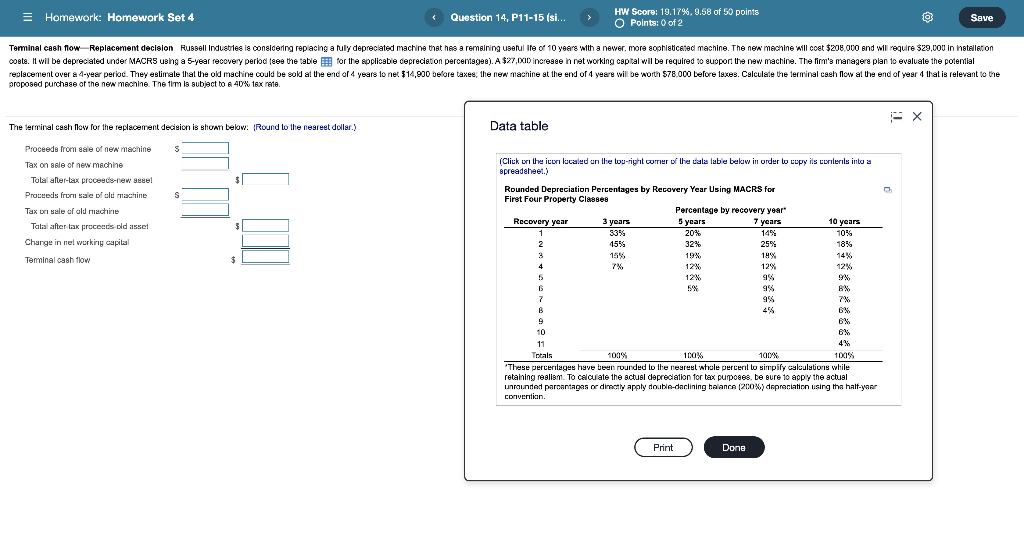

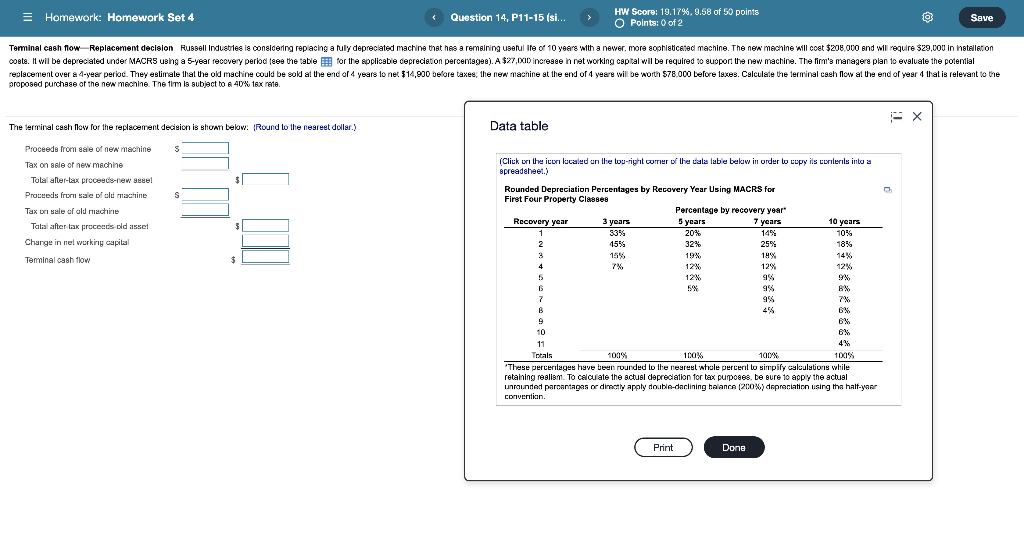

= Homework: Homework Set 4 Question 14, P11-15 (si... HW Score: 19.17%, 9.58 of 50 points Points: 0 of 2 Save Teminal cash flow Replacement decision Russell Industries is considering replacing a ruly depreciated machine that has a remaining useful ite of 10 years with a newer, more sophisticated machine. The new machine will cost $208,000 and will require $29.000 in installation coste. It wil be depreciated under MACRS using a 5-year recovery period see the table for the applicable depreciation percentages). A $27,0XCID increase in networking capital wil be required to support the new machine. The firm's managera plan to evaluate the potential replacement over a 4-year period. They estimale that the old machine could be sold at the end of 4 years to net $14,900 before taxes, the new machine at the end of 4 yeare will be worth $78.000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 40% 16x rarte. FX The terminal cash flow for the replacement decision is shown below: Round to the nearest dollar.) Data table $ 07 S Proceeds from gale of new machine Tax on sale of new machine Tolal alter-lax proceeds-new segel Proceeds from sale of old machine Tax or sale of old machine Talal after-tax proceeds old asset Charge in net working capital Terminal cash flow 5 $ (Click on the iconi localed on the low-right corner of the cala table below in order to copy ils crierils into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years 33% 20% 14% 10% 2 4556 32% % 25% 18% 3 15% 19% 19% 14% 4 12% 12% 12% 5 12% 9% 9% 6 5% 95 6 998 7% B 45 X 9 6% 10 B% 4% Totals 100% 100% 100% 100% 'These percerlages have been rounded to the nearest whole percerillo simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual . unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year Convertian Print Done