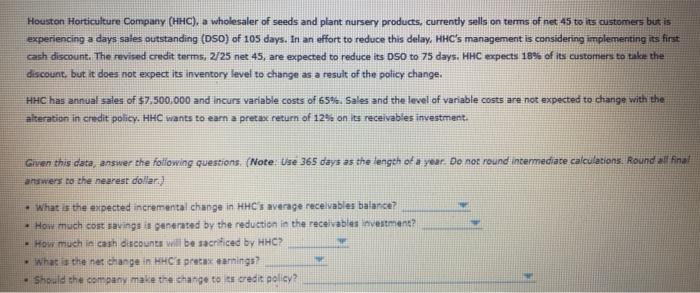

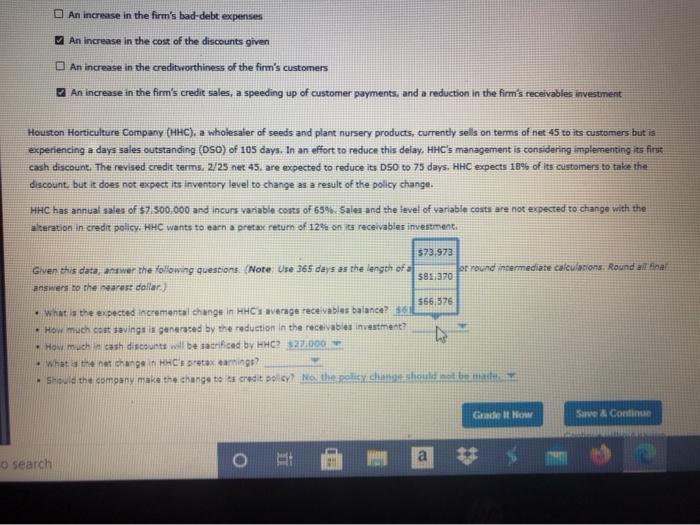

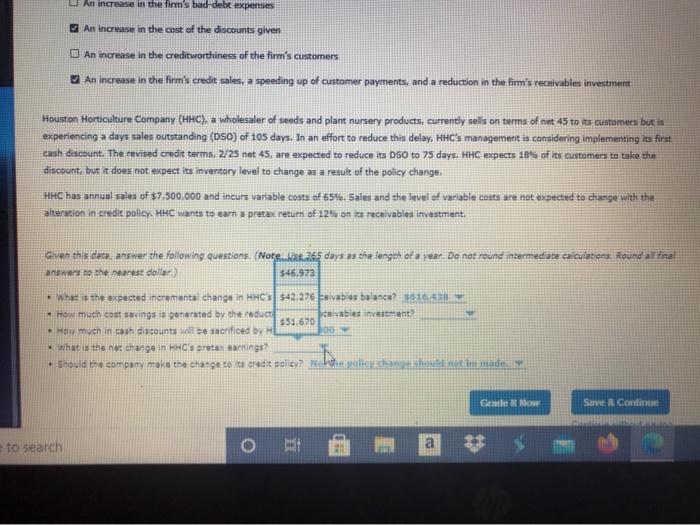

Houston Horticulture Company (HHC), a wholesaler of seeds and plant nursery products, currently sells on terms of net 45 to its customers but is experiencing a days sales outstanding (DSC) of 105 days. In an effort to reduce this delay, HHC's management is considering implementing its first cash discount. The revised credit terms, 2725 net 45, are expected to reduce its DSO to 75 days. HHC expects 18% of its customers to take the discount, but it does not expect its inventory level to change as a result of the policy change. HHC has annual sales of $7.500.000 and Incurs variable costs of 65%. Sales and the level of variable costs are not expected to change with the alteration in credit policy. HHC wants to earn a pretax return of 12% on its receivables investment. Given this data, answer the following questions. (Note: Use 365 days as the length of a year. Do not round intermediate calculations. Round at final answers to the nearest dollar.) - What is the expected incremental change in HHC's average receivables balance? - How much cost savings in generated by the reduction in the receivables investment? - How much in cash discounts will be sacrificed by HHC? What the ner change HHC pretex earnings? Should the company make the change to credit policy? An increase in the firm's bad-debt expenses An increase in the cost of the discounts given An increase in the creditworthiness of the firm's customers An increase in the firm's credit sales, a speeding up of customer payments, and a reduction in the firm's receivables investment Houston Horticulture Company (AHC), a wholesaler of seeds and plant nursery products, currently sells on terms of net 45 to its customers but is experiencing a days sales outstanding (DSC) of 105 days. In an effort to reduce this delay, HHC's management is considering implementing its first cash discount. The revised credit terms, 2/25 ner 45. are expected to reduce its D50 to 75 days, HHC expects 18% of its customers to take the discount but it does not expect its inventory level to change as a result of the policy change. HHC has annual sales of $7.500.000 and Incurs vanable costs of 65% Sales and the level of variable costs are not expected to change with the alteration in credit policy, HHC wants to earn a pretase return of 12% of its receivables investment 573.973 Given this data, answer the following questions. Note Use 365 days as the length of a for round intermediate calculations. Round all snar 591370 answers to the nearest dollar) 566.576 What is the expected incremental change in HHC average receivables balance * How much cost savings is generated by the reduction in the receivables investment? - How much in cash discount will be sacrificed by HHC220,000 What the change in HHC Etxearninga? Should the company make the chance to a credit pory? Non policy chinhould Grache NM Sarve Continue o search O An increase in the firm's bad-debt expenses An increase in the cost of the discounts given An increase in the creditworthiness of the firm's customers An increase in the firm's credit sales, a speeding up of customer payments, and a reduction in the firm's receivables investment Houston Horticulture Company (HHC), a wholesaler of seeds and plant nursery products, currently sells on terms of net 45 to its customers but is experiencing a days sales outstanding (DSC) of 105 days. In an effort to reduce this delay, HHC's management is considering implementing its first cash discount. The revised credit terms. 2/25 net 45, are expected to reduce its D50 to 75 days. HHC expects 18% of its customers to take the discount, but it does not expect its inventory level to change as a result of the policy change, HHC has annual sales of $7,500,000 and ineurs variable costs of 65%. Sales and the level of variable costs are not expected to change with the alteration in credit policy. HHC wants to earn a pretax return of 125 on its receivables investment Given this case, answer the following questions. (Note. His 365 days as the length of a year. Do not round intermediate calculations Round all fina! answers to the nearese dollar $46,973 What is the expected incremental change in HCS 542276 eivables balance? +91641 How much cost savings in generated by the reduct cavables investment $51.670 How much in cash discounts will be sacrificed by M What is the ne change in His preta sainga? . Should the company make the chance to to credit policy? We made CHO Gende Same & Continue to search O BI