Question

How can I get those answer? I need the process to solve those problems. 1. Firm A is a US based firm with net cash

How can I get those answer? I need the process to solve those problems.

1. Firm A is a US based firm with net cash inflows of Swiss Francs and net cash inflows of Japanese Yen. Firm B is also a US firm with net cash inflows of Swiss Francs and net cash outflows of Japanese Yen. These two currencies are highly negatively correlated in their movements against the dollar. Which firm has a high exposure to exchange rate risk? Answer: Firm B

2. Firm J is a US based MNC with net cash inflows of Japanese Yen and net cash outflows of French Francs. Firm K is also a US based MNC with net cash inflows of German Marks and net cash outflows of French Francs. While Japanese Yen and French Francs are positively correlated, German Marks and French Francs are negatively correlated in their movements against the dollar. Which firm has a high exposure to exchange rate risk? Answer: Firm K

3. Assume that SF and DM are highly positively correlated. A US firm anticipates the equivalent of $1 million cash inflows in SF and the equivalent of $1 million cash inflows in DM. When the dollar _______ , the firm is _______ affected by its exposure.

A. appreciates, favorably

B. depreciates, not

C. appreciates, not

D. depreciates, favorably

E. B and C

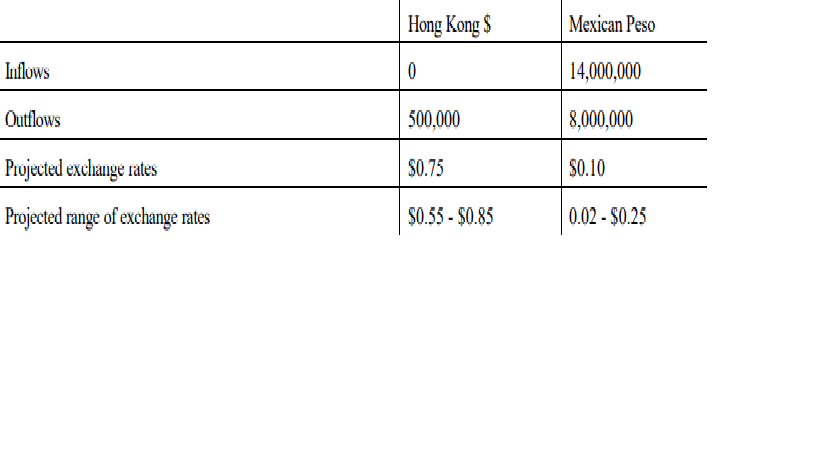

Please answer the next two questions based on the following table which projects inflows and outflows in two different currencies for Digiphone.com, a US based firm. Also given are the projected exchange rates for these currencies as well as the projected range of each exchanges rate

4. Based on the above projections, the overall net cash flow from both currencies is expected to be:

A. + $2,575,000

B. + $975,000

C. + $225,000

D. - $2,575,000

5. Based on the above projections, the range of the overall net cash flows from both currencies is expected to be:

A. from +$1,075,000 to - $155,000

B. from +$1,225,000 to - $155,000

C. from +$1,075,000 to - $305,000

D. from +$1,225,000 to - $305,000

For the next two questions assume the following: Exxon does a large part of its crude petroleum extraction and refining the UK. In both the US and UK markets it has to compete with other US and British firms.

6. Which of the following is correct if the US dollar depreciates:

A. The level of Exxon's operating costs in the UK, if those payments have to be made in US dollars, will decrease

B. The level of Exxon's operating costs in the UK, if those payments have to be made in Pounds, will increase

C. The dollar value of Exxon's sales in the UK, if exports are denominated in British Pounds will not change

D. The level of Exxon's domestic revenue will decrease

7. Which of the following is correct if the British pound depreciates:

A. The level of Exxon's operating costs in the UK, if those payments have to be made in US dollars, will increase

B. The level of Exxon's sales in the UK (denominated in US dollars) will increase

C. The dollar value of Exxon's sales in the UK, if exports are denominated in Pounds will not change

D. The level of Exxon's domestic revenue will increase

E. None of the above

8. Consider three US based MNCs. Firm X neither imports nor exports, but competes in the US chinese manufactures. Firm Y sells most of its goods in China. Firm Z outsources most of its manufacturing to firms in China but pays its bills in US dollars. If the Chinese currency appreciates against the US dollar, and everything else remains constant, then firm Xs net income will _____, firm Ys net income will _____, and firm Zs net income will ______:

A. increase, increase, increase

B. not change, increase, increase

C. increase, increase, not change

D. decrease, decrease, not change

E. not change, decrease, not change

9. Your company will receive CD1,200,000 in 90 days. The 90 day forward rate for Canadian dollars is $0.80 and the current spot rate is $0.75. If you use a forward hedge, estimate the cost of hedging the receivable if the spot rate for CD 90 days later turns out to be $0.82

A. $ 24,000

B.

C. $ 84,000

D.

10. Use the following information to calculate the number of dollars needed to cover 200,000 pounds of payables due in one year, if you use a money market hedge. Assume the spot rate of the pound is $2.02, the 1-year forward rate is $2.00, the British interest rate is 5% and the US interest rate is 4%.

A. $391,210

B. $396,190

C. $388,210

D. $400,152

E. $384,761

11. Assume that a US company will receive SF 500,000 in 360 days. Interest rates are 12% in the US and 5% in Switzerland. One-year forward rate for Swiss franc is $0.51 and the current spot rate of Swiss franc is $0.48.

If the US company uses a money market hedge, it will need to borrow _________ and invest _________.

A. $ 228,571 ; SF 476,190

B. SF 476,190 ; $ 228,571

C. $ 214,286 ; SF 446,429

D. SF 446,429 ; $ 214,286

E. SF 476,190 ; $ 242,857

12. Based on the information in the previous problem, the firm should execute a ________.

A. forward hedge

B. money market hedge

13. Suppose you are trying to set up a money market hedge to cover 1,000,000 pounds of receivables one year from now, you should:

A. Borrow pounds from a UK bank, sell the pounds for dollars at the current spot rate, invest in the dollars in a US bank.

B. Borrow dollars from a US bank, sell the pounds for dollars at the current spot rate, invest in the pounds in a UK bank.

C. Borrow dollars from a US bank, buy pounds with dollars at the current spot rate, invest in the pounds in a UK bank.

D. Borrow pounds from a UK bank, buy pounds with dollars at the current spot rate, invest in the dollars in a US bank.

14. Which of the following reflects a hedge of net receivables on British pounds by a US firm?

A. purchase a currency put option in British pounds

B. sell forward contract on pounds

C. borrow US dollars, convert them to pounds, and invest in a British pound deposit

D. A and B

E. A, B and C

15. If interest rate parity exists and transaction costs are zero, the hedging of payables with a forward hedge will:

A. have the same result as a call option hedge on payables

B. have the same result as a put option hedge on payables

C. have the same result as a money market hedge on payables

D. require more dollars than a money market hedge

16. A call option exists in British pounds with an exercise price of $1.60, a 90 day expiration date, and a premium of $.03 per unit. A put option exists on British pounds with an exercise price of $1.60, a 90 day expiration date, and a premium of $.02 per unit. You plan to purchase options to cover your future receivables of 700,000 pounds in 90 days. You will exercise the option in 90 days if at all. You expect the spot rate of the pound to be $1.57 in 90 days. Determine the amount of dollars to be received, after deducting payment for the option premium.

A. $1,169,000

B. $1,099,000

C. $1,106,000

D. $1,143,000

E. $1,134,000

Hong KongsMexican Peso Inflows Outflows Projected exchange rates Projected range of exchange rates 500,000 $0.75 $0.55-$0.85 14,000,000 8,000,000 0.10 0.02-$0.25Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started