Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Homework I To be submitted in the next class. Late submissions or electronic submissions will NOT be accepted. Suppose that x tel currently is selling

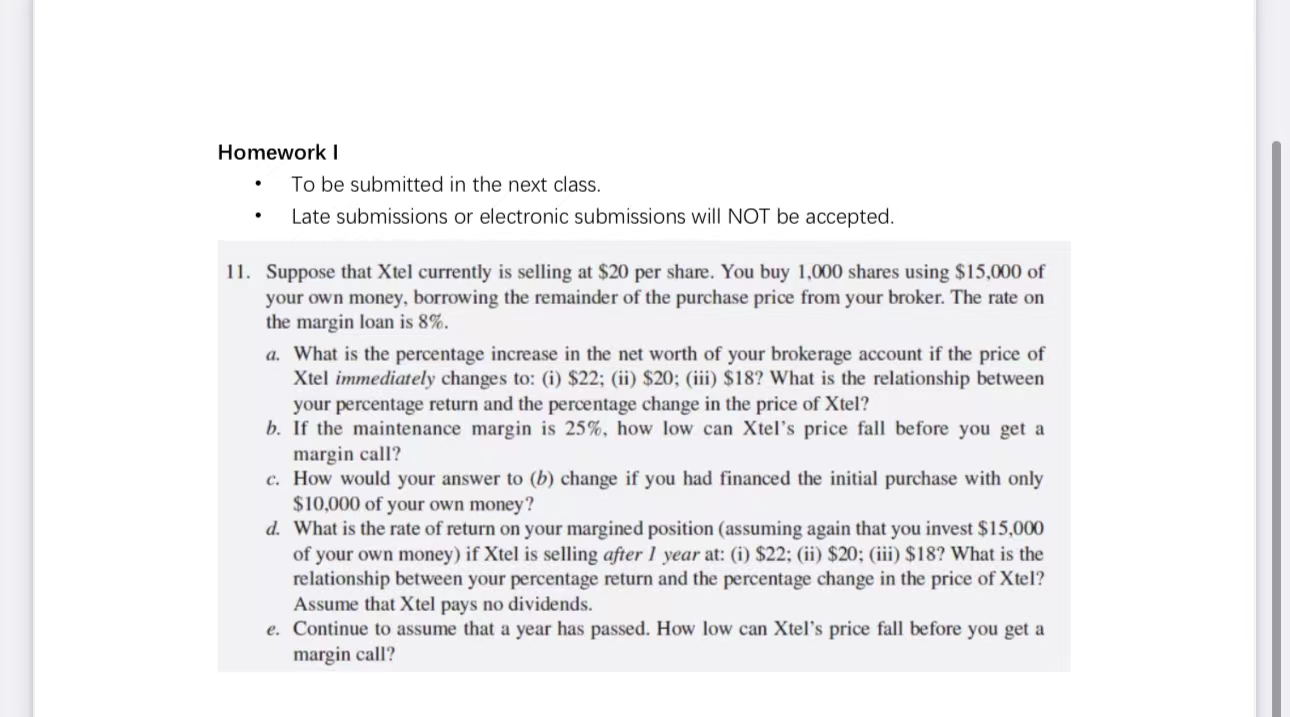

Homework I

To be submitted in the next class.

Late submissions or electronic submissions will NOT be accepted.

Suppose that tel currently is selling at $ per share. You buy shares using $ of

your own money, borrowing the remainder of the purchase price from your broker. The rate on

the margin loan is

a What is the percentage increase in the net worth of your brokerage account if the price of

Xtel immediately changes to: i $; ii $; iii $ What is the relationship between

your percentage return and the percentage change in the price of Xtel?

b If the maintenance margin is how low can Xtel's price fall before you get a

margin call?

c How would your answer to b change if you had financed the initial purchase with only

$ of your own money?

d What is the rate of return on your margined position assuming again that you invest $

of your own money if Xtel is selling after year at: i $; ii $; iii $ What is the

relationship between your percentage return and the percentage change in the price of Xtel?

Assume that Xtel pays no dividends.

Continue to assume that a year has passed. How low can Xtel's price fall before you get a

margin call?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started