Answered step by step

Verified Expert Solution

Question

1 Approved Answer

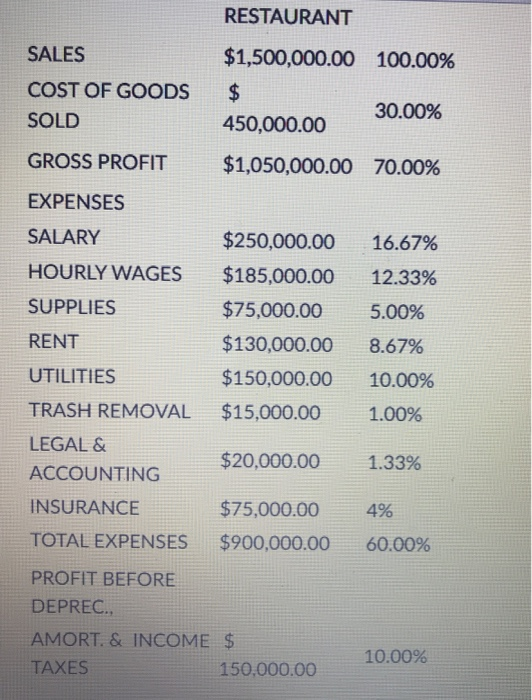

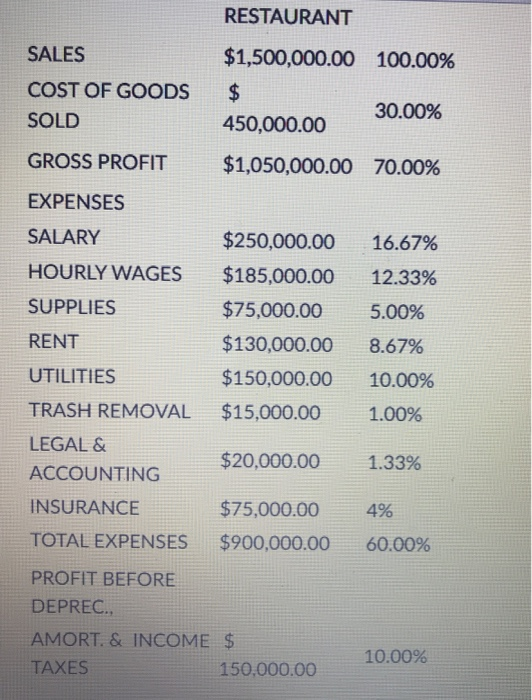

Hospitality Cost Accounting question Sorry! question already answered! thanks! RESTAURANT SALES COST OF GOODS SOLD $1,500,000.00 100.00% $ 30.00% 450,000.00 GROSS PROFIT $1,050,000.00 70.00% EXPENSES

Hospitality Cost Accounting question

Sorry! question already answered! thanks!

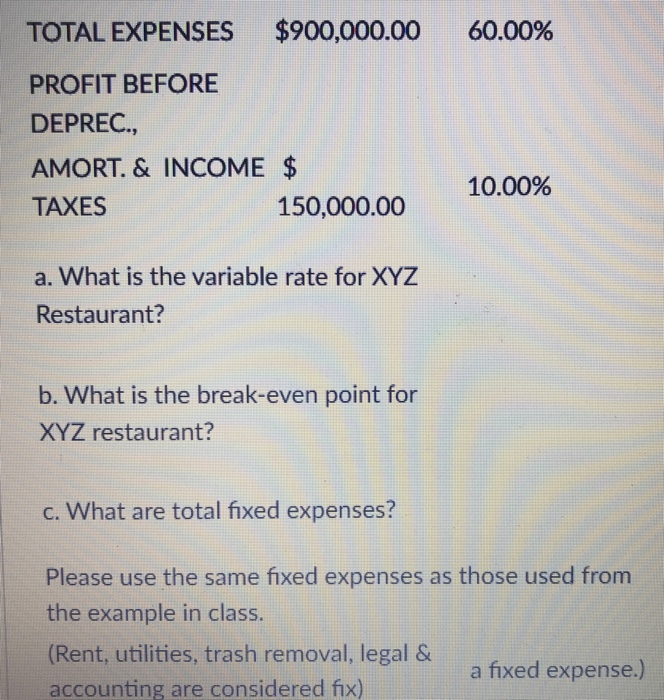

RESTAURANT SALES COST OF GOODS SOLD $1,500,000.00 100.00% $ 30.00% 450,000.00 GROSS PROFIT $1,050,000.00 70.00% EXPENSES SALARY 16.67% HOURLY WAGES 12.33% SUPPLIES 5.00% $250,000.00 $185,000.00 $75,000.00 $130,000.00 $150,000.00 $15,000.00 RENT 8.67% UTILITIES 10.00% TRASH REMOVAL 1.00% LEGAL & ACCOUNTING $20,000.00 1.33% 4% INSURANCE TOTAL EXPENSES $75,000.00 $900,000.00 60.00% PROFIT BEFORE DEPREC.. AMORT. & INCOME $ TAXES 150,000.00 10.00% TOTAL EXPENSES $900,000.00 60.00% PROFIT BEFORE DEPREC., AMORT. & INCOME $ TAXES 150,000.00 10.00% a. What is the variable rate for XYZ Restaurant? b. What is the break-even point for XYZ restaurant? c. What are total fixed expenses? Please use the same fixed expenses as those used from the example in class. (Rent, utilities, trash removal, legal & a fixed expense.) accounting are considered fix) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started