homework help, answer whatever you can please and thank you.

homework help , answer as much as you can for my finance case study . i zoomed in on the text i cannot make if more clear than it already is please do not flag it for more information this is the best i have its all together .

I just took pictures of my email instead of screen shots on my phone this should be more legible i need Finance homework help on my case study please as much as you can.

update : Case study for finance homework help please and thank you as much as you can.

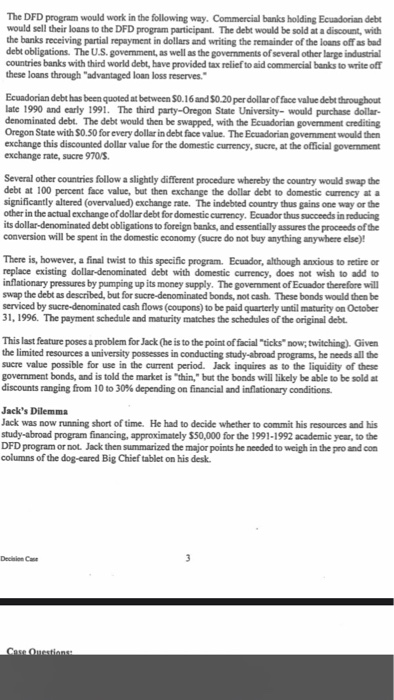

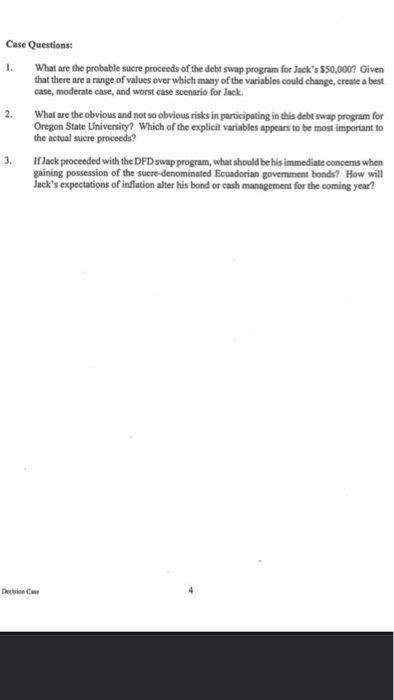

. Boost (8:33 PM 775% Done 2(1).pdf CASE Ecuadori Debe for Development Mal l incial Management Jack servo uk dewlers the Director for wo m en Suiventand therefore response for manging the financing of It is May 1991 doofh o f lack'serve is the d ecide where the ventiske part in the Debt for Development the DFD) is facing dy programs in the country of E der. The DFD program is designed to aid for profit entities like universities in increasing their spending capabilities broad while contributing to the reduction of large foreign debt levels offered by many developing countries Ecuador und Debt Ecundor is another in the long line of Latin American countries attempting to deal with large levels of foreign debit. This debt is made up of loans taken out by the government of Banderand other sem government institutions in Ecuador (like utilities, railroads, etc) during the late 1970s and early 1980s when the prospects for sconomic development in the part of the world were quite trong Ecuador, like and Mexico, went to the international markets to be funds to speed up its rule of industriation. The debt was primarily in the form of US dollars, a currency with wide international purchasing power at the time. The capital was intended to improve themel Infrastructure and manufacturing Industries of Ecuador to allow to genere increased earings-particularly in export markets where it could be paid in US dollars the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The intemal and external sector of the Ecuadorian economy did not grow sufficiently to get the large amounts of foreign currency earnings needed for det vice during the 1980s. By 1987, a large amount of Ecuadoriandebt was classified as in areas, and by 1983 w i l secondary market had developed for the sale of dollar debt owed by Ecuador to come ankthroughout the world. Ecuador, like other heavily indebted countries, was faced with few a maties to service dollar-denominated debe (1) export or export surplus or 2) bomow additional del The second seative was not considered overly attractive by either the home or the end The export market was eatively stable, but not growing sufficiently to service the existing levels of debt. Aww amatierow: Miss the deb-service payments The term die normally and in reference to developing count of long- bomowings by government or government from the capital marks The lenders are governments, international and development organi t he Monetary Fund (IMF and large commercial banks worldwide. Although the first do not operate on the basis of pro, the commercial banking cor desperate increasingly competitive mode. As the debt crises of the early 1980s came and stayed many of the comme barried to either reschedule this to foi bomowershel g en not being is a ricing is obligations of de comply dumping of which the commerc e willing all the e nd parties which is the growing condary market for t . Since the loans are not being serviced by the borrowing country, and there fore in full weathe poor the banks are willing to the las . Boost 8:33 PM 1 75% Done 2(1).pdf l comply dumping of , in which the commercia which is the growing condarymafor of being serviced by the bowing t he in een poor, the banks willing to the s c ene value of the es See form from the face The Debe for Development Program The DFD program is described in the follow "The Debt for Develope Coalition for organis ed dig d Inmations of cours into comic development opportunities e If a portiothermal debe of developing nations can be w hy d o purchase-into local currencies for profit organis e the funds for development projects ended to help spureconomic growth in Latin America, Africa, Asia and the Pacific Coalition members are US.colleges and universities, cooperatives, private vol and research e s engaged in economic development programs Over maintain close cooperation with various U.S. environmental organisations The c i on le The coalition work closely with private organizations in debtortions to West programs important to each country's economic priorities such as education public health nutrition agriculture, small business enterprises, research, housing, credit, and natural resource management programs The DFD program wone from the growing activity in what is called debt for ty was. Many of the indebted countries wished to her the r e of their obligations from date participating equity, where the older would see returns tied to the profits for losses of the pri c e with the capital. The idea was to encourage long-term equity involvement in the country.ther than the debt repayment at anycost posture of most debt holders The Debt for Development wap is something into a debt for equity The dollar deb swapped for suredeaminated debe in this case, however, ther than in their ownership of were denominated r is Most debit holders have traditionally opposed e cem schemes to the weakness and convertibility of any of the developing country currencies. A country leavily indebedi dollars might allebeiis own currency. p ng money to pay the debt. This is commonly thought to be dangerous for all parties, ingin deprecated a n d inducing the country to unde police soli its own best interest. The DFD program, however, this process by the wh ere to be apped and by requiring adb wap with a scheduleching that of the dog The first and foremost conce on the profi e Ecuador is that the debe de services in c urrency US dollar. This program would allow E x change det fordi det Ecuadorian Debe for Development Boost 8:33 PM 75% Done 2(1).pdf The DFD w ork in the following wey Coc i do would sell their mothe DFD programa The would be with the movi e indoles and writing the doo d dows The US well as the govo r i chankwird, have provided to com o these through avantaged loans reserves Ecuadoriandebhas been goed between $0.16and $0.20 per dollar of face de troughout late 1990 and early 1991. The third party-Oregon S e University purchased dented debt Thebt would the beswapped, with the corne r ing Oregon Sute with $0.50 for every dollar in d i e value. The Ecuador over would then exchange this discounted dollar value for the domestic currency. W e official government exchange 97015 Several other countries follow a slightly different procedure whereby the country would the debeat 100 percent face value, but then exchange the dollar debt to domestic currency significantly altered overvalued exchange rate. The indebted country th e way or the other in the exchange of dollar debt for domestic currency Eeundort e d in reducing its dollar-denominated debt obligations to forebanks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything wywhere ! There is, however, afinal twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency, does not wish to add to inflationary pressures by pumping up its money supply. The government of Ecunder therefore will wap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flow (coupon) to be paid quarterly until maturity on October 31, 1996. The payment schedule and marity matches the schedules of the original debit This last feature poses a problem for Jack the is to the point official ticksnow.twitching Given the limited resources a university possesses in conducting studyabroad programs, he needs all the sucre value possible for the current period Jack Inquires the widty of these government bonds, and is told the market ishin but the beds will be able to be sold at discounts ranging from 10 to 30% depending on financial and inflationary conditions Jack's Dilema Jack was now running short of time. He had to decide whether to commit his resources and his Sadyabroad program financing, approximately 350,000 for the 1991-1992cademic year, the DFD program or not, Jack the summa thejor poseeded to weigh in the ground.com colums of the dog card Big Chiefable on his desk Boost " 8:33 PM 75% Done 2(1).pdf 4 of 4 Cases What are the probabile che proceeds of the debt w program for $50.00 Given that there are ov e rwhich many of the walls could change crabes cas, mode , and otseseo for Jack 2. What the obvious and more obvious risks in participating in this Oregon Se University? Which of the explicit variables appears to be the actual e proceeds? program for importante 3. Jack proceeded with the DFD program, what should be his immediate concerns when gaining possession of the sucre-denominated Ecuadorian government bends? How will Jack's expectations of nationaler Nisbond or cash management for the coming year? CASE Ecuadorian Delt for Development Multinational Financial Management A Sohrabian Jack is nervous. Jack Van de Water is the Director for International Education Programs at Oregon State University, and therefore responsible for managing the financing of all studyabroad programs It is May 1991 and one of the causes of Jack's nervousness is the need to decide whether or not the university is to take part in the Debt for Development program (hereafter DFD) in financing its study programs in the country of Ecuador. The DFD program is designed to aid not-for-profit entities like universities in increasing their spending capabilities abroad while contributing to the reduction of large foreign debt levels suffered by many developing countries Ecuador and Debt Ecuador is another in the long line of Latin American countries tempting to deal with large levels of foreign debt. This debt is made up of loans taken out by the government of Ecuador and other semi government institutions in Ecuador (like utilities, railroads, etc.) during the late 1970s and early 1980s when the prospects for economic development in the part of the world were quite strong Ecuador, like Brazil and Mexico, went to the international capital markets to obtain funds to speed up its rate of industrialization. The debt was primarily in the form of US dollars, a currency with wide international purchasing power at the time. The capital was intended to improve the internal infrastructure and manufacturing industries of Ecuador to allow to generate increased camnings-particularly in export markets where it could be paid in US dollars the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The interal and external sectors of the Ecuadorian economy did not grow sufficiently to generate the large amounts of foreign currency camings needed for debt service during the 1980s. By 1987, a large amount of Ecuadorian debt was classified as in arrears, and by 1983 a substantial secondary market had developed for the sale of dollar debt owed by Ecuador to commercial banks throughout the world. Ecuador, like other heavily indebted countries, was faced with few alternatives to service dollar-denominated debt: (1) export (or run a net export surplus or (2) borrow additional dollars. The second alternative was not considered overly attractive by either the borrower or the lenders The export market was relatively stable, but not growing sufficiently to service the existing levels of debt. A new alternative rose: Miss the debt-service payments! The term debt, as normally used in reference to developing countries, consists of long-term borrowings by government or semi government entities from the international capital markets. The lenders are governments, international aid and development organisations like the International Monetary Fund (IMF), and large commercial banks worldwide. Although the first two organizations do not operate on the basis of profit, the commercial banking sector does operate in an increasingly competitive mode. As the debt crises of the early 1980s came and stayed, many of the commercial banks tried to either reschedule their loans to foreign bomowers (thus effectively redefining the loan as not being in artears on servicing its obligations) or to rid themselves of their foreign debt Decision Case completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans to related third parties, which feeds the growing secondary market for third world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospects for payment in full are often poor, the banks are willing to sell the lansat e from the free completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans to unrelated third parties, which feeds the growing secondary market for third world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospects for payment in full are often poor, the banks are willing to sell the lansata considerable discount from the face value of the loan The Debt for Development Program The DFD program is described in its own literature as follows: "The Debt for Development Coalition, Inc., represents not-for-profit organizations committed to finding ways to turn the international debts of countries into economic development opportunities If a portion of the external debt of developing nations can be converted-by donation or purchase-into local currencies, not-for-profit organizations can use the funds for development projects needed to help spur economic growth in Latin America, Africa, Asia, and the Pacific. Coalition members are U.S. colleges and universities, cooperatives, private volunteer organizations, and research institutes engaged in economic development programs overseas. The coalition also maintains close cooperation with various U.S. environmental organizations The coalition works closely with private organizations in debtorations to identify programs important to each country's economic priorities such as education, public health, nutrition agriculture, small business enterprises, research, housing, credit, and matural resource management programs The DFD program arose from the growing activity in what is called debt for equity swaps. Many of the indebted countries wished to alter the nature of their obligations from debt to participating equity, where the holder would see returns tied to the profits (or losses) of the enterprises associated with the capital. The idea was to encourage long-term equity involvement in the country, rather than the debt repayment at anycost posture of most debt holders. The Debt for Development swap is something akin to a debt for equity swap. The dollar debt is swapped for sucre-denominated debt in this case, however, rather than into the equity ownership of a sucre-denominated enterprise. Most debt holders have traditionally opposed debt redenomination schemes due to the weakness and inconvertibility of many of the developing country currencies. A country heavily indebted in dollars might reissue all debt in its own currency, essentially printing money to repay the debt. This is commonly thought to be toodangerous for all parties, resulting in depreciated values in repayment and inducing the country to undertake inflationary policies not in its own best interest. The DFD program, however, altered this process substantially by limiting the actual sucre to be swapped and by requiring a debt swap with a repayment schedule matching that of the initial debt obligation. The first and foremost concern on the part of an indebted country like Ecuador is that the debt and debt service is in a foreign currency, in this case U.S. dollars. This swap program would allow Ecuador to exchange sucre debt for dollar debt. Ecuadorian Debt for Development Decisione The DFD program would work in the following way. Commercial banks holding Ecuadorian debt would sell their loans to the DFD program participant. The debt would be sold at a discount, with the banks receiving partial repayment in dollars and writing the remainder of the loans off as bad debt obligations. The U.S. government, as well as the governments of several other large industrial countries banks with third world debt, have provided tax relief to aid commercial banks to write off these loans through advantaged loan los reserves." Ecuadorian debt has been quoted at between $0.16 and 50.20 per dollar of face value debt throughout late 1990 and early 1991. The third party-Oregon State University would purchase dollar denominated debt. The debt would then be swapped, with the Ecuadorian government crediting Oregon State with $0.50 for every dollar in debt face value. The Ecuadorian goverment would then Exchange this discounted dollar value for the domestic currency, sucre, at the official government exchange rate, sucre 970/5. Several other countries follow a slightly different procedure whereby the country would swap the debt at 100 percent face value, but then exchange the dollar debt to domestic currency at a significantly altered (overvalued) exchange rate. The indebted country thus gains one way or the other in the actual exchange of dollar debt for domestic currency. Ecuador thus succeeds in reducing its dollar-denominated debt obligations to foreign banks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything anywhere else)! There is, however, a final twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency, does not wish to add to inflationary pressures by pumping up its money supply. The government of Ecuador therefore will swap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flows (coupons) to be paid quarterly until maturity on October 31, 1996. The payment schedule and maturity matches the schedules of the original debt. This last feature poses a problem for Jack (he is to the point of facial ticksnow, twitching). Given the limited resources a university possesses in conducting studyabroad programs, he needs all the sucre value possible for use in the current period. Jack inquires as to the liquidity of these government bonds, and is told the market is "thin, but the bonds will likely be able to be sold at discounts ranging from 10 to 30% depending on financial and inflationary conditions Jack's Dilemma Jack was now running short of time. He had to decide whether to commit his resources and his studyabroad program financing, approximately 550,000 for the 1991-1992 academic year, to the DFD program or not. Jack then summarized the major points he needed to weigh in the pro and.com columns of the dog-cared Big Chief tablet on his desk Decisions Case Questions: 1. What are the probable sucre proceeds of the debt swap program for Jack's $50,000? Given that there are a range of values over which many of the variables could change, create a best case, moderate case, and worst case scenario for Jack 2. What are the obvious and not so obvious risks in participating in this debtswap program for Oregon State University? Which of the explicit variables appears to be most important to the actual sucre proceeds? If Jack proceeded with the DFD swap program, what should be his immediate concerns when gaining possession of the sucre-denominated Ecuadorian government bonds? How will Jack's expectations of inflation alter his bond or cash management for the coming year? DC B&N Gena Showalter Thornton Winery L A CULL U WUN CASE Ecuadorian Debt for Development' Multinational Financial Management A. Sohrabian Jack is nervous. Jack Van de Water is the Director for International Education Programs at Oregon State University, and therefore responsible for managing the financing of all study-abroad programs. It is May 1991 and one of the causes of Jack's nervousness is the need to decide whether or not the university is to take part in the "Debt for Development" program (hereafter DFD) in financing its study programs in the country of Ecuador. The DFD program is designed to aid not-for-profit entities like universities in increasing their spending capabilities abroad while contributing to the reduction of large foreign debt levels suffered by many developing countries. Ecuador and Debt Ecuador is another in the long line of Latin American countries attempting to deal with large levels of foreign debt. This debt is made up of loans taken out by the government of Ecuador and other semi government institutions in Ecuador (like utilities, railroads, etc.) during the late 1970s and early 1980s when the prospects for economic development in that part of the world were quite strong. Ecuador, like Brazil and Mexico, went to the international capital markets to obtain funds, to speed up its rate of industrialization. The debt was primarily in the form of U.S. dollars, a currency with wide international purchasing power at the time. The capital was intended to improve the internal infrastructure and manufacturing industries of Ecuador to allow it to generate increased earnings-particularly in export markets where it could be paid in U.S. dollars-so the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The internal and external sectors of the Ecuadorian economy did not grow sufficiently to generate the large amounts of foreign currency camnings needed for debt service during the 1980s. By 1987, a large amount of Ecuadorian debt was classified as in arrears, and by 1988 a substantial secondary ar1286/Documents/Cory%20case%20study%20chegg.pdf BN BAN Gena Showalter Thornton Winery C... Airlines College Links Ambassador Wolf earnings-particularly in export markets where it could be paid in U.S. dollars-so the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The internal and external sectors of the Ecuadorian economy did not grow sufficiently to generate the large amounts of foreign currency carings needed for debt service during the 1980s. By 1987, a large amount of Ecuadorian debt was classified as in arrears, and by 1988 a substantial secondary market had developed for the sale of dollar debt owed by Ecuador to commercial banks throughout the world. Ecuador, like other heavily indebted countries, was faced with few alternatives to service dollar-denominated debt: (1) export (or run a net export surplus); or (2) borrow additional dollars. The second alternative was not considered overly attractive by either the borrower or the lenders. The export market was relatively stable, but not growing sufficiently to service the existing levels of debt. A new alternative arose: Miss the debt-service payments! The term debt, as normally used in reference to developing countries, consists of long-term borrowings by government or semi goverment entities from the international capital markets. The lenders are governments, international aid and development organizations like the International Monetary Fund (IMF), and large commercial banks worldwide. Although the first two organizations do not operate on the basis of profit, the commercial banking sector does operate in an increasingly competitive mode. As the debt crises of the early 1980s came and stayed, many of the commercial banks tried to either reschedule their loans to foreign borrowers (thus effectively redefining the loan as not being in arrears on servicing its obligations) or to rid themselves of their foreign debt Decision Case completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans BN B&N Gena Showalter Thornton Winery C... Airlines College Links Ambassador Woll completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans to unrelated third parties, which feeds the growing secondary market for third world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospects for payment in full are often poor, the banks are willing to sell the leans at a considerable discount from the face value of the loan. The Debt for Development Program The DFD program is described in its own literature as follows: "The Debt for Development Coalition, Inc., represents not-for-profit organizations committed to finding ways to turn the international debts of countries into economic development opportunities." If a portion of the external debt of developing nations can be converted-by donation or purchase-into local currencies, not-for-profit organizations can use the funds for development projects needed to help spur economic growth in Latin America, Africa, Asia, and the Pacific. Coalition members are U.S. colleges and universities, cooperatives, private volunteer organizations, and research institutes engaged in economic development programs overseas. The coalition also maintains close cooperation with various U.S. environmental organizations The coalition works closely with private organizations in debtor nations to identify programs important to each country's economic priorities such as education, public health, nutrition agriculture, small business enterprises, research, housing, credit, and natural resource management programs The DFD program arose from the growing activity in what is called debt for equity swaps. Many of the indebted countries wished to alter the nature of their obligations from debt to participating equity, where the holder would see returns tied to the profits for losses of the enterprises associated BN B&N Gena Showalter Thornton Winery C... Airlines College Links Ambassador Wolf H OTTEETTINE ID con un MIVEISTOS, cooperatives, private Vorunteer organizations, and research institutes engaged in economic development programs overseas. The coalition also maintains close cooperation with various U.S. environmental organizations. The coalition works closely with private organizations in debtor nations to identify programs important to each country's economic priorities such as education, public health, nutrition, agriculture, small business enterprises, research, housing, credit, and natural resource management programs. The DFD program arose from the growing activity in what is called debt for equity swaps. Many of the indebted countries wished to alter the nature of their obligations from debt to participating equity, where the holder would see returns tied to the profits (or losses) of the enterprises associated with the capital. The idea was to encourage long-term equity involvement in the country, rather than the debt repayment at any cost posture of most debt holders. The Debt for Development swap is something akin to a debt for equity swap. The dollar debt is swapped for sucre-denominated debt in this case, however, rather than into the equity ownership of a sucre-denominated enterprise. Most debt holders have traditionally opposed debt redenomination schemes due to the weakness and inconvertibility of many of the developing country currencies. A country heavily indebted in dollars might reissue all debt in its own currency, essentially printing money to repay the debt. This is commonly thought to be too dangerous for all parties, resulting in depreciated values in repayment and inducing the country to undertake inflationary policies not in its own best interest. The DFD program, however, altered this process substantially by limiting the actual sucre to be swapped and by requiring a debt swap with a repayment schedule matching that of the initial debt obligation. The first and foremost concern on the part of an indebted country like Ecuador is that the debt and debt service is in a foreign currency, in this case U.S. dollars. This swap program would allow Ecuador to exchange sucre debt for dollar debt. Ecuadorian Debt for Development The DFD program would work in the following way. Commercial banks holding Ecuadorian debt would sell their loans to the DFD program participant. The debt would be sold at a discount, with the banks receiving partial repayment in dollars and writing the remainder of the loans off as bad debt obligations. The U.S. government, as well as the governments of several other large industrial countries banks with third world debt, have provided tax relief to aid commercial banks to write off these loans through "advantaged loan loss reserves." Ecuadorian debt has been quoted at between $0.16 and $0.20 per dollar of face value debt throughout late 1990 and early 1991. The third party-Oregon State University- would purchase dollar- denominated debt. The debt would then be swapped, with the Ecuadorian government crediting Oregon State with $0.50 for every dollar in debt face value. The Ecuadorian government would then exchange this discounted dollar value for the domestic currency, sucre, at the official government exchange rate, sucre 970/5. Several other countries follow a slightly different procedure whereby the country would swap the debt at 100 percent face value, but then exchange the dollar debt to domestic currency at a significantly altered (overvalued) exchange rate. The indebted country thus gains one way or the other in the actual exchange of dollar debt for domestic currency. Ecuador thus succeeds in reducing its dollar-denominated debt obligations to foreign banks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything anywhere else)! There is, however, a final twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency. does not wish to add to inflationary pressures by pumping up its money supply. The government of Ecuador therefore will swap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flows (coupons) to be paid quarterly until maturity on October 31. 1996. The payment schedule and maturity matches the schedules of the original debt. W nad tedbery Cory case study chegg.pdf ar 1286/Documents/Cory%20case%20study%20chegg.pdf BN BAN Gena Showalter Thornton Winery C... Airlines College Links Ambassador Wolf other in the actual exchange of dollar debt for domestic currency. Ecuador thus succeeds in reducing its dollar-denominated debt obligations to foreign banks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything anywhere else)! There is, however, a final twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency, does not wish to add to y pumping up its money supply. The government of Ecuador therefore will swap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flows (coupons) to be paid quarterly until maturity on October 31, 1996. The payment schedule and maturity matches the schedules of the original debt. This last feature poses a problem for Jack (he is to the point of facial "ticks" now; twitching). Given the limited resources a university possesses in conducting study-abroad programs, he needs all the sucre value possible for use in the current period. Jack inquires as to the liquidity of these government bonds, and is told the market is "thin," but the bonds will likely be able to be sold at discounts ranging from 10 to 30% depending on financial and inflationary conditions. Jack's Dilemma Jack was now running short of time. He had to decide whether to commit his resources and his study-abroad program financing, approximately $50,000 for the 1991-1992 academic year, to the DFD program or not. Jack then summarized the major points he needed to weigh in the pro and con columns of the dog-cared Big Chief tablet on his desk. Case Questions: What are the probable sucre proceeds of the debt swap program for Jack's $50,000? Given that there are a range of values over which many of the variables could change, create a best case, moderate case, and worst case scenario for Jack. What are the obvious and not so obvious risks in participating in this debt swap program for Oregon State University? Which of the explicit variables appears to be most important to the actual sucre proceeds? If Jack proceeded with the DFD swap program, what should be his immediate concerns when gaining possession of the sucre-denominated Ecuadorian goverment bonds? How will Jack's expectations of inflation alter his bond or cash management for the coming year? Ecuador Dele for Devel Ma Mengement Jack is vous Jack Van de W er is the Director for International Program Oregon State University, and therefore responsible for managing the financing of all broad programs It is May 1991 and of the cause of duck's nervousness is the need to decide whether or not the university is to take part in the "Debe for Development program Chere DFD) is financing is study programs in the country of Ecuador. The DFD program is designed to aid not-for-profit entities like universities increasing their spending capabilities abroad while contributing to the reduction of large foreign debt levels suffered by many developing countries Ecuador and Debt Ecuador is another in the long line of Latin American countries tempting to deal with large levels of foreign debt. This debitis made up of k out by the government of E n d other semi govem u tions in Ecuador (k ilities, roadste) during the 1970s and early 1980s when the prospects for development in the part of the world w o ng Ecuador, Bund Mexion, wh ic h fundi spend p oin ti The was primarily in the mous e with wide power theme The e Gaming-party in export market when it could be paid in US doo r could be service and eventually read Things, however, did not work out that may The intendeels of the E conomy did not own to the large amount of foreign currency caringsmeded for debt wervice during the 1980s. By 1987, a large amount of Edit was d ied in and by 1983 whicondary market had developed for the sale of dollar debt owed by Eunder t h an throughout the world. Bedelike other heavily indebted countries, was faced with few imatives to service dollar-denominated debt: (1) export for an export surplus or (2) bomow additional dollars The second seative was not considered overly attractive by either the borrower or the endir The expert market relatively stable, but not growing sufficiently to ivice the existing levels of debt. A walemave sowe: Mis the debt service payments! The term die normally and inference to developing costs of long-tem borowings by government or government from the international The lenders are governments, international and development organisations the main Monetary Fund (IMF) and large commercial banks worldwide. Although the fi r st do not operate on the basis of the commercial banking c es s ing competitive mode As the debtors of the early 1980 ye y ote bus tried to the schedule the sto fornbomowe(h effectively mot being s inggah oh oh completely. It is this dumping of debt, in which the commercial banks are willing to well their loans to related third parties, which feeds the growing secondary market for the world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospect for a t in full are often poor, the banks are willing to sell the last considerable from the face value of the loan The Debe for Development Program The DPD is described in the follow "The Debt Coalition for organisations com be of d e porte Devel m e If a portion of the external debe of developing nations can be covered-by donation purchase-into local comencies, not for profit organisations came the funds for develop projected the pur e growth in Latin America, Africa Asia Pacific Coalition members are US colleges and universities, cooperative private vo and research inte din comic dev e o r m completely. It is this dumping of debt, in which the c a se willing to well their own to ed ind parties, which feeds the growing condecy f i Since the so n being serviced by the bowing counter in full of poor, he willing to sell the l a t te The for Development Program The DPD permis described in the follow "The Debt for Devel Comfort co de em of cours e development opportunities a part of the wee of doing some comby purchase local c ompofito w e the funds for develop projecte d to helpur growth in Latin America Africa A n te Pacific t ion Coalition members are US colleges and universities, cooperative r evolu and research engaged in economic development programs Over maintain close cooperation with various US organisations The The cost work closely with private organizations in deborations will program important to each country's economic priorities such as education, public health, sutrition agriculture, small business enterprises, research, housing, credit, and e re management programs The DFD programose from the growing activity in what is called debt for equity was. Many of the indebted countries wished to alter the ware of their obligations from debt to participating equity, where the older would returns tied to the profits for losses of the we s ted with the capital. The idea was to encourage long-term equity involvement in the country, wher than the debt repayment at anycost posture of most det holders The Debe for Development wap is something skin to a debt for equity ww The dollar debitis swapped for sucre-denominated debe in this case, however, rather than in the equity ownership of acre-denominated enterprise. Most det holders have traditionally opposed deberedenomination schemes due to the weakness and inconvertibility of many of the developing country currencies. A country heavily indebed is dolls might all debt in its own Gurrency. c y pricing money to pay the debt. This is commonly thought to be the dangerous for all parties, sultingin deprecated aloin repayment inducing the country to undertake into policisti its own best interest The DFD program, however, altered this process by limiting the stawucre to be wwapped and by requiring a debt wap with payment schedule maching that of the initial debt obligation The first and foremost concern on the part of indeed country like Ecser is that the debt and debt service is in a foreign currency in this case US . This program would allow Ecuador to exchange sucre det for dollar debt. E dorta Debe for Development The DFDP work the way. C h i d be would sell them to the DFD programacion. The debt would be sodat dit with the receiving a t indoles and writing the remainder of the fasad debt is The US well as the government of severler inde cores banks with third world debt, have provided tax relief to come to write of these loans through aged lans erves Ecuadoriandebt has been quoted at between $0.16 and 50.20 per dollar of face value debe throughout late 1990 and early 1991. The third party-Oregon State University would purchase dollar denominated debt. The debt would then be swapped, with the Bunderlagov r editing Oregon State with $050 for every dollar in debt free value. The Feudorin povement would then The DFD program would work in the following way. Commerci o would will be the DFD program participant The wobe c the banks receiving pa y ment in dollars and writing them e of the foo debt obligations. The US goverment as well as the government of several other langen countries banks with this world debt, have provided to meetod.com with d E would donde habe quoted between $0.16and 50.20 per dollar of late 1990 and early 1991. The ind party-Oregon State University de m ed det. The would then be apped, with the End Oregon State with $0.50 for every dollar in debt face value. The B o exchange this i d dollar for the domestic currency. c exchange 9705 the h e do o th o m Several other follow a slightly different procedure where the y would the debt 100 percet face au but then exchange the dollar de todomestic a significantly red overvalued exchange rate. The indeed country th e way or the other in the exchange of dollar de for domestic currency. Bendor i nducing its de la denominad obligations to foreign and s ay sure the proceeds of the Conversion will be sent in the domestic economy (sucre do not buy thing wywhere ! There is, however, afinal twist to this specific program. Feudor, although is to retire or replace existing dollar denominated debt with domestie currency, does not wish to add to inflationary press by pumping up is money supply, The government of Ecuador therefore will wap the debt as described, but for sucre-denominated bonds, mocash. These bonds would then be serviced by sucre denominated cash flows (coupons) to be paid quarterly until maturity on October 31, 1996. The payment schedule and maturity matches the schedules of the original debt This last feature poses a problem for Jack (he is to the point official ticksnow.twitch . Given the limited resources a university possesses in conducting studyabroad programs, he needs all the sucre value possible for use is the current period Jack inquires as to the liquidity of these government bonds, and is told the market ishin but the bends will kely be able to be sold at discounts ranging from 10 to 30% depending on financial and inflationary conditions Jack's Diens Jack was now running short of time. He had to decide whether to commit is sure and his studyabroad program financing, approximately 550,000 for the 1991-1992 academic year to the DFD program or not. Jack then summarised the major points he needed to weigh in the ground.com columns of the dog-card Big Chief tablet on his desk CQ What the po w er proceeds of the debt wappog that there are mange of which many of the w cas, model and wo n for Jack o ' 0.0007 Given uld change best What we the obvious and o bvious in participating in this debt www program for Oregon State University? Which of the explicit variables appears to be most important to the actual proceeds? fack proceeded with the DFD program, what should be his immediate comes when gaining possession of the sucre-denominated Fedorian d will Yeo w current period Jack Inquires as to the daty of these government bonds, and is told the market is "thin" but the bonds will likely be able to be soldat discounts ranging from 10 to 30% depending on financial and intory conditions Jack's Dilema Jack was now running short of time. He had to decide whether to commit his resources and his studyabroad program financing, approximately 350,000 for the 1991-1992 academic year, the DFD program or not, Jack the summ e r point e d to weigh in the road.com columes of the dog cared Big Chief tablet on his desk Ce Questions What are the probabile che proceeds of the debt wapper for Jack's 550.0007 Given that there we range of values over which many of the variables couchage, cewe best case, moderate case, and worst case scenario for Jack What we the obvious and not so obvious risks in participating in this data program for Oregon State University? Which of the explicitariales appears to be most important to the actual sucre proceeds? 3. Back proceeded with the DFD wap program, what should be is immediate concerns when gaining possession of the sucre-denominated Leuadorian government bonds? How will Jack's expectations of inflationer his bond or cash management for the coming year? . Boost (8:33 PM 775% Done 2(1).pdf CASE Ecuadori Debe for Development Mal l incial Management Jack servo uk dewlers the Director for wo m en Suiventand therefore response for manging the financing of It is May 1991 doofh o f lack'serve is the d ecide where the ventiske part in the Debt for Development the DFD) is facing dy programs in the country of E der. The DFD program is designed to aid for profit entities like universities in increasing their spending capabilities broad while contributing to the reduction of large foreign debt levels offered by many developing countries Ecuador und Debt Ecundor is another in the long line of Latin American countries attempting to deal with large levels of foreign debit. This debt is made up of loans taken out by the government of Banderand other sem government institutions in Ecuador (like utilities, railroads, etc) during the late 1970s and early 1980s when the prospects for sconomic development in the part of the world were quite trong Ecuador, like and Mexico, went to the international markets to be funds to speed up its rule of industriation. The debt was primarily in the form of US dollars, a currency with wide international purchasing power at the time. The capital was intended to improve themel Infrastructure and manufacturing Industries of Ecuador to allow to genere increased earings-particularly in export markets where it could be paid in US dollars the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The intemal and external sector of the Ecuadorian economy did not grow sufficiently to get the large amounts of foreign currency earnings needed for det vice during the 1980s. By 1987, a large amount of Ecuadoriandebt was classified as in areas, and by 1983 w i l secondary market had developed for the sale of dollar debt owed by Ecuador to come ankthroughout the world. Ecuador, like other heavily indebted countries, was faced with few a maties to service dollar-denominated debe (1) export or export surplus or 2) bomow additional del The second seative was not considered overly attractive by either the home or the end The export market was eatively stable, but not growing sufficiently to service the existing levels of debt. Aww amatierow: Miss the deb-service payments The term die normally and in reference to developing count of long- bomowings by government or government from the capital marks The lenders are governments, international and development organi t he Monetary Fund (IMF and large commercial banks worldwide. Although the first do not operate on the basis of pro, the commercial banking cor desperate increasingly competitive mode. As the debt crises of the early 1980s came and stayed many of the comme barried to either reschedule this to foi bomowershel g en not being is a ricing is obligations of de comply dumping of which the commerc e willing all the e nd parties which is the growing condary market for t . Since the loans are not being serviced by the borrowing country, and there fore in full weathe poor the banks are willing to the las . Boost 8:33 PM 1 75% Done 2(1).pdf l comply dumping of , in which the commercia which is the growing condarymafor of being serviced by the bowing t he in een poor, the banks willing to the s c ene value of the es See form from the face The Debe for Development Program The DFD program is described in the follow "The Debt for Develope Coalition for organis ed dig d Inmations of cours into comic development opportunities e If a portiothermal debe of developing nations can be w hy d o purchase-into local currencies for profit organis e the funds for development projects ended to help spureconomic growth in Latin America, Africa, Asia and the Pacific Coalition members are US.colleges and universities, cooperatives, private vol and research e s engaged in economic development programs Over maintain close cooperation with various U.S. environmental organisations The c i on le The coalition work closely with private organizations in debtortions to West programs important to each country's economic priorities such as education public health nutrition agriculture, small business enterprises, research, housing, credit, and natural resource management programs The DFD program wone from the growing activity in what is called debt for ty was. Many of the indebted countries wished to her the r e of their obligations from date participating equity, where the older would see returns tied to the profits for losses of the pri c e with the capital. The idea was to encourage long-term equity involvement in the country.ther than the debt repayment at anycost posture of most debt holders The Debt for Development wap is something into a debt for equity The dollar deb swapped for suredeaminated debe in this case, however, ther than in their ownership of were denominated r is Most debit holders have traditionally opposed e cem schemes to the weakness and convertibility of any of the developing country currencies. A country leavily indebedi dollars might allebeiis own currency. p ng money to pay the debt. This is commonly thought to be dangerous for all parties, ingin deprecated a n d inducing the country to unde police soli its own best interest. The DFD program, however, this process by the wh ere to be apped and by requiring adb wap with a scheduleching that of the dog The first and foremost conce on the profi e Ecuador is that the debe de services in c urrency US dollar. This program would allow E x change det fordi det Ecuadorian Debe for Development Boost 8:33 PM 75% Done 2(1).pdf The DFD w ork in the following wey Coc i do would sell their mothe DFD programa The would be with the movi e indoles and writing the doo d dows The US well as the govo r i chankwird, have provided to com o these through avantaged loans reserves Ecuadoriandebhas been goed between $0.16and $0.20 per dollar of face de troughout late 1990 and early 1991. The third party-Oregon S e University purchased dented debt Thebt would the beswapped, with the corne r ing Oregon Sute with $0.50 for every dollar in d i e value. The Ecuador over would then exchange this discounted dollar value for the domestic currency. W e official government exchange 97015 Several other countries follow a slightly different procedure whereby the country would the debeat 100 percent face value, but then exchange the dollar debt to domestic currency significantly altered overvalued exchange rate. The indebted country th e way or the other in the exchange of dollar debt for domestic currency Eeundort e d in reducing its dollar-denominated debt obligations to forebanks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything wywhere ! There is, however, afinal twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency, does not wish to add to inflationary pressures by pumping up its money supply. The government of Ecunder therefore will wap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flow (coupon) to be paid quarterly until maturity on October 31, 1996. The payment schedule and marity matches the schedules of the original debit This last feature poses a problem for Jack the is to the point official ticksnow.twitching Given the limited resources a university possesses in conducting studyabroad programs, he needs all the sucre value possible for the current period Jack Inquires the widty of these government bonds, and is told the market ishin but the beds will be able to be sold at discounts ranging from 10 to 30% depending on financial and inflationary conditions Jack's Dilema Jack was now running short of time. He had to decide whether to commit his resources and his Sadyabroad program financing, approximately 350,000 for the 1991-1992cademic year, the DFD program or not, Jack the summa thejor poseeded to weigh in the ground.com colums of the dog card Big Chiefable on his desk Boost " 8:33 PM 75% Done 2(1).pdf 4 of 4 Cases What are the probabile che proceeds of the debt w program for $50.00 Given that there are ov e rwhich many of the walls could change crabes cas, mode , and otseseo for Jack 2. What the obvious and more obvious risks in participating in this Oregon Se University? Which of the explicit variables appears to be the actual e proceeds? program for importante 3. Jack proceeded with the DFD program, what should be his immediate concerns when gaining possession of the sucre-denominated Ecuadorian government bends? How will Jack's expectations of nationaler Nisbond or cash management for the coming year? CASE Ecuadorian Delt for Development Multinational Financial Management A Sohrabian Jack is nervous. Jack Van de Water is the Director for International Education Programs at Oregon State University, and therefore responsible for managing the financing of all studyabroad programs It is May 1991 and one of the causes of Jack's nervousness is the need to decide whether or not the university is to take part in the Debt for Development program (hereafter DFD) in financing its study programs in the country of Ecuador. The DFD program is designed to aid not-for-profit entities like universities in increasing their spending capabilities abroad while contributing to the reduction of large foreign debt levels suffered by many developing countries Ecuador and Debt Ecuador is another in the long line of Latin American countries tempting to deal with large levels of foreign debt. This debt is made up of loans taken out by the government of Ecuador and other semi government institutions in Ecuador (like utilities, railroads, etc.) during the late 1970s and early 1980s when the prospects for economic development in the part of the world were quite strong Ecuador, like Brazil and Mexico, went to the international capital markets to obtain funds to speed up its rate of industrialization. The debt was primarily in the form of US dollars, a currency with wide international purchasing power at the time. The capital was intended to improve the internal infrastructure and manufacturing industries of Ecuador to allow to generate increased camnings-particularly in export markets where it could be paid in US dollars the debt could be serviced and eventually repaid. Things, however, did not quite work out that smoothly. The interal and external sectors of the Ecuadorian economy did not grow sufficiently to generate the large amounts of foreign currency camings needed for debt service during the 1980s. By 1987, a large amount of Ecuadorian debt was classified as in arrears, and by 1983 a substantial secondary market had developed for the sale of dollar debt owed by Ecuador to commercial banks throughout the world. Ecuador, like other heavily indebted countries, was faced with few alternatives to service dollar-denominated debt: (1) export (or run a net export surplus or (2) borrow additional dollars. The second alternative was not considered overly attractive by either the borrower or the lenders The export market was relatively stable, but not growing sufficiently to service the existing levels of debt. A new alternative rose: Miss the debt-service payments! The term debt, as normally used in reference to developing countries, consists of long-term borrowings by government or semi government entities from the international capital markets. The lenders are governments, international aid and development organisations like the International Monetary Fund (IMF), and large commercial banks worldwide. Although the first two organizations do not operate on the basis of profit, the commercial banking sector does operate in an increasingly competitive mode. As the debt crises of the early 1980s came and stayed, many of the commercial banks tried to either reschedule their loans to foreign bomowers (thus effectively redefining the loan as not being in artears on servicing its obligations) or to rid themselves of their foreign debt Decision Case completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans to related third parties, which feeds the growing secondary market for third world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospects for payment in full are often poor, the banks are willing to sell the lansat e from the free completely. It is this dumping of debt, in which the commercial banks are willing to sell their loans to unrelated third parties, which feeds the growing secondary market for third world debt. Since the loans are often not currently being serviced by the borrowing country, and the prospects for payment in full are often poor, the banks are willing to sell the lansata considerable discount from the face value of the loan The Debt for Development Program The DFD program is described in its own literature as follows: "The Debt for Development Coalition, Inc., represents not-for-profit organizations committed to finding ways to turn the international debts of countries into economic development opportunities If a portion of the external debt of developing nations can be converted-by donation or purchase-into local currencies, not-for-profit organizations can use the funds for development projects needed to help spur economic growth in Latin America, Africa, Asia, and the Pacific. Coalition members are U.S. colleges and universities, cooperatives, private volunteer organizations, and research institutes engaged in economic development programs overseas. The coalition also maintains close cooperation with various U.S. environmental organizations The coalition works closely with private organizations in debtorations to identify programs important to each country's economic priorities such as education, public health, nutrition agriculture, small business enterprises, research, housing, credit, and matural resource management programs The DFD program arose from the growing activity in what is called debt for equity swaps. Many of the indebted countries wished to alter the nature of their obligations from debt to participating equity, where the holder would see returns tied to the profits (or losses) of the enterprises associated with the capital. The idea was to encourage long-term equity involvement in the country, rather than the debt repayment at anycost posture of most debt holders. The Debt for Development swap is something akin to a debt for equity swap. The dollar debt is swapped for sucre-denominated debt in this case, however, rather than into the equity ownership of a sucre-denominated enterprise. Most debt holders have traditionally opposed debt redenomination schemes due to the weakness and inconvertibility of many of the developing country currencies. A country heavily indebted in dollars might reissue all debt in its own currency, essentially printing money to repay the debt. This is commonly thought to be toodangerous for all parties, resulting in depreciated values in repayment and inducing the country to undertake inflationary policies not in its own best interest. The DFD program, however, altered this process substantially by limiting the actual sucre to be swapped and by requiring a debt swap with a repayment schedule matching that of the initial debt obligation. The first and foremost concern on the part of an indebted country like Ecuador is that the debt and debt service is in a foreign currency, in this case U.S. dollars. This swap program would allow Ecuador to exchange sucre debt for dollar debt. Ecuadorian Debt for Development Decisione The DFD program would work in the following way. Commercial banks holding Ecuadorian debt would sell their loans to the DFD program participant. The debt would be sold at a discount, with the banks receiving partial repayment in dollars and writing the remainder of the loans off as bad debt obligations. The U.S. government, as well as the governments of several other large industrial countries banks with third world debt, have provided tax relief to aid commercial banks to write off these loans through advantaged loan los reserves." Ecuadorian debt has been quoted at between $0.16 and 50.20 per dollar of face value debt throughout late 1990 and early 1991. The third party-Oregon State University would purchase dollar denominated debt. The debt would then be swapped, with the Ecuadorian government crediting Oregon State with $0.50 for every dollar in debt face value. The Ecuadorian goverment would then Exchange this discounted dollar value for the domestic currency, sucre, at the official government exchange rate, sucre 970/5. Several other countries follow a slightly different procedure whereby the country would swap the debt at 100 percent face value, but then exchange the dollar debt to domestic currency at a significantly altered (overvalued) exchange rate. The indebted country thus gains one way or the other in the actual exchange of dollar debt for domestic currency. Ecuador thus succeeds in reducing its dollar-denominated debt obligations to foreign banks, and essentially assures the proceeds of the conversion will be spent in the domestic economy (sucre do not buy anything anywhere else)! There is, however, a final twist to this specific program. Ecuador, although anxious to retire or replace existing dollar-denominated debt with domestic currency, does not wish to add to inflationary pressures by pumping up its money supply. The government of Ecuador therefore will swap the debt as described, but for sucre-denominated bonds, not cash. These bonds would then be serviced by sucre-denominated cash flows (coupons) to be paid quarterly until maturity on October 31, 1996. The payment schedule and maturity matches the sc