Answered step by step

Verified Expert Solution

Question

1 Approved Answer

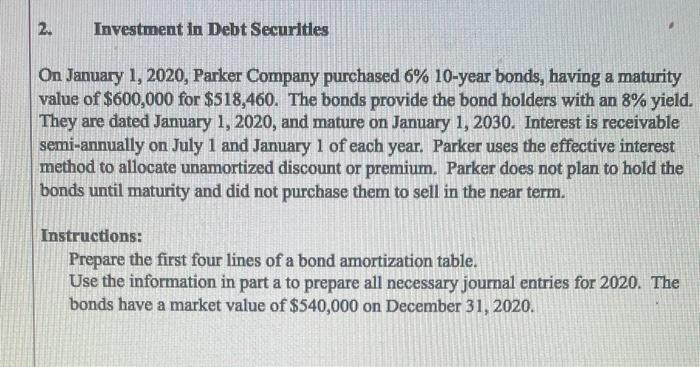

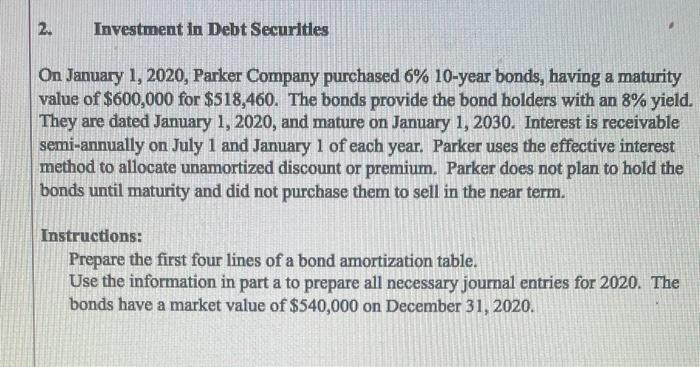

please show all work 2. Investment in Debt Securities On January 1, 2020, Parker Company purchased 6% 10-year bonds, having a maturity value of $600,000

please show all work

2. Investment in Debt Securities On January 1, 2020, Parker Company purchased 6\% 10-year bonds, having a maturity value of $600,000 for $518,460. The bonds provide the bond holders with an 8% yield. They are dated January 1, 2020, and mature on January 1, 2030. Interest is receivable semi-annually on July 1 and January 1 of each year. Parker uses the effective interest method to allocate unamortized discount or premium. Parker does not plan to hold the bonds until maturity and did not purchase them to sell in the near term. Instructions: Prepare the first four lines of a bond amortization table. Use the information in part a to prepare all necessary journal entries for 2020. The bonds have a market value of $540,000 on December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started