Answered step by step

Verified Expert Solution

Question

1 Approved Answer

how can i attach the excel? can you give me your mail, im not gettng an option of attaching Part 1 (50 pts) Construct a

how can i attach the excel?

can you give me your mail, im not gettng an option of attaching

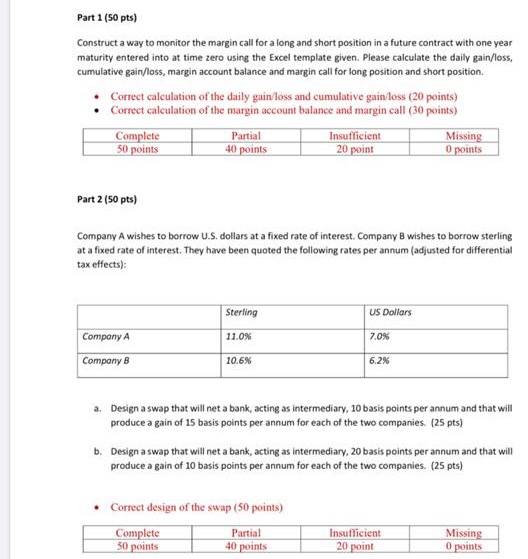

Part 1 (50 pts) Construct a way to monitor the margin call for a long and short position in a future contract with one year maturity entered into at time zero using the Excel template given. Please calculate the daily gain/loss, cumulative gain/loss, margin account balance and margin call for long position and short position Correct calculation of the daily gain/loss and cumulative gain/loss (20 points) Correct calculation of the margin account balance and margin call (30 points) Complete Partial Insufficient Missing 50 points 40 points 20 point 0 points Part 2 (50 pts) Company A wishes to borrow U.S. dollars at a fixed rate of interest. Company B wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects): Sterling US Dollars Company A 11.0% 7.0% Company B 10.6% 6.2% a. Design a swap that will net a bank, acting as intermediary, 10 basis points per annum and that will produce a gain of 15 basis points per annum for each of the two companies. (25 pts) b. Design a swap that will net a bank, acting as intermediary, 20 basis points per annum and that will produce a gain of 10 basis points per annum for each of the two companies. (25 pts) Correct design of the swap (50 points) Complete 30 points 40 points Partial Insufficient 20 point Missing 0 points Part 1 (50 pts) Construct a way to monitor the margin call for a long and short position in a future contract with one year maturity entered into at time zero using the Excel template given. Please calculate the daily gain/loss, cumulative gain/loss, margin account balance and margin call for long position and short position Correct calculation of the daily gain/loss and cumulative gain/loss (20 points) Correct calculation of the margin account balance and margin call (30 points) Complete Partial Insufficient Missing 50 points 40 points 20 point 0 points Part 2 (50 pts) Company A wishes to borrow U.S. dollars at a fixed rate of interest. Company B wishes to borrow sterling at a fixed rate of interest. They have been quoted the following rates per annum (adjusted for differential tax effects): Sterling US Dollars Company A 11.0% 7.0% Company B 10.6% 6.2% a. Design a swap that will net a bank, acting as intermediary, 10 basis points per annum and that will produce a gain of 15 basis points per annum for each of the two companies. (25 pts) b. Design a swap that will net a bank, acting as intermediary, 20 basis points per annum and that will produce a gain of 10 basis points per annum for each of the two companies. (25 pts) Correct design of the swap (50 points) Complete 30 points 40 points Partial Insufficient 20 point Missing 0 points Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started