Answered step by step

Verified Expert Solution

Question

1 Approved Answer

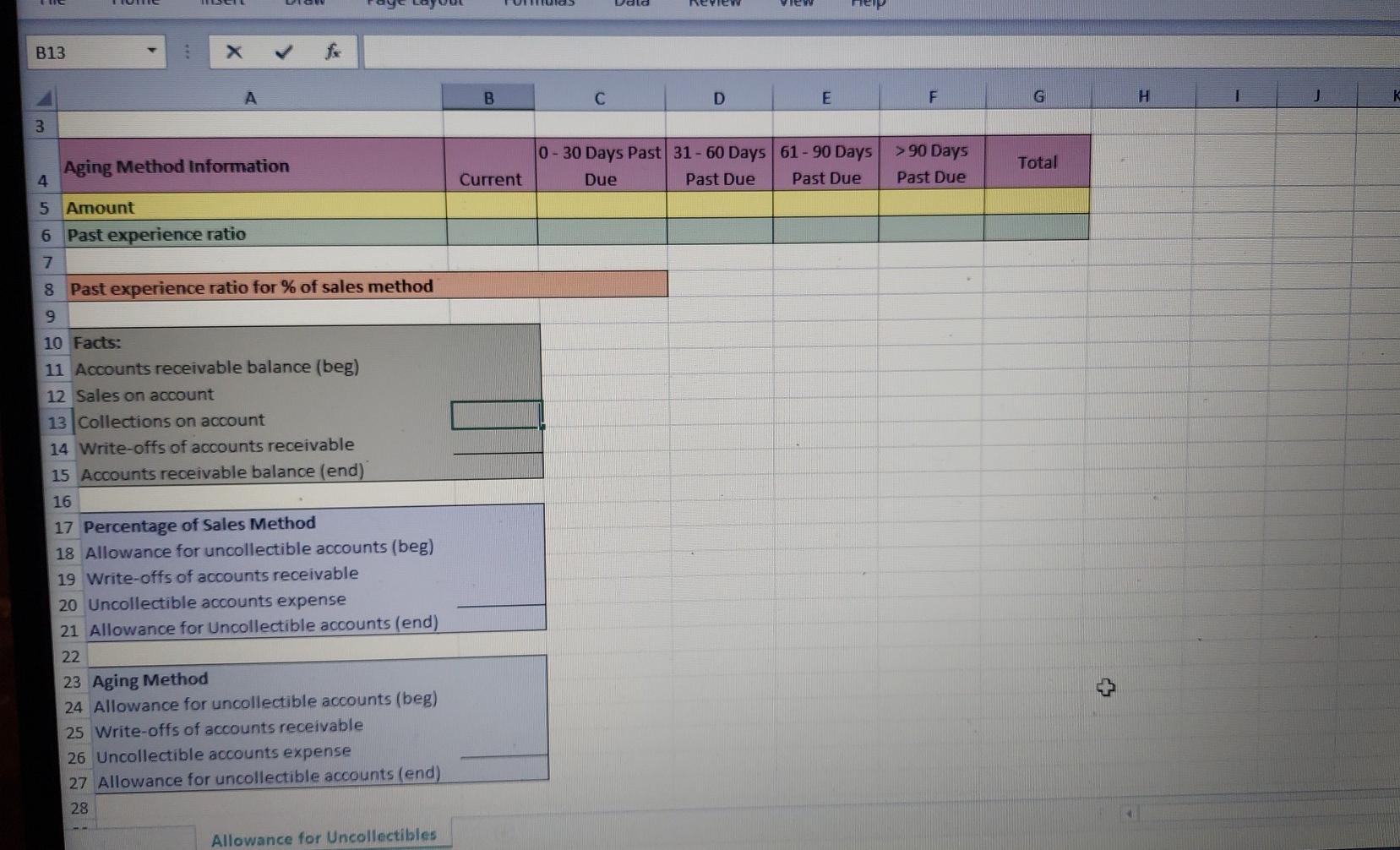

please fill out Excel sheet using the information below. Attach spreadsheet and send me both formula view and value so that I can see all

please fill out Excel sheet using the information below. Attach spreadsheet and send me both formula view and value so that I can see all the formulas and answer question. Thank you kindly

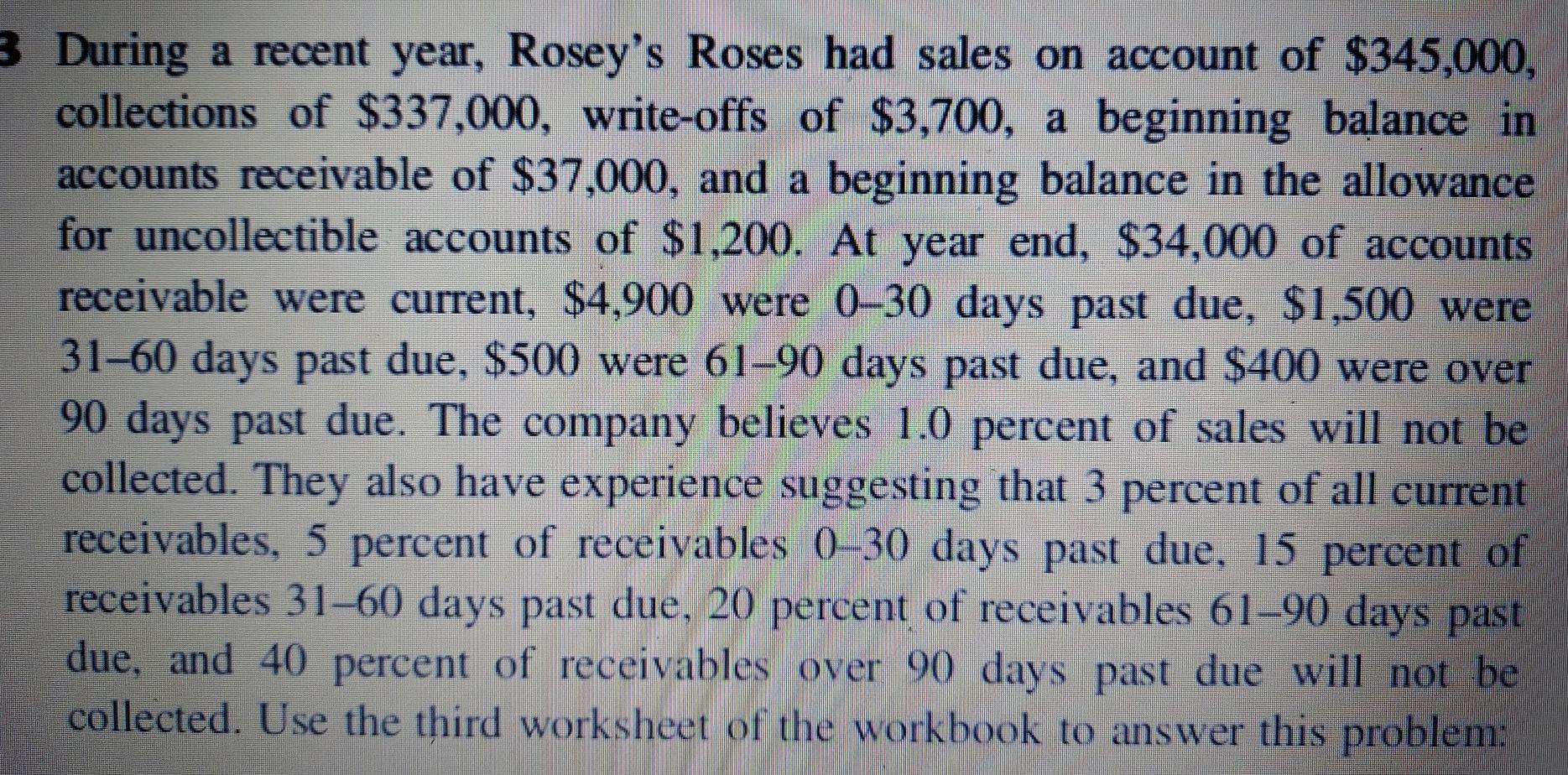

B13 A B D E F H 3 0 - 30 Days Past 31 - 60 Days 61 - 90 Days Due Past Due Past Due Aging Method Information >90 Days Past Due Total 4 Current 5 Amount 6 Past experience ratio 7 8 Past experience ratio for % of sales method 10 Facts: 11 Accounts receivable balance (beg) 12 Sales on account 13 Collections on account 14 Write-offs of accounts receivable 15 Accounts receivable balance (end) 16 17 Percentage of Sales Method 18 Allowance for uncollectible accounts (beg) 19 Write-offs of accounts receivable 20 Uncollectible accounts expense 21 Allowance for Uncollectible accounts (end) 22 23 Aging Method 24 Allowance for uncollectible accounts (beg) 25 Write-offs of accounts receivable 26 Uncollectible accounts expense 27 Allowance for uncollectible accounts (end) 28 Allowance for Uncollectibles 3 During a recent year, Rosey's Roses had sales on account of $345,000, collections of $337,000, write-offs of $3.700, a beginning balance in accounts receivable of $37,000, and a beginning balance in the allowance for uncollectible accounts of $1,200. At year end, $34,000 of accounts receivable were current, $4,900 were 030 days past due, $1,500 were 31-60 days past due, $500 were 6190 days past due, and $400 were over 90 days past due. The company believes 1.0 percent of sales will not be collected. They also have experience suggesting that 3 percent of all current receivables, 5 percent of receivables 030 days past due, 15 percent of receivables 3160 days past due, 20 percent of receivables 6190 days past due, and 40 percent of receivables over 90 days past due will not be collected. Use the third worksheet of the Workbook to answer this problem: b. Complete an allowance for uncollectible accounts analysis using the aging method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started