Question

Housing-maker Ltd is a property developer. It acquired a land use right from the government in January 2017 and developed an office building on the

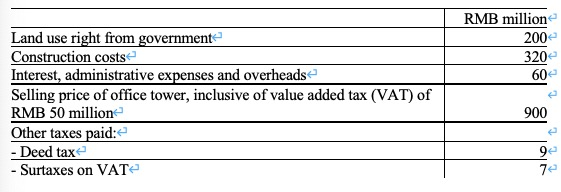

Housing-maker Ltd is a property developer. It acquired a land use right from the government in January 2017 and developed an office building on the land which was completed in January 2018. Housing-maker Ltd sold the office building to P-buy Ltd in January 2018. The following information, relating to the office building, is taken from the records of Housing-maker Ltd:

P-buy Ltd purchased the office building for RMB850 million exclusive of VAT and paid deed tax of RMB32million. It financed part of this purchase by taking out a one-year loan of RMB 700 million with a financial institution on 1 January 2018 at an interest rate of 10% per year. However, P-buy Ltd could not pay the loan by the due date and as a result , on 1 January 2019, the financial institution took over the office building as payment of the loan and interest. The office building revalue, after discount, was RMB890 million. P-buy Ltd paid VAT of RMB 90 million and surtaxes on VAT of RMB 12 million. The office building qualifies as 'used property' for land appreciation tax purposes.

Requirement: (a) Calculate the land appreciation tax (LAT) payable by Housing-maker Ltd on the sale of the office building in January 2018. (6 points)

(b) Calculate the LAT payable by P-buy on transfer of the office building to the financial institution on 1 January 2019. (4 points)

RMB million 200 320 60 Land use right from government Construction costs Interest, administrative expenses and overheads Selling price of office tower, inclusive of value added tax (VAT) of RMB 50 million Other taxes paid: - Deed tax - Surtaxes on VAT 900 9 72 RMB million 200 320 60 Land use right from government Construction costs Interest, administrative expenses and overheads Selling price of office tower, inclusive of value added tax (VAT) of RMB 50 million Other taxes paid: - Deed tax - Surtaxes on VAT 900 9 72Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started