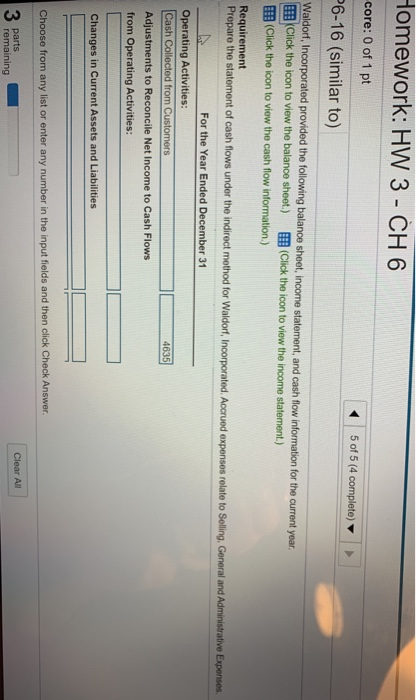

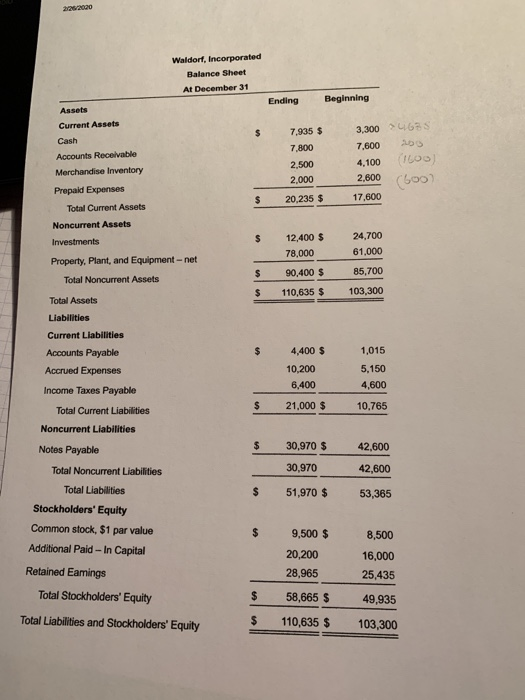

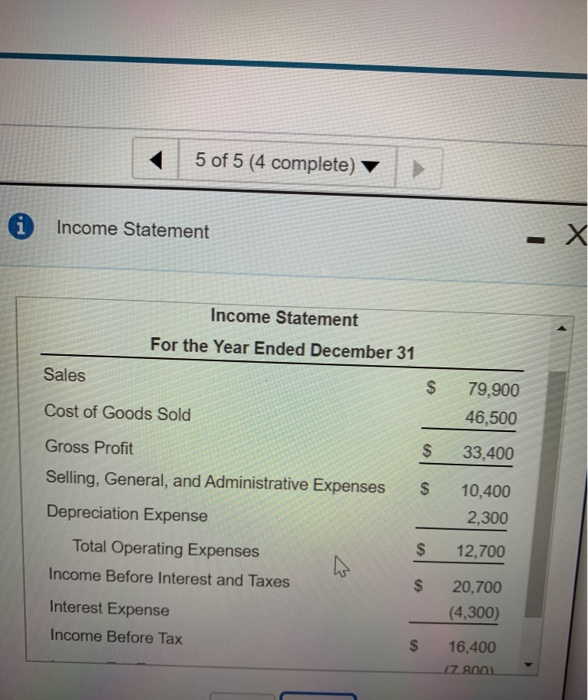

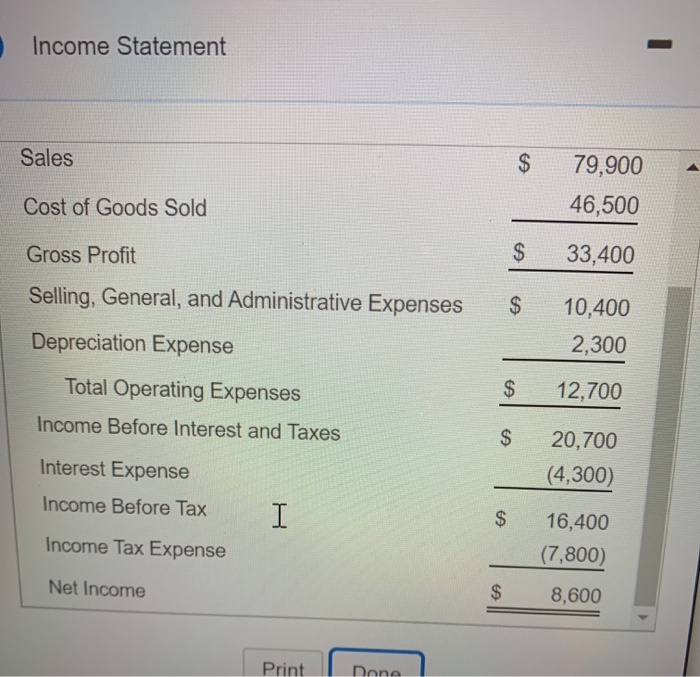

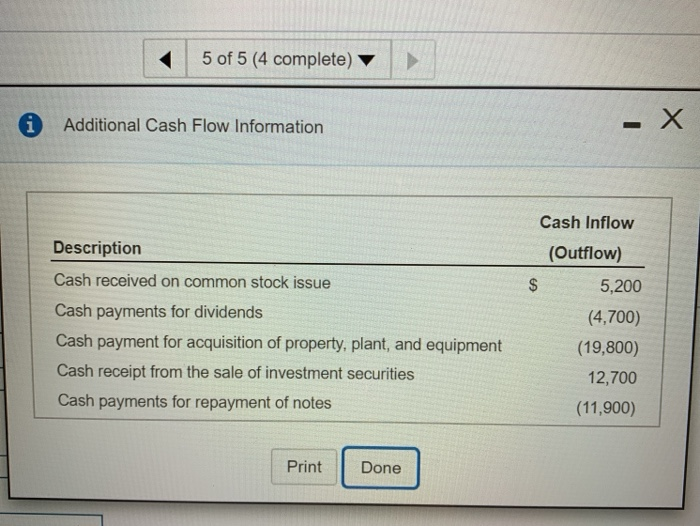

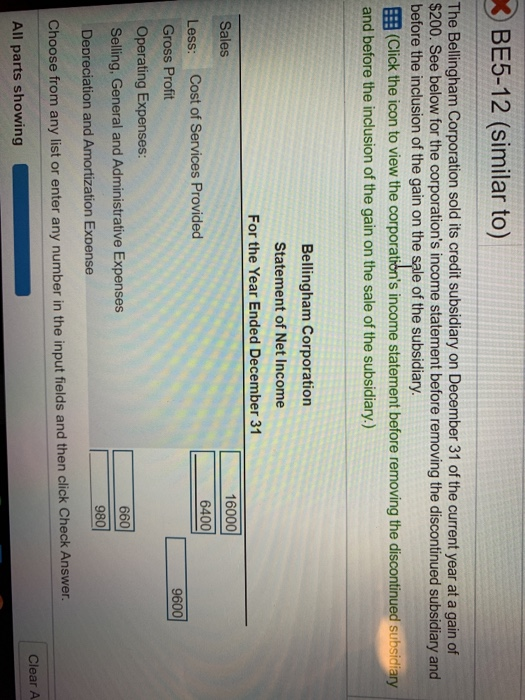

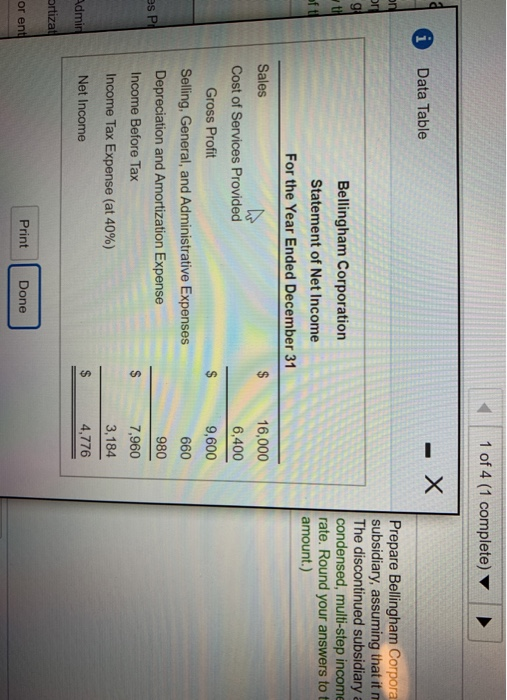

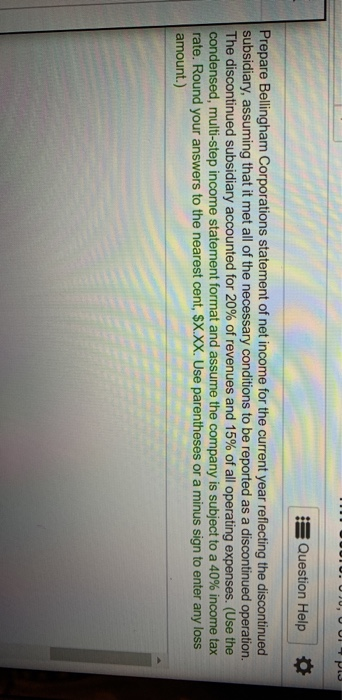

Homework: HW 3 - CH 6 core: 0 of 1 pt P6-16 (similar to) 5 of 5 (4 complete) Waldorf, Incorporated provided the following balance sheet, income statement, and cash flow information for the current year. Click the icon to view the balance sheet.) (Click the icon to view the income statement.) (Click the icon to view the cash flow information.) Requirement Prepare the statement of cash flows under the indirect method for Waldorf, Incorporated. Accrued expenses relate to Selling, General and Administrative Expenses For the Year Ended December 31 Operating Activities: Cash Collected from Customers 4635 Adjustments to Reconcile Net Income to Cash Flows from Operating Activities: Changes in Current Assets and Liabilities Choose from any list or enter any number in the input fields and then click Check Answer 3 parts Clear All remaining 2/26/2020 Waldorf, Incorporated Balance Sheet At December 31 Ending Beginning Assets Current Assets Cash 7.935 $ 7.800 2,500 2,000 3,300 46S 7,600 DO 4,100 100) 2,600 (50) 20,235 $ 17,600 24,700 61,000 Accounts Receivable Merchandise Inventory Prepaid Expenses Total Current Assets Noncurrent Assets Investments Property, Plant, and Equipment-net Total Noncurrent Assets Total Assets Liabilities Current Liabilities Accounts Payable Accrued Expenses 12,400 $ 78,000 90,400 $ 110,635 $ $ $ 85,700 103,300 4,400 $ 10,200 6,400 1,015 5,150 4,600 21,000 $ 10.765 Income Taxes Payable Total Current Liabilities Noncurrent Liabilities Notes Payable 30,970 $ 30,970 42,600 42,600 51,970 $ 53,365 Total Noncurrent Liabilities Total Liabilities Stockholders' Equity Common stock, $1 par value Additional Paid - In Capital Retained Eamings Total Stockholders' Equity 9,500 $ 20,200 28,965 58,665 $ 110,635 $ 8,500 16,000 25,435 49,935 Total Liabilities and Stockholders' Equity $ 103,300 5 of 5 (4 complete) di Income Statement Income Statement For the Year Ended December 31 Sales $ Cost of Goods Sold 79,900 46,500 33,400 10,400 $ 2.300 Gross Profit Selling, General, and Administrative Expenses Depreciation Expense Total Operating Expenses Income Before Interest and Taxes Interest Expense Income Before Tax $ $ 12,700 20,700 (4,300) 16,400 17 800 Income Statement Sales $ 79,900 46,500 Cost of Goods Sold Gross Profit $ 33,400 $ 10,400 2,300 Selling, General, and Administrative Expenses Depreciation Expense Total Operating Expenses Income Before Interest and Taxes $ 12,700 $ Interest Expense Income Before Tax 20,700 (4,300) I $ Income Tax Expense 16,400 (7,800) Net Income 8,600 Print Done 5 of 5 (4 complete) i Additional Cash Flow Information Description Cash received on common stock issue Cash payments for dividends Cash payment for acquisition of property, plant, and equipment Cash receipt from the sale of investment securities Cash payments for repayment of notes Cash Inflow (Outflow) 5,200 (4,700) (19,800) 12,700 (11,900) Print Done BE5-12 (similar to) The Bellingham Corporation sold its credit subsidiary on December 31 of the current year at a gain of $200. See below for the corporation's income statement before removing the discontinued subsidiary and before the inclusion of the gain on the sale of the subsidiary. ES: (Click the icon to view the corporation's income statement before removing the discontinued subsidiary and before the inclusion of the gain on the sale of the subsidiary.) Bellingham Corporation Statement of Net Income For the Year Ended December 31 Sales 16000 6400 9600 Less: Cost of Services Provided Gross Profit Operating Expenses: Selling, General and Administrative Expenses Depreciation and Amortization Expense 660 980 Choose from any list or enter any number in the input fields and then click Check Answer. Clear A All parts showing 1 of 4 (1 complete) - X Data Table Prepare Bellingham Corpora subsidiary, assuming that it The discontinued subsidiary condensed, multi-step income rate. Round your answers to amount.) Bellingham Corporation Statement of Net Income For the Year Ended December 31 16,000 6,400 9,600 660 980 Sales Cost of Services Provided Gross Profit Selling, General, and Administrative Expenses Depreciation and Amortization Expense Income Before Tax Income Tax Expense (at 40%) Net Income ! s P 7,960 3,184 4,776 Admin Ortizat Print Done or ent Question Help Prepare Bellingham Corporations statement of net income for the current year reflecting the discontinued subsidiary, assuming that it met all of the necessary conditions to be reported as a discontinued operation. The discontinued subsidiary accounted for 20% of revenues and 15% of all operating expenses. (Use the condensed, multi-step income statement format and assume the company is subject to a 40% income tax rate. Round your answers to the nearest cent, $X.XX. Use parentheses or a minus sign to enter any loss amount.)