Question

Hospitality Products, Inc. (HPI) is a manufacturer of cosmetic soap products with plants located throughout North America and customers worldwide. There is no doubt that

Hospitality Products, Inc. (HPI) is a manufacturer of cosmetic soap products with plants located throughout North America and customers worldwide. There is no doubt that the need to continue to grow sales is an important corporate objective and one which we need to always have in mind, remarked Anton Lagarde, managing director. Not only is this important in terms of continuing to increase sales revenue overall but it is an essential part of our commitment for next years budget. Resisting group pressure and allowing ourselves this time to test the market for other new segments has brought some order into this phase of our development. The segment penetration achieved so far and the opportunity to build on this most successful initiative augers well for the future. Thank you, George, for a comprehensive summary of the market result to date concluded Anton. It seems as though this initiative is one which will help us meet out short and longer-term objectives. Anton Laragdes summary concerned a strategy overview provided by George Martin, marketing director of the company.

MARKETING STRATEGY

During the past ten years, HPI has successfully developed a line of soap products in small packages that it has marketed to large hotel chains. The hotels place the small hand soap items and shampoos and conditioners in hotel rooms for the convenience of their guests. HPI has introduced a product that is attractive to these hotels because of HPIs careful choice of fragrances and attractive packaging. These products, with the hotels name embossed on them, are a strong positive statement about the quality of the hotels service. HPI has achieved a strong market position in the industry by taking a high-end approach to its product, an approach which has served it well in recent years. The company concentrated its efforts in selling to the top twenty hotel chains in North America. By limiting its marketing efforts to a relatively few, very large multi-outlet chains (which have centralized purchasing groups), the company achieved low marketing and selling costs but high market penetration. Last year the company reached a market share of 65% in the large hotel chain market and, in turn, relatively large customer order sizes. Two market segments are evident in the large hotel chain market. In the first (called the value-added segment) customers buy the companys product primarily because of its advantage in fragrance and attractiveness of the product. Frequently, the hotel operations personnel in this segment are active in making the buying decision. The second segment is referred to as being price sensitive as the customers purchase these products primarily on the basis of price. For these customers, purchasing managers are the key decision-makers in the buying decision.

RECENT COMPETITION

HPIs success in the hotel chain market has attracted an increasing number of competitors into the market. While the company had been very successful in bringing out a series of new product types with innovative packaging, new fragrances and other features (moisturizing lotion content) for the hotels, the competitors have eventually been able to develop quite similar products. The result has been increased competition with a substantial reduction in HPIs prices (dropping 26% last year), and a major decline in the firms profit margin. The size of the price sensitive segment is growing rapidly while the value-added market segment is shrinking in size. The company faces an increasingly competitive market situation characterized by significant excess producer capacity.

WHOLESALE MARKET INITIATIVE

As a result of the increased competition in the hotel chain market, George has proposed to begin to a focus on the small independent hotels, motels, and B&Bs (Bed and Breakfast Inns) that purchase the soap products from large wholesale distributors. The potential sales for this wholesaler segment is about the same size as the hotel chain market (20 billion room-sets per year versus 25 billion room-sets per year). A room-set is a packet of soap, shampoo, and conditioner. While customers usually order the same quantity of soap, shampoo, and conditioner, some buy only one or two of these products. Therefore, HFI sells the soap, shampoo, and conditioner separately, in 24-unit cases. The Wholesale segment includes a much larger number of independent customers. At this time less than 15% of the soap room-sets sold in the wholesale market are of the quality of HPIs product. The independent hotels differ from the large hotel chains in that they purchase their hotel soap room-sets from wholesalers and distributors. Compared to the hotel chains, there are many more independent hotels widely dispersed over a large geographical area. The pilot marketing studies run last year by HPI indicate that the customer order sizes for the wholesaler segment tend to be relatively small, and that the number of different product variations (in terms for example of fragrance, packaging, and size ) tend to be relatively large in comparison with the large hotel chain market. These studies also indicate that prices (and corresponding profit margins) are much higher than in the price-sensitive segment currently served by the company. Chapter 08 - Cost Estimation Blocher, Stout, Juras, Smith: Cost Management 8/e 8-5 Copyright 2018 McGraw-Hill Education. All rights reserved. No reproduction or distribution without the prior written consent of McGraw-Hill Education.

MANUFACTURING

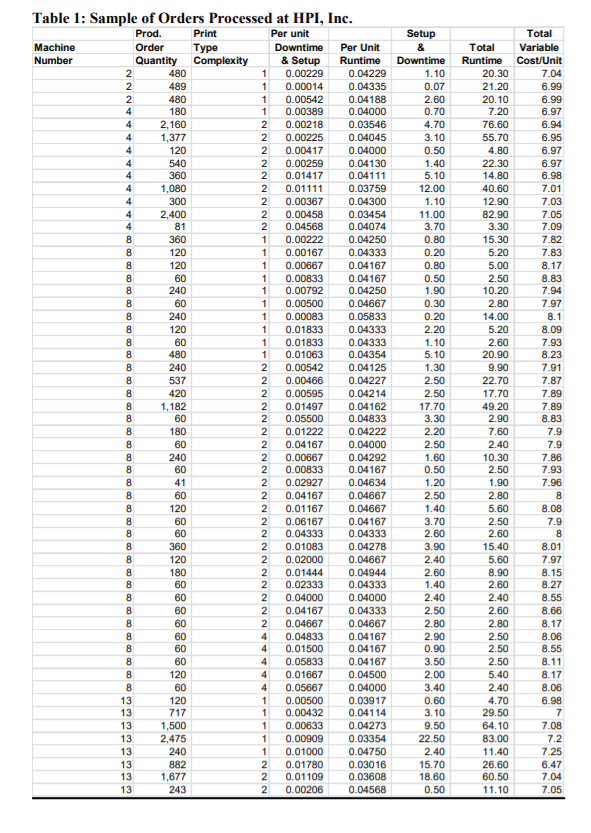

To support domestic and export sales, the company has located a number of plants throughout North America to best support the geographical spread of its various customers. In the early years, explained Michelle Ray, manufacturing director, capacity had, by necessity, always chased demand. The rapid growth in sales during the past few years and the need to make major decisions concerning new plant locations and process investments had understandably contributed to this capacity following the demand situation. However, with sales starting to level off this problem of capacity has now corrected itself. Investments in manufacturing had been to support two principal objectives; to increase capacity and to reduce costs. The cost reduction initiatives principally concerned material costs and reduced processing times. Current initiatives explained Michelle are continuing these themes. Our capacity uplifts will take the form of equipment similar to our existing machines. Over the years we have deliberately chosen to invest in machines that are similar to existing equipment in order to capitalize on the fact that the process is relatively simple and that products can, with relatively few exceptions, be processed on any machine in the plant. In order to make best use of total capacity at all sites, customer orders are collated at the head office site in Cleveland. They are then allocated to plants to take account of current plant loading, available capacity, customer lead times, and transport distances between the plant and a customers required delivery location. As a result, forward loading on a plant is only two or, at most three days ahead. Plants then schedule these orders into their production processes in order to meet customer call-offs and individual equipment loading rules. Once the order details are agreed with a customer, the order is scheduled for the targeted plant. Table 1 provides an actual schedule of orders for the hand soap product at the Lexington, KY plant.

CONCLUDING REMARKS

In reviewing the proposed marketing initiatives regarding the wholesaler market, Anton Lagarde, commented, Since sales in our traditional markets are leveling off, the new marketing initiative appears to be an important step in giving us a fresh impetus to sales volume growth. We have now reached a point in our company where we do not have to endure capacity shortage problems. In fact, with the drop in sales last year, the company currently has excess capacity with which to pursue the wholesaler market. So, our main concern is to improve the decline in the profit performance that has occurred during the past year, and the new marketing initiatives should help to re the profit margins and hence to secure this necessary, overall improvement.

REQUIRED

1. Discuss briefly HPIs competitive position and strategy.

2. What are the implications of the marketing and manufacturing initiatives for future costs and profits of HPI?

3. Using the data in Table 1 Below, explain how you would use appropriate methods of analysis such as regression analysis or correlation analysis to analyze the effect of order size and product variety on the productivity and cost structure of the Lexington plant.

1 2 1 1 1 1 1 1 Table 1: Sample of Orders Processed at HPI, Inc. Prod. Print Per unit Machine Order Type Downtime Per Unit Number Quantity Complexity & Setup Runtime 2 480 1 0.00229 0.04229 2 489 1 0.00014 0.04335 2 480 0.00542 0.04188 4 180 0.00389 0.04000 4 2,160 0.00218 0.03546 4 1,377 2 0.00225 0.04045 4 120 2 0.00417 0.04000 4 540 2 0.00259 0.04130 360 2 0.01417 0.04111 4 1,080 2 0.01111 0.03759 4 300 2 0.00367 0.04300 4 2,400 2 0.00458 0.03454 4 81 2 0.04568 0.04074 8 360 1 0.00222 0.04250 8 120 0.00167 0.04333 8 120 0.00667 0.04167 8 60 1 0.00833 0.04167 8 240 0.00792 0.04250 8 60 1 0.00500 0.04667 8 240 0.00083 0.05833 8 120 0.01833 0.04333 8 60 1 0.01833 0.04333 8 480 0.01063 0.04354 8 240 2 0.00542 0.04125 8 537 2 0.00466 0.04227 8 420 2 0.00595 0.04214 8 1,182 2 0.01497 0.04162 8 60 2 0.05500 0.04833 8 180 2 0.01222 0.04222 8 60 2 0.04167 0.04000 8 240 2 0.00667 0.04292 8 60 0.00833 0.04167 8 41 0.02927 0.04634 8 60 0.04167 0.04667 8 120 0.01167 0.04667 8 60 0.06167 0.04167 8 60 0.04333 0.04333 8 360 0.01083 0.04278 8 120 0.02000 0.04667 8 180 0.01444 0.04944 8 60 0.02333 0.04333 8 60 0.04000 0.04000 8 60 0.04167 0.04333 8 60 2 0.04667 0.04667 8 60 4 0.04833 0.04167 8 60 4 0.01500 0.04167 8 60 4 0.05833 0.04167 8 120 4 0.01667 0.04500 8 60 4 0.05667 0.04000 13 120 0.00500 0.03917 13 717 0.00432 0.04114 13 1,500 0.00633 0.04273 13 2,475 1 0.00909 0.03354 13 240 1 0.01000 0.04750 13 882 2 0.01780 0.03016 13 1,677 2 0.01109 0.03608 13 243 2 0.00206 0.04568 Setup & Downtime 1.10 0.07 2.60 0.70 4.70 3.10 0.50 1.40 5.10 12.00 1.10 11.00 3.70 0.80 0.20 0.80 0.50 1.90 0.30 0.20 2.20 1.10 5.10 1.30 2.50 2.50 17.70 3.30 2.20 2.50 1.60 0.50 1.20 2.50 1.40 3.70 2.60 3.90 2.40 2.60 1.40 2.40 2.50 2.80 2.90 0.90 3.50 2.00 3.40 0.60 3.10 9.50 22.50 2.40 15.70 18.60 0.50 Total Runtime 20.30 21.20 20.10 7.20 76.60 55.70 4.80 22.30 14.80 40.60 12.90 82.90 3.30 15.30 5.20 5.00 2.50 10.20 2.80 14.00 5.20 2.60 20.90 9.90 22.70 17.70 49.20 2.90 7.60 2.40 10.30 2.50 1.90 2.80 5.60 2.50 2.60 15.40 5.60 8.90 2.60 2.40 2.60 2.80 2.50 2.50 2.50 5.40 2.40 4.70 29.50 64.10 83.00 11.40 26.60 60.50 11.10 Total Variable Cost/Unit 7.04 6.99 6.99 6.97 6.94 6.95 6.97 6.97 6.98 7.01 7.03 7.05 7.09 7.82 7.83 8.17 8.83 7.94 7.97 8.1 8.09 7.93 8.23 7.91 7.87 7.89 7.89 8.83 7.9 7.9 7.86 7.93 7.96 8 8.08 7.9 8 8.01 7.97 8.15 8.27 8.55 8.66 8.17 8.06 8.55 8.11 8.17 8.06 6.98 7 7.08 7.2 7.25 6.47 7.04 7.05 NNNNNNNNNNNNNN 1 1 1 1 2 1 1 1 1 1 1 Table 1: Sample of Orders Processed at HPI, Inc. Prod. Print Per unit Machine Order Type Downtime Per Unit Number Quantity Complexity & Setup Runtime 2 480 1 0.00229 0.04229 2 489 1 0.00014 0.04335 2 480 0.00542 0.04188 4 180 0.00389 0.04000 4 2,160 0.00218 0.03546 4 1,377 2 0.00225 0.04045 4 120 2 0.00417 0.04000 4 540 2 0.00259 0.04130 360 2 0.01417 0.04111 4 1,080 2 0.01111 0.03759 4 300 2 0.00367 0.04300 4 2,400 2 0.00458 0.03454 4 81 2 0.04568 0.04074 8 360 1 0.00222 0.04250 8 120 0.00167 0.04333 8 120 0.00667 0.04167 8 60 1 0.00833 0.04167 8 240 0.00792 0.04250 8 60 1 0.00500 0.04667 8 240 0.00083 0.05833 8 120 0.01833 0.04333 8 60 1 0.01833 0.04333 8 480 0.01063 0.04354 8 240 2 0.00542 0.04125 8 537 2 0.00466 0.04227 8 420 2 0.00595 0.04214 8 1,182 2 0.01497 0.04162 8 60 2 0.05500 0.04833 8 180 2 0.01222 0.04222 8 60 2 0.04167 0.04000 8 240 2 0.00667 0.04292 8 60 0.00833 0.04167 8 41 0.02927 0.04634 8 60 0.04167 0.04667 8 120 0.01167 0.04667 8 60 0.06167 0.04167 8 60 0.04333 0.04333 8 360 0.01083 0.04278 8 120 0.02000 0.04667 8 180 0.01444 0.04944 8 60 0.02333 0.04333 8 60 0.04000 0.04000 8 60 0.04167 0.04333 8 60 2 0.04667 0.04667 8 60 4 0.04833 0.04167 8 60 4 0.01500 0.04167 8 60 4 0.05833 0.04167 8 120 4 0.01667 0.04500 8 60 4 0.05667 0.04000 13 120 0.00500 0.03917 13 717 0.00432 0.04114 13 1,500 0.00633 0.04273 13 2,475 1 0.00909 0.03354 13 240 1 0.01000 0.04750 13 882 2 0.01780 0.03016 13 1,677 2 0.01109 0.03608 13 243 2 0.00206 0.04568 Setup & Downtime 1.10 0.07 2.60 0.70 4.70 3.10 0.50 1.40 5.10 12.00 1.10 11.00 3.70 0.80 0.20 0.80 0.50 1.90 0.30 0.20 2.20 1.10 5.10 1.30 2.50 2.50 17.70 3.30 2.20 2.50 1.60 0.50 1.20 2.50 1.40 3.70 2.60 3.90 2.40 2.60 1.40 2.40 2.50 2.80 2.90 0.90 3.50 2.00 3.40 0.60 3.10 9.50 22.50 2.40 15.70 18.60 0.50 Total Runtime 20.30 21.20 20.10 7.20 76.60 55.70 4.80 22.30 14.80 40.60 12.90 82.90 3.30 15.30 5.20 5.00 2.50 10.20 2.80 14.00 5.20 2.60 20.90 9.90 22.70 17.70 49.20 2.90 7.60 2.40 10.30 2.50 1.90 2.80 5.60 2.50 2.60 15.40 5.60 8.90 2.60 2.40 2.60 2.80 2.50 2.50 2.50 5.40 2.40 4.70 29.50 64.10 83.00 11.40 26.60 60.50 11.10 Total Variable Cost/Unit 7.04 6.99 6.99 6.97 6.94 6.95 6.97 6.97 6.98 7.01 7.03 7.05 7.09 7.82 7.83 8.17 8.83 7.94 7.97 8.1 8.09 7.93 8.23 7.91 7.87 7.89 7.89 8.83 7.9 7.9 7.86 7.93 7.96 8 8.08 7.9 8 8.01 7.97 8.15 8.27 8.55 8.66 8.17 8.06 8.55 8.11 8.17 8.06 6.98 7 7.08 7.2 7.25 6.47 7.04 7.05 NNNNNNNNNNNNNN 1 1 1

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started