including employee deductions. Ninte: Enter debits before credits. Chapter Paul Company completed the salary and wage payroll for the month of March. The payroll provided the following details: Salaries and wages earned by employees Employee income taxes withheld Employee government insurance premiums withheld PICA payroll taxes $ 218,000 43,600 1,000 15,200 "Assessed on both employer and employee (i.e., $15,200 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have been paid, but that Paul has yet to transfer any withholdings to the government. 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government. 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet 1 2 3 Record the employer's payroll taxes. Note: Enter debits before credits Debit Credit General Journal Date March 31 "Assessed on both employer and employee (ie, $15,200 each). Required: 1. Prepare the journal entry to record the payroll for March, including employee deductions. Assume employees have that Paul has yet to transfer any withholdings to the government 2. Prepare the journal entry to record the employer's payroll taxes, which have not yet been paid to the government 3. Provide a combined journal entry to show the payment of all amounts owed to governmental agencies. (For all requirements, If no entry is required for a transaction/event, select "No journal entry required" in the first View transaction list Journal entry worksheet Record the entry to show the payment of amounts owed to governmental agencies. Note: Enter debits before credits. Debit Credit General Journal Date March 31