Question

Hondor Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2021. The stated

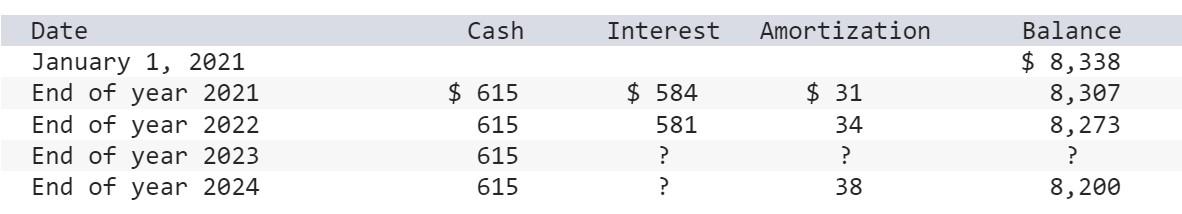

Hondor Corporation issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2021. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The following schedule has been completed (amounts in thousands):

Complete the amortization schedule.

What was the maturity amount (face value) of the bonds?

How much cash was received at date of issuance (sale) of the bonds?

Was there a premium or a discount? If so, which and how much was it?

How much cash is paid for interest each period and will be paid in total for the full life of the bond issue?

What is the stated interest rate? TIP: The stated interest rate can be calculated by comparing the cash payment to the face value of the bond.

What is the market interest rate?

What amount of interest expense should be reported on the income statement each year?

Show how the bonds should be reported on the balance sheet at the end of 2022 and 2023.

DateJanuary1,2021Endofyear2021Endofyear2022Endofyear2023Endofyear2024Cash$615615615615Interest$584581??Amortization$3134?38Balance$8,3388,3078,273?8,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started