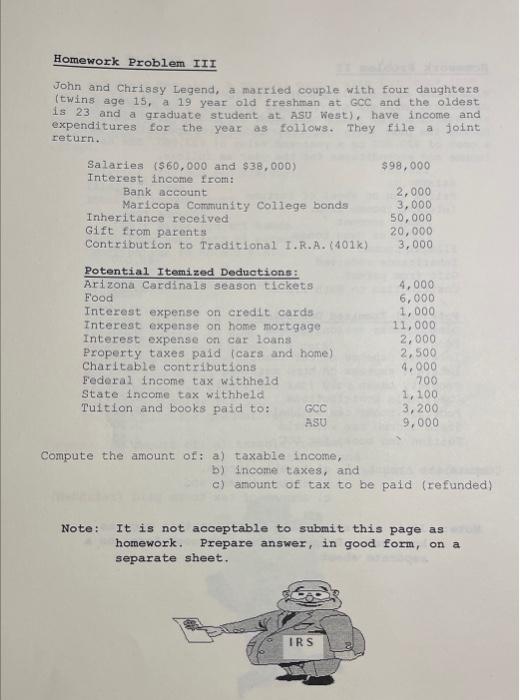

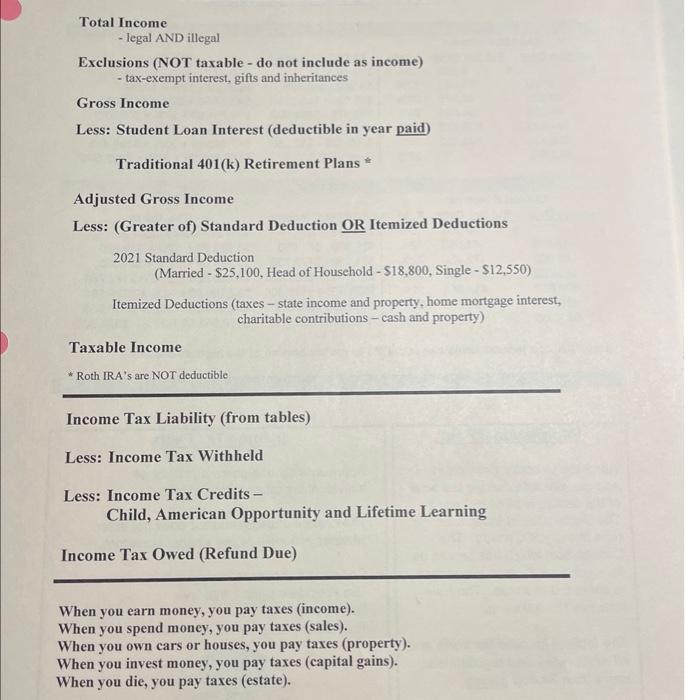

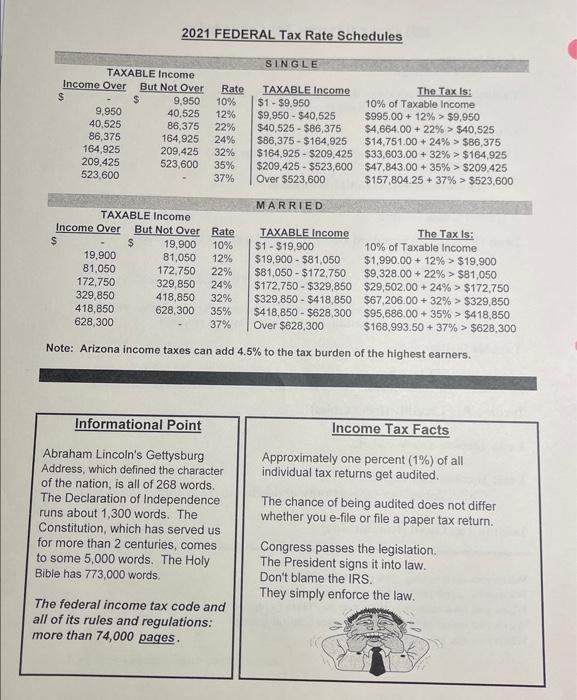

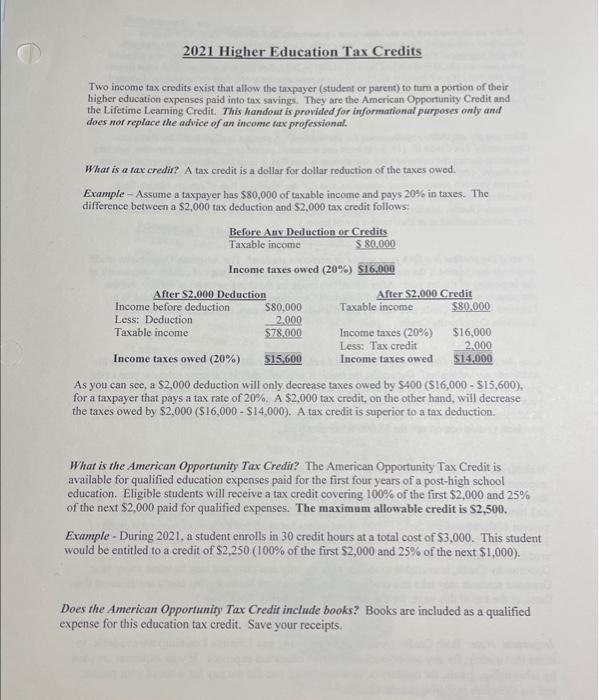

Homework Problem III John and Chrissy Legend, a matried couple with four daughters (twins age 15 , a 19 year old freshman at GCC and the oldest is 23 and a graduate student at ASU West), have income and expenditures for the year as follows. They file a joint return. Compute the amount of: a) taxable income, b) Income taxes, and c) amount of tax to be pald (refunded) Note: It is not acceptable to submit this page as homework. Prepare answer, in good form, on a separate sheet. Total Income - legal AND illegal Exclusions (NOT taxable - do not include as income) - tax-exempt interest, gifts and inheritances Gross Income Less: Student Loan Interest (deductible in year paid) Traditional 401(k) Retirement Plans # Adjusted Gross Income Less: (Greater of) Standard Deduction OR Itemized Deductions 2021 Standard Deduction (Married - $25,100, Head of Household - \$18,800, Single - \$12,550) Itemized Deductions (taxes - state income and property, home mortgage interest, charitable contributions - cash and property) Taxable Income * Roth IRA's are NOT deductible Income Tax Liability (from tables) Less: Income Tax Withheld Less: Income Tax Credits Child, American Opportunity and Lifetime Learning Income Tax Owed (Refund Due) When you earn money, you pay taxes (income). When you spend money, you pay taxes (sales). When you own cars or houses, you pay taxes (property). When you invest money, you pay taxes (capital gains). When you die, you pay taxes (estate). 2021 FEDERAL Tax Rate Schedules Note: Arizona income taxes can add 4.5% to the tax burden of the highest earners. Informational Point Abraham Lincoln's Gettysburg Address, which defined the character of the nation, is all of 268 words. The Declaration of Independence runs about 1,300 words. The Constitution, which has served us for more than 2 centuries, comes to some 5,000 words. The Holy Bible has 773,000 words. The federal income tax code and all of its rules and regulations: more than 74,000 pages. Income Tax Facts Approximately one percent (1%) of all individual tax returns get audited. The chance of being audited does not differ whether you e-file or file a paper tax return. Congress passes the legislation. The President signs it into law. Don't blame the IRS. They simply enforce the law. Two income tax crodits exist that allow the taxpayer (student or parent) to tum a portion of their higher education expenses paid into tax savings. They are the American Opportunity Credit and the Lifetime Learning Credit. This handout is provided for informational purposes only and does not replace the advice of an income faxc professional. What is a fax credir? A tax credit is a dollar for dollar roduction of the taxes owed. Example - Assume a taxpayer has $80,000 of taxable income and pays 20% in taxes. The difference between a $2,000 tax deduction and $2,000 tax credit follows: As you can see, a $2,000 deduction will only decrease taxes owed by $400($16,000 - $15,600), for a taxpayer that pays a tax rate of 20%. A $2,000 tax credit, on the other hand, will decrease the taxes owed by $2,000($16,000$14,000). A tax credit is superior to a tax deduction. What is the American Opportunity Tax Credit? The American Opportunity Tax Credit is available for qualified education expenses paid for the first four years of a post-high school education. Eligible students will receive a tax credit covering 100% of the first $2,000 and 25% of the next $2,000 paid for qualified expenses. The maximum allowable credit is $2,500. Example - During 2021, a student enrolls in 30 credit hours at a total cost of $3,000. This student would be entitled to a credit of $2,250 ( 100% of the first $2,000 and 25% of the next $1,000). Does the American Opportunity Tax Credit include books? Books are included as a qualified expense for this education tax credit. Save your receipts. Is there an income limit for the American Opportunity Tax Creilit?. YeL. As with most deductions and credits, the American Opportunity Tax Credit is not available to all taxpayers. The full amount of the eredit is only available to married taxpayers, filing jointly, with adjusted. gross incomes (AGI) that are less than $160,000 in 2021. For single taxpayers, AGI must be less than $80,000, If your status is married, filing separately, the credit may not available. Generally speaking, AGt is your income after subtracting retirement contributions such as 401ks, but not Roth IRAs. What are the eligibility requirements for the student? A student is eligible for the American Opportumity Tax Credit if (1) for at least one academic period (e.g. semester, trimester, quarier) beginning during the calendar year, the student is enrolled at least half-time in a program leading to a degree, certificate, or other recognized educational credential and is enrolled in one of the first two years of postsecondary education, and (2) the student is froe of any conviction for a Federal or State felony offense consisting of the possession or distribution of a controlled substance. (Aside: Maricopa Community College Distriet's definition of a full-time student is iny student enrolled in at least twelve credit hours.) What if the studemt is a fifth year senior or part-time sudem? The American Opportunity credit may only be claimed if the student has not completed the first four years of college coursework at. the beginning of the tax year, After taking this credit for the first four years of college, neither the parents nor student may claim an Ameriean Opportunity Credit. At this point, there is a Lifetime Learning Credit (see below) that is available. However, it is not as generous ns the American Opportunity Credit. Can the American Opporfunity Tax Credit be claimed for fuition paid in advance of when the academic period begins? Generally, the credit is available only in the same calendar year as the payment is made. A credit card payment is the same as a cash payment. (Aside: If you paid for your Spring 2021 tuition during January of 2021, your Fall 2021 tuition in 2021, and your Spring. 2022 tuition by December 31,2021 -all three amounts would be eligible for the credit in 2021. provided you do not exceed the $4,000 maximum paid.) What is the Lifetime Learning Credit? The Lifetime Learning Credit is to help cover college expenses after the first four years. It's also intended to help workers return to school to upgrade their job skills or to retrain for a new career. Only one of the two credits (American Opportunity or Lifetime) may be claimed in any given year. For 2021 , the credit amount is equal to 20 percent of the taxpayer's first $10,000 of out-of-pocket qualified expenses (maximum credit of $2,000 ). In other words, if two or more students on the same taxpayer's return use the Lifetime credit, the maximum credit is still $2,000. The Lifetime Learning, unlike the American Opportunity Credit, is available to students taking only one class and may be taken every year. Graduate students may take this credit. Note: The income limits for this credit are different than those, at the top of this page, for the American Opportunity Tax Credit.) Important Note: Both Credits (American Opportunity and Lifetime Learning) are available, to those that qualify, for any out-of-pocket qualified education expenses. If your expenses are paid by scholarship, grants, the military or your employer, you did not pay for it out of your pocket and are therefore ineligible for the Credits