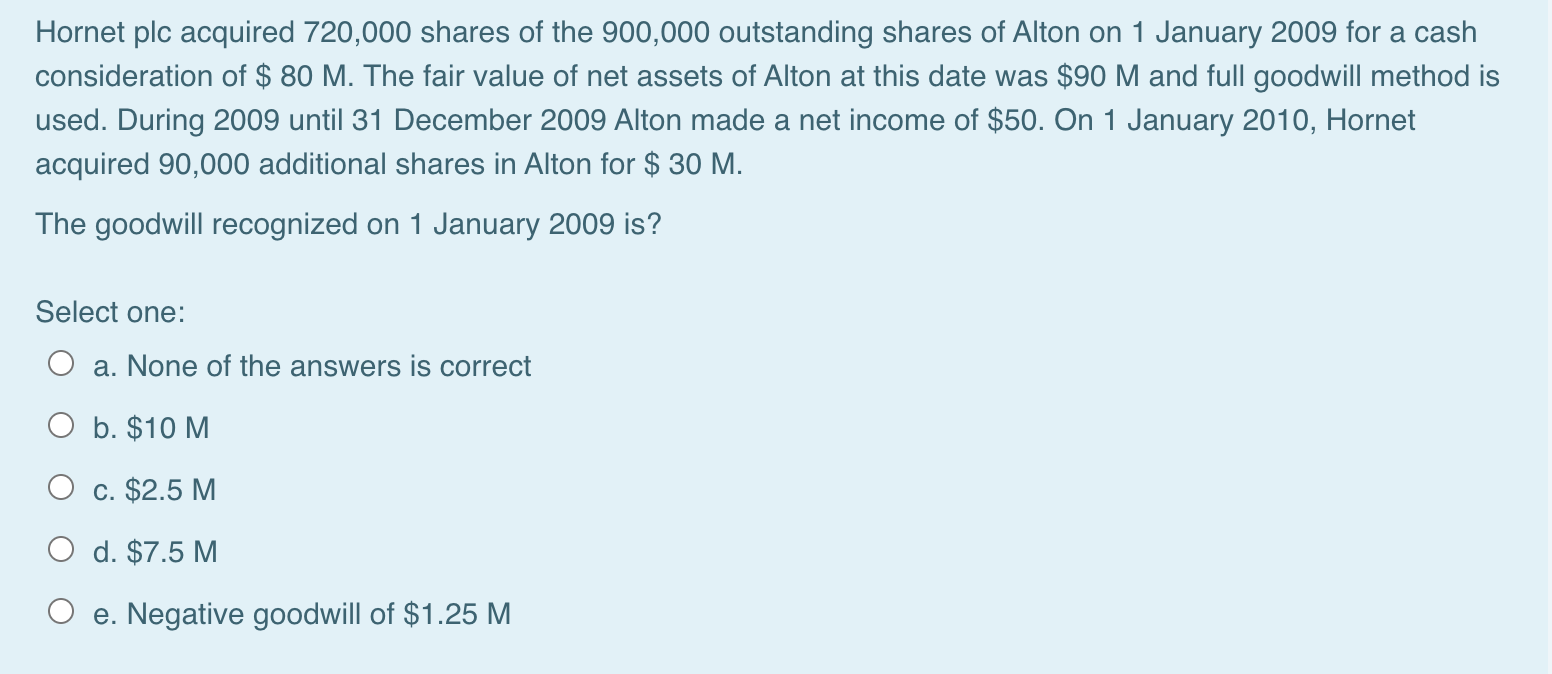

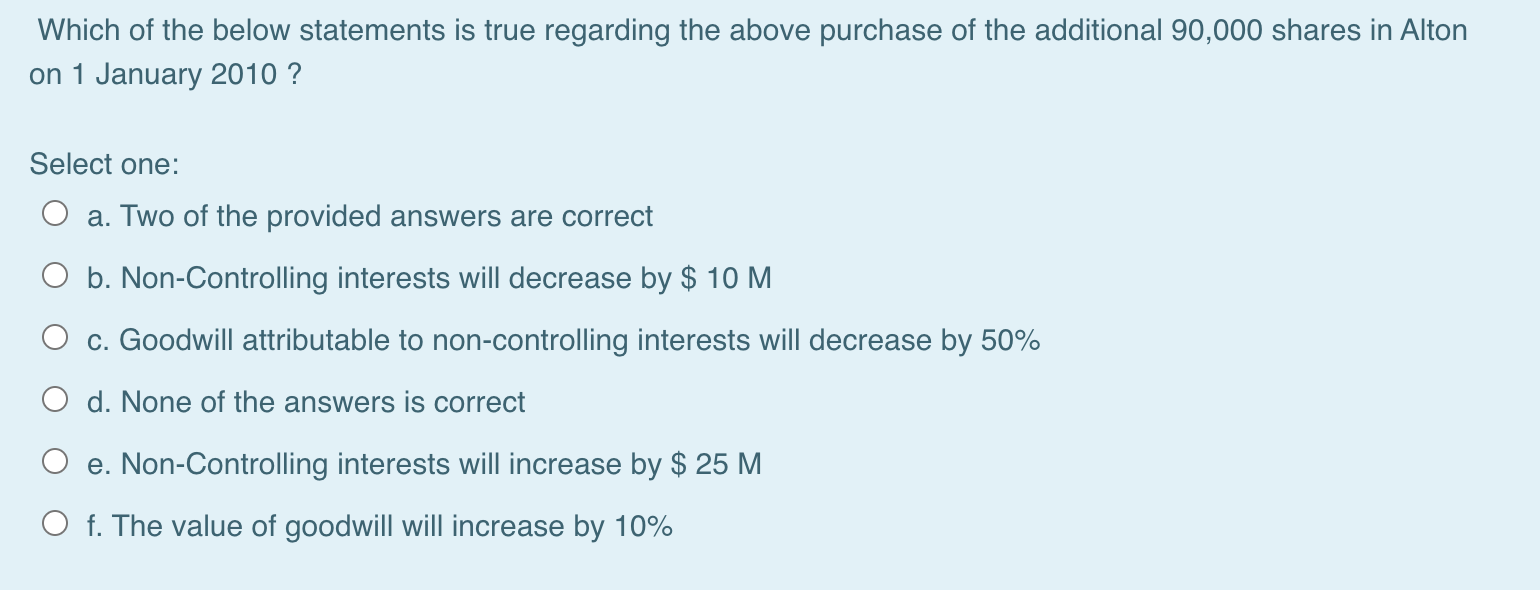

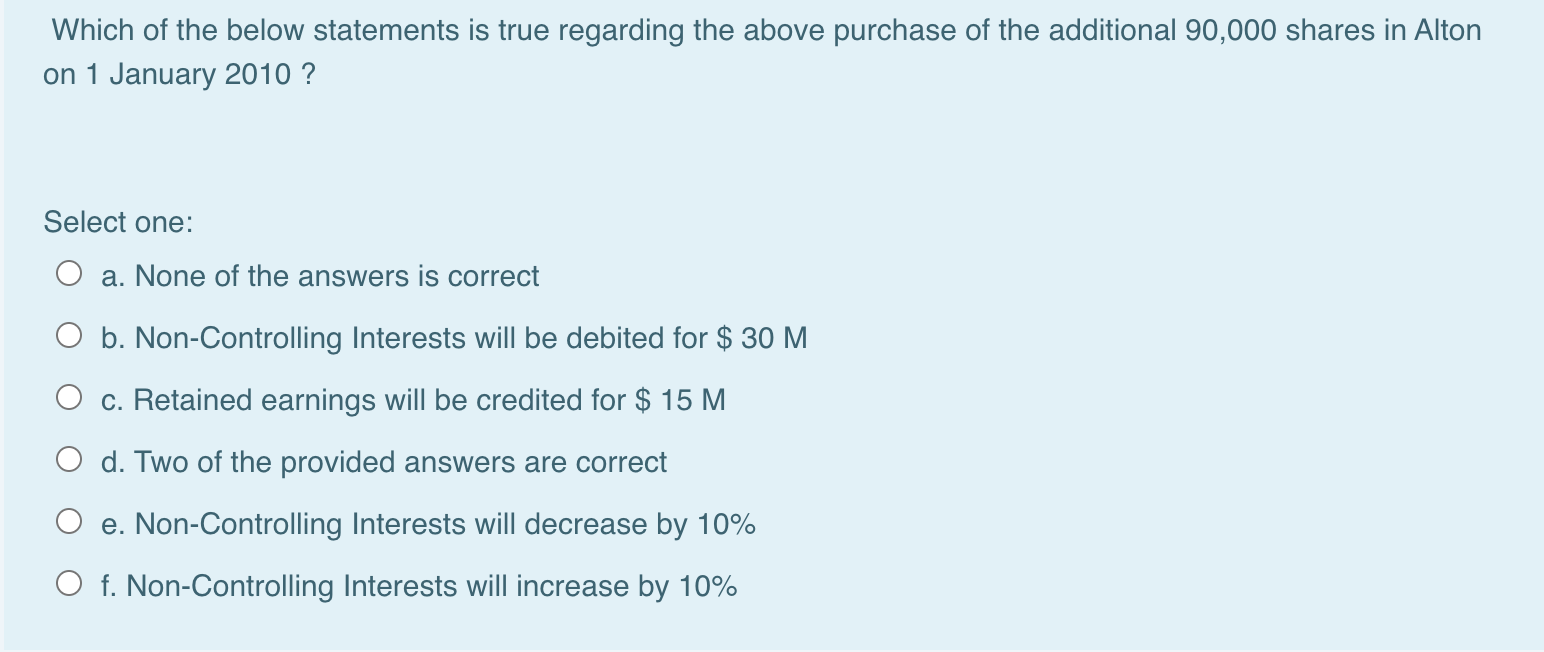

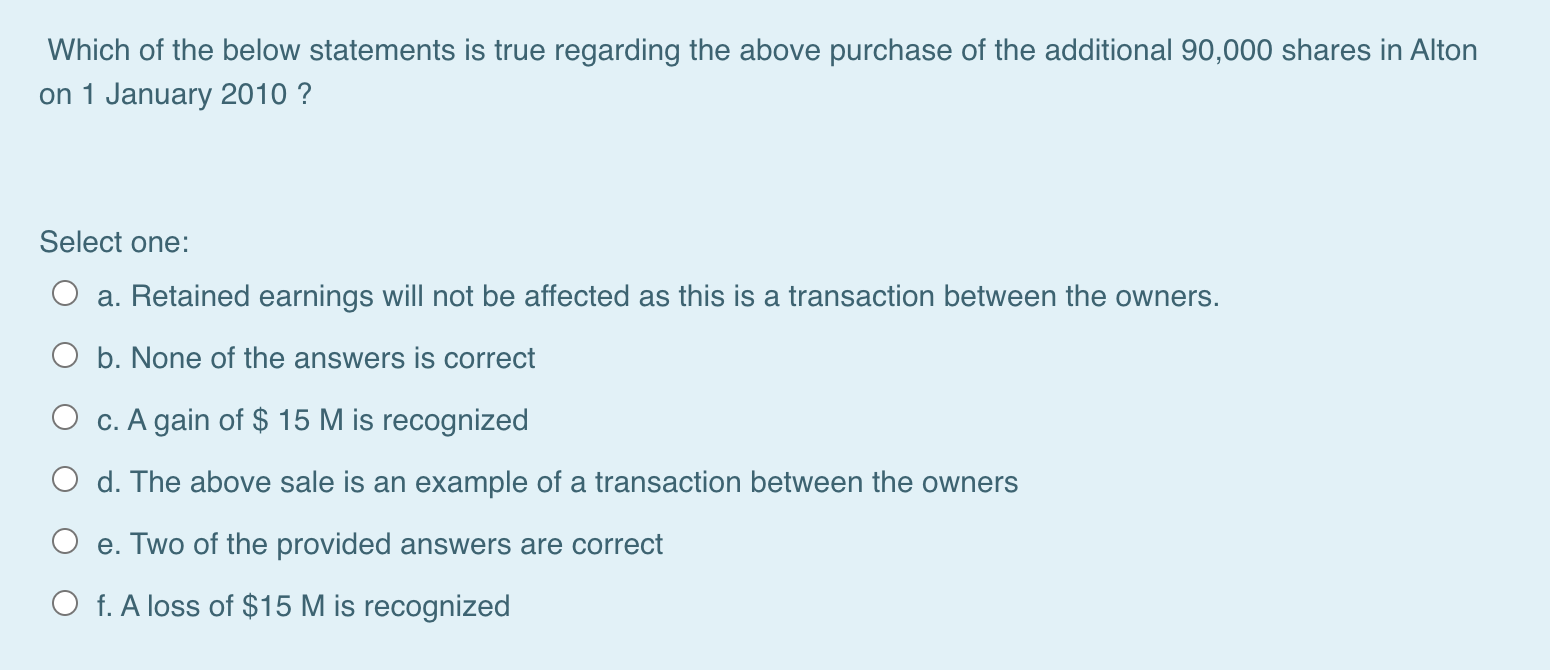

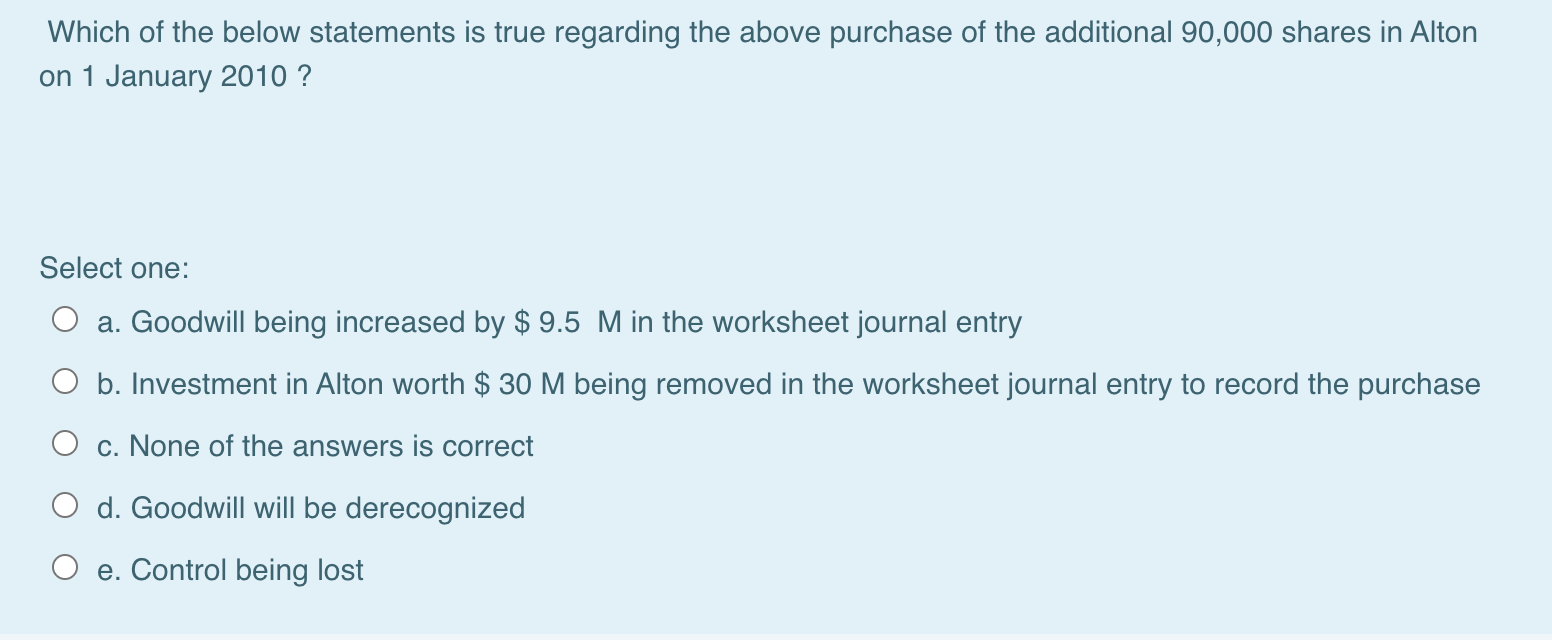

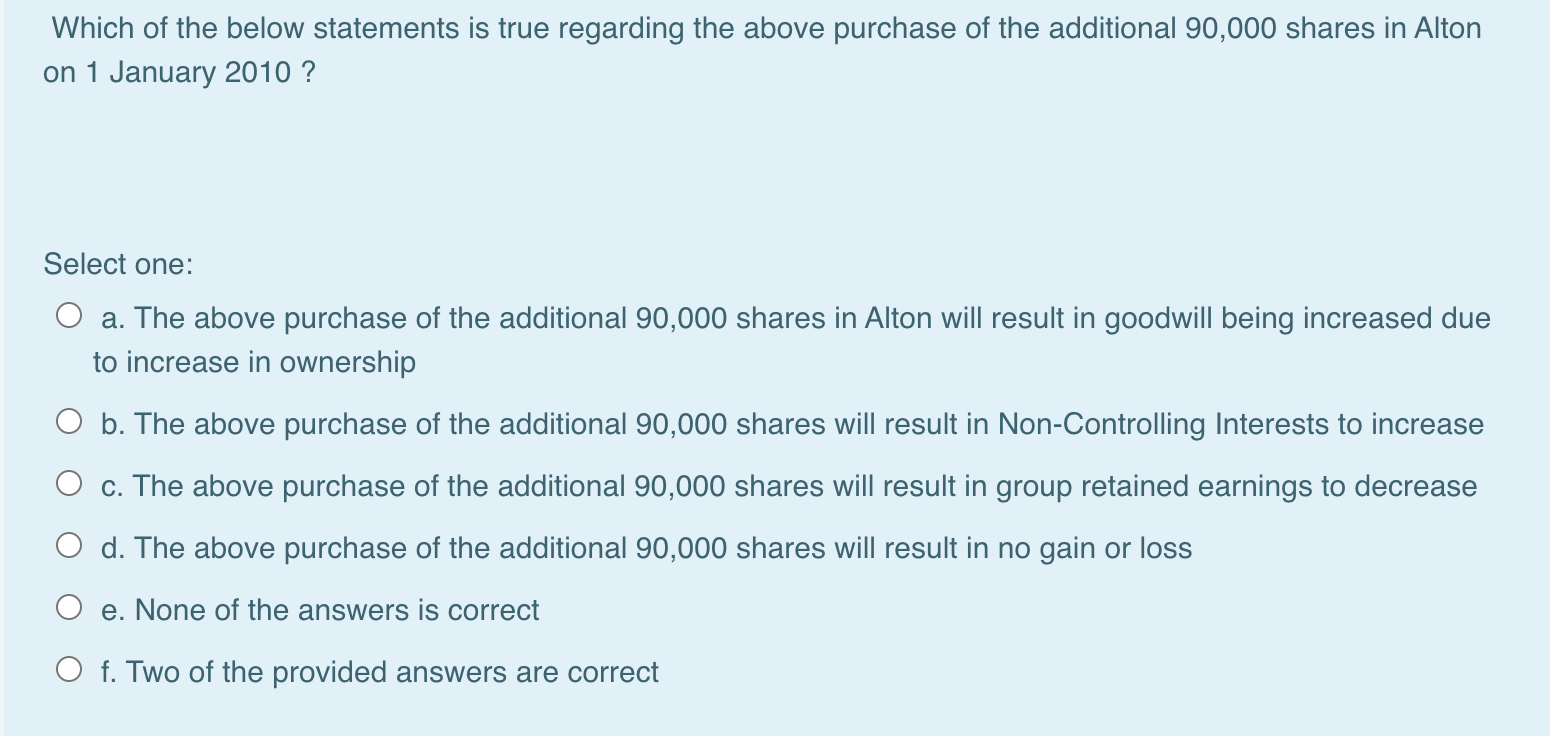

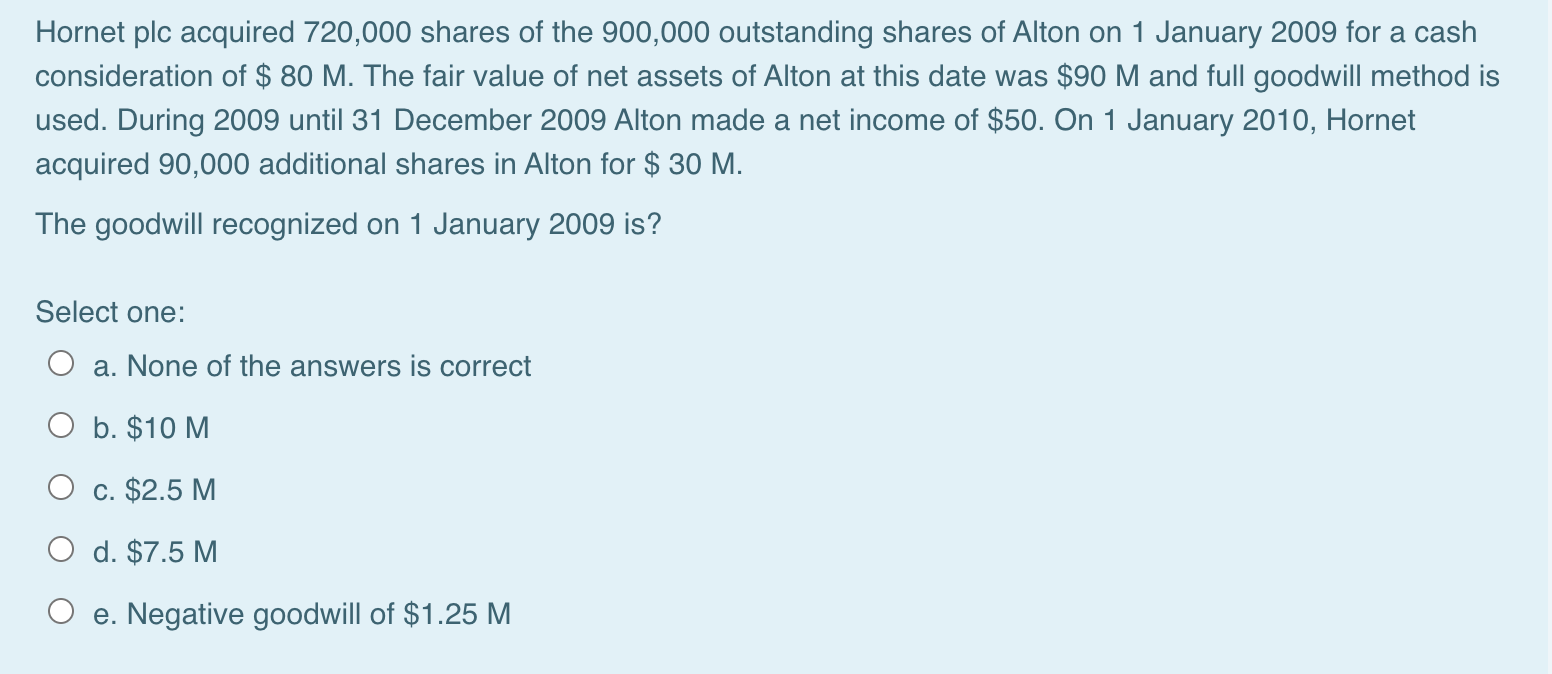

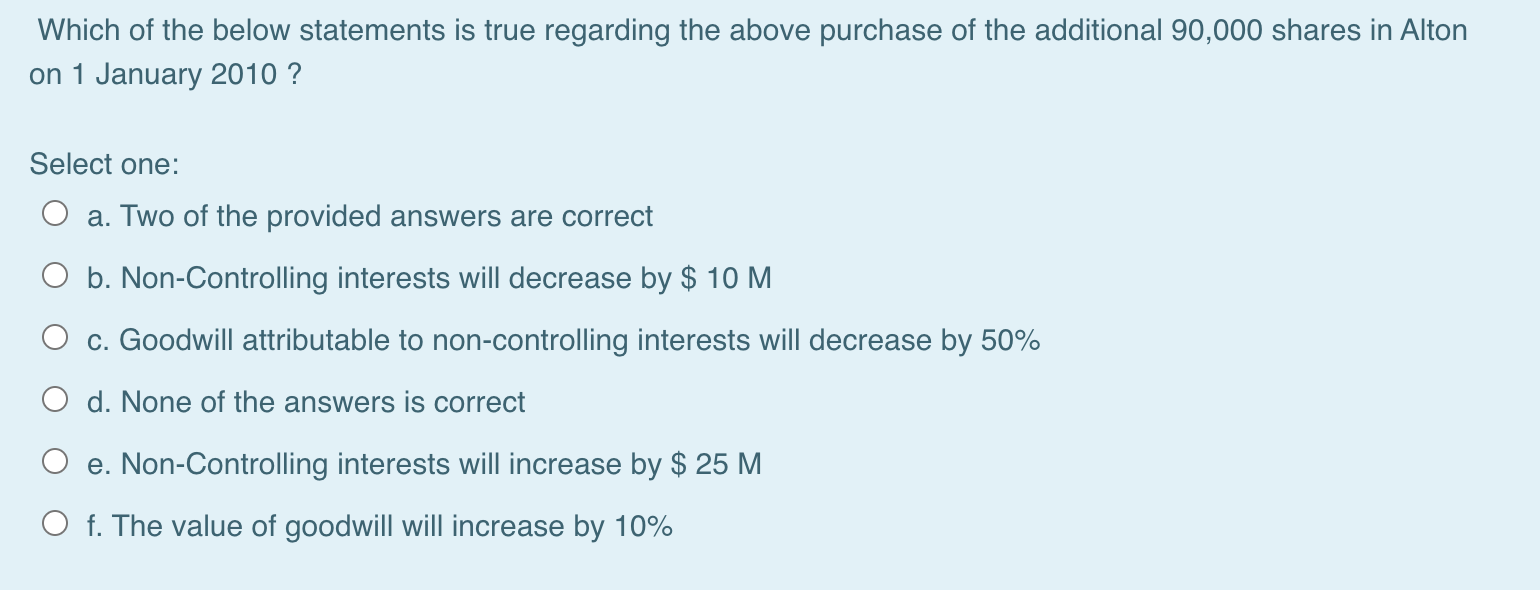

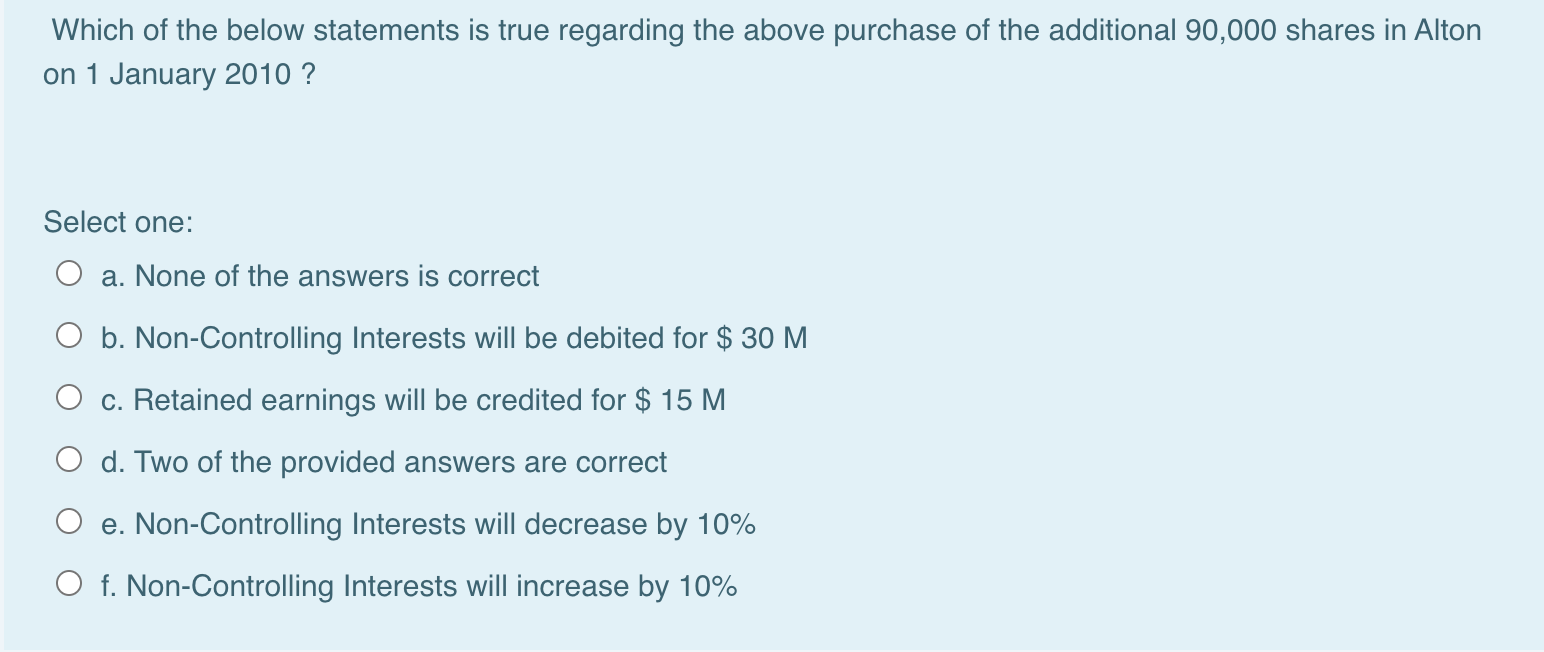

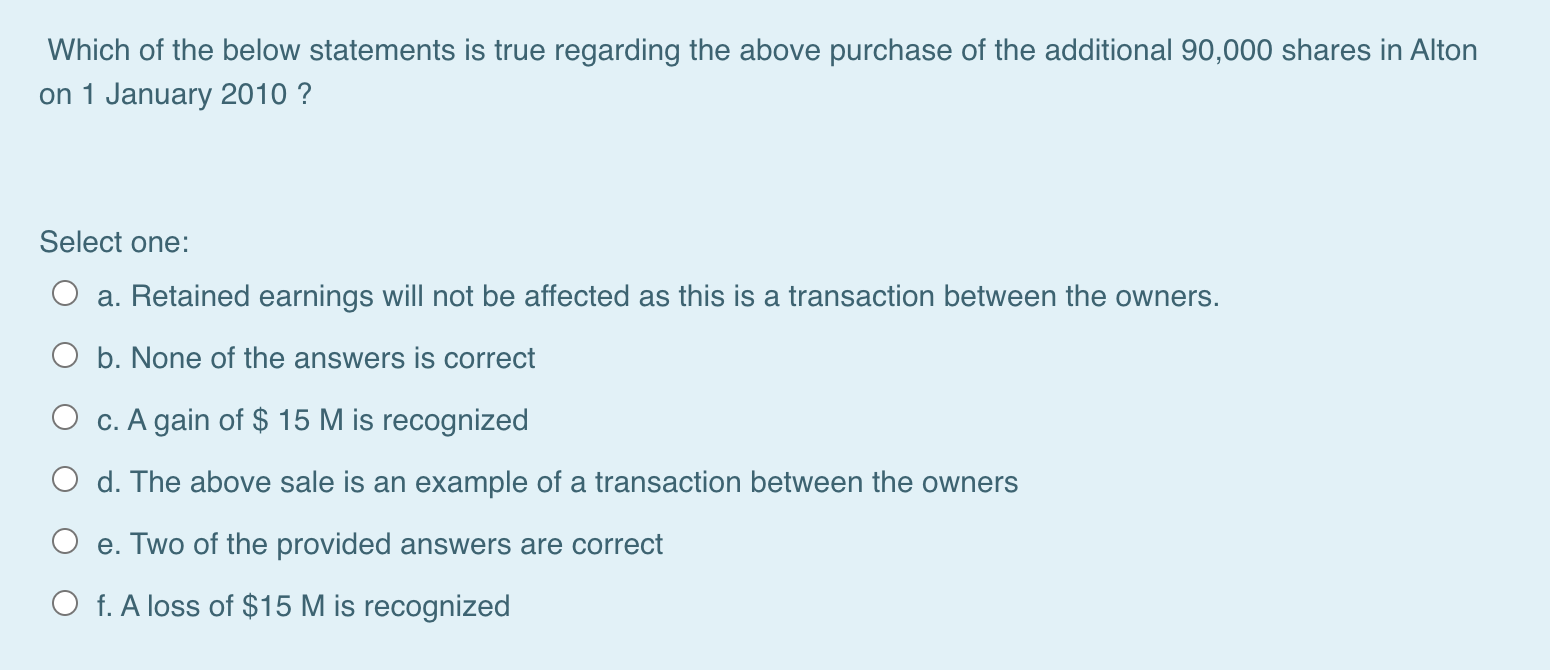

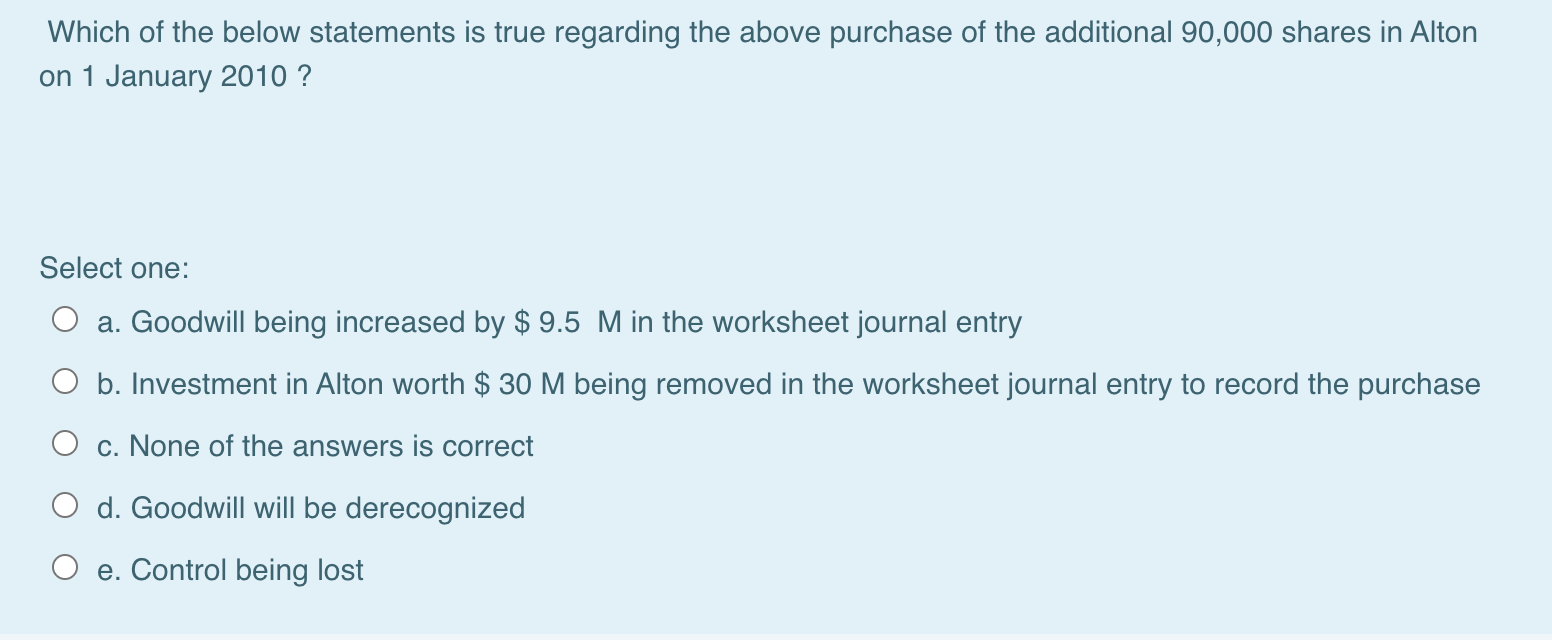

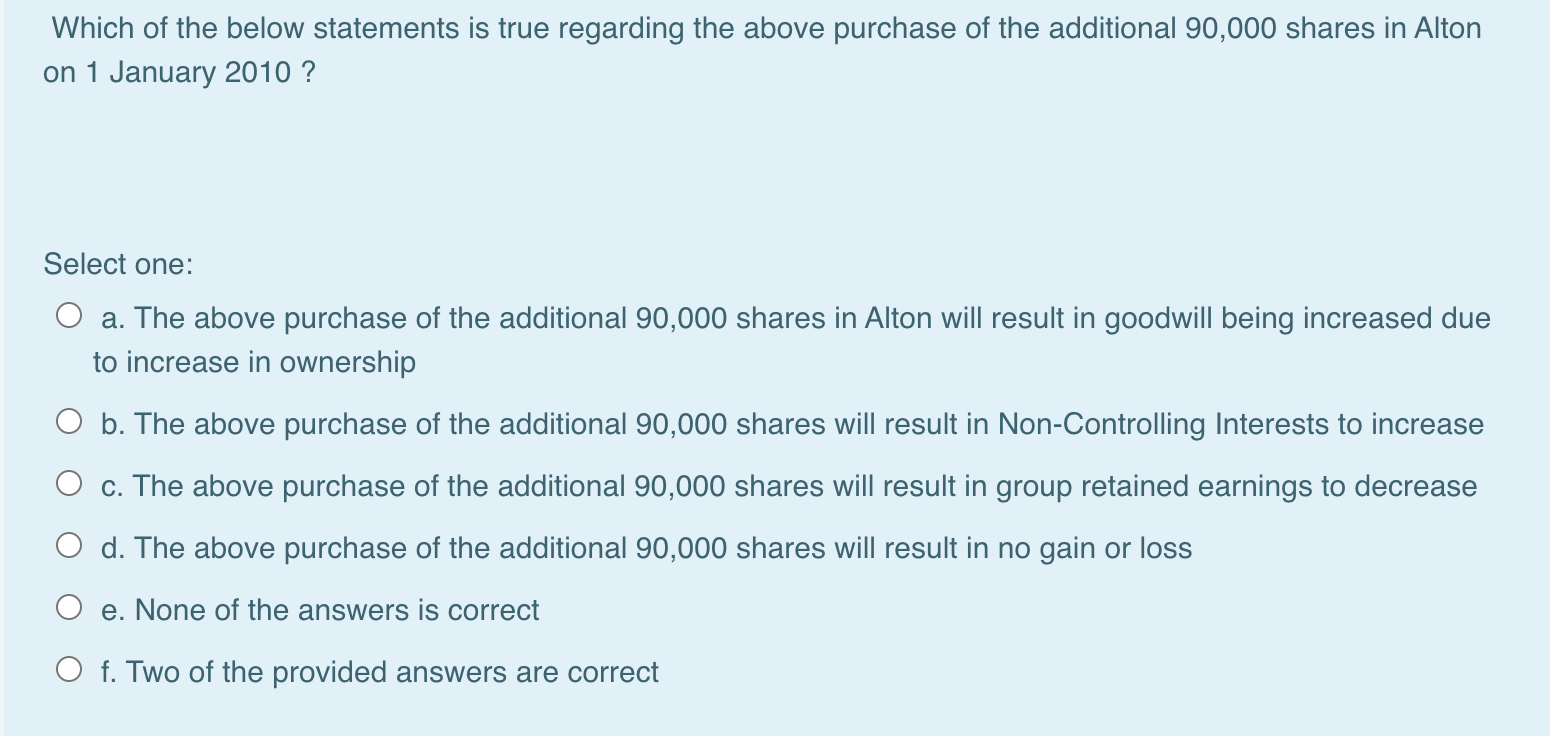

Hornet plc acquired 720,000 shares of the 900,000 outstanding shares of Alton on 1 January 2009 for a cash consideration of $ 80 M. The fair value of net assets of Alton at this date was $90 M and full goodwill method is used. During 2009 until 31 December 2009 Alton made a net income of $50. On 1 January 2010, Hornet acquired 90,000 additional shares in Alton for $ 30 M. The goodwill recognized on 1 January 2009 is? Select one: O a. None of the answers is correct O b. $10 M O c. $2.5 M O d. $7.5 M O e. Negative goodwill of $1.25 M Which of the below statements is true regarding the above purchase of the additional 90,000 shares in Alton on 1 January 2010 ? Select one: a. Two of the provided answers are correct O b. Non-Controlling interests will decrease by $ 10 M c. Goodwill attributable to non-controlling interests will decrease by 50% O d. None of the answers is correct O e. Non-Controlling interests will increase by $ 25 M O f. The value of goodwill will increase by 10% Which of the below statements is true regarding the above purchase of the additional 90,000 shares in Alton on 1 January 2010 ? Select one: a. None of the answers is correct O b. Non-Controlling Interests will be debited for $ 30 M O c. Retained earnings will be credited for $ 15 M O d. Two of the provided answers are correct O e. Non-Controlling Interests will decrease by 10% O f. Non-Controlling Interests will increase by 10% Which of the below statements is true regarding the above purchase of the additional 90,000 shares in Alton on 1 January 2010 ? Select one: O a. Retained earnings will not be affected as this is a transaction between the owners. O b. None of the answers is correct O c. A gain of $ 15 M is recognized O d. The above sale is an example of a transaction between the owners e. Two of the provided answers are correct O f. A loss of $15 M is recognized Which of the below statements is true regarding the above purchase of the additional 90,000 shares in Alton on 1 January 2010 ? Select one: a. Goodwill being increased by $ 9.5 M in the worksheet journal entry O b. Investment in Alton worth $ 30 M being removed in the worksheet journal entry to record the purchase O c. None of the answers is correct O d. Goodwill will be derecognized e. Control being lost Which of the below statements is true regarding the above purchase of the additional 90,000 shares in Alton on 1 January 2010 ? Select one: O a. The above purchase of the additional 90,000 shares in Alton will result in goodwill being increased due to increase in ownership O b. The above purchase of the additional 90,000 shares will result in Non-Controlling Interests to increase O c. The above purchase of the additional 90,000 shares will result in group retained earnings to decrease O d. The above purchase of the additional 90,000 shares will result in no gain or loss O e. None of the answers is correct O f. Two of the provided answers are correct