Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How are net receipts from an interest in timber treated? O A. Net receipts are allocated 10% to income and 90% to principal. B. Net

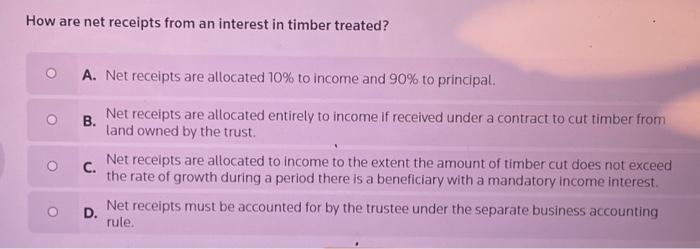

How are net receipts from an interest in timber treated? O A. Net receipts are allocated 10% to income and 90% to principal. B. Net receipts are allocated entirely to income if received under a contract to cut timber from land owned by the trust. C. Net receipts are allocated to income to the extent the amount of timber cut does not exceed the rate of growth during a period there is a beneficiary with a mandatory income interest. D. Net receipts must be accounted for by the trustee under the separate business accounting rule.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started