Answered step by step

Verified Expert Solution

Question

1 Approved Answer

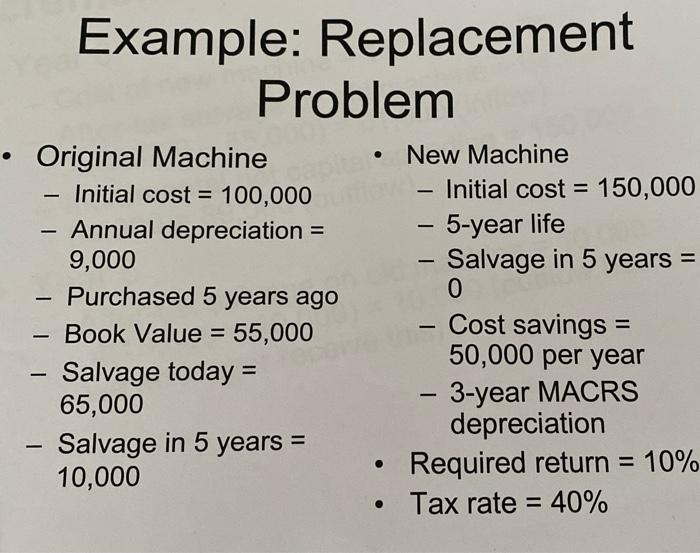

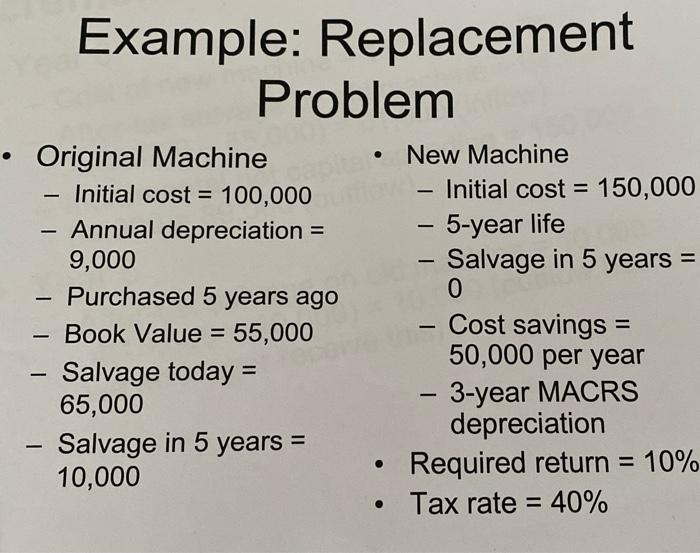

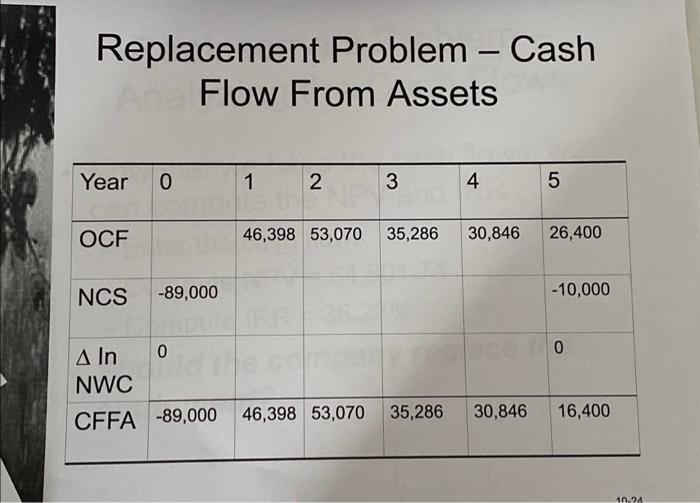

how did NCS (net capital spending) change to -10,000 in year 5? Example: Replacement Problem = - - Original Machine Initial cost = 100,000 Annual

how did NCS (net capital spending) change to -10,000 in year 5?

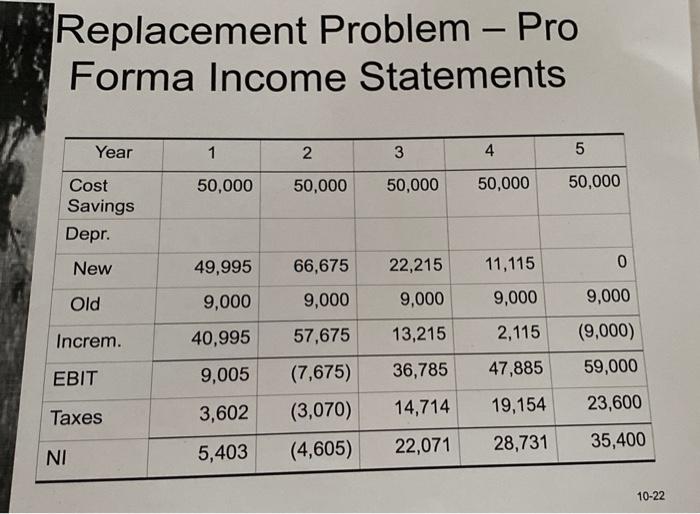

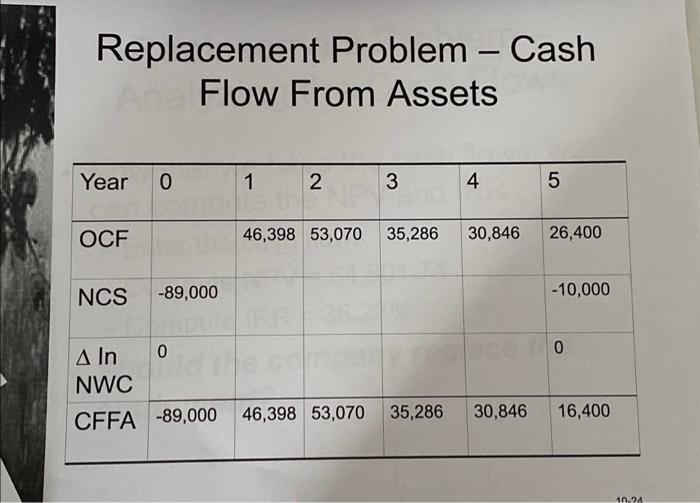

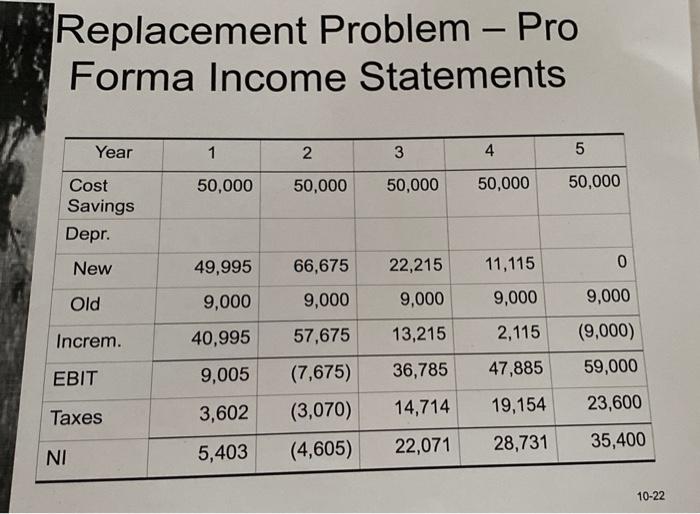

Example: Replacement Problem = - - Original Machine Initial cost = 100,000 Annual depreciation = 9,000 Purchased 5 years ago Book Value = = 55,000 Salvage today = 65,000 - Salvage in 5 years = 10,000 = New Machine - Initial cost = 150,000 - 5-year life - Salvage in 5 years = 0 Cost savings 50,000 per year - 3-year MACRS depreciation Required return = 10% Tax rate = 40% - . . Replacement Problem - Pro Forma Income Statements Year 1 2 3 4 5 50,000 50,000 50,000 50,000 50,000 Cost Savings Depr. New 49,995 66,675 22,215 11,115 0 Old 9,000 9,000 9,000 9,000 9,000 Increm. 40,995 57,675 13,215 2,115 (9,000) 9,005 EBIT (7,675) 36,785 47,885 59,000 3,602 Taxes (3,070) 14,714 19,154 23,600 (4,605) 22,071 28,731 35,400 NI 5,403 10-22 Replacement Problem - Cash Flow From Assets Year 0 1 2 3 4 5 OCF 46,398 53,070 35,286 30,846 26,400 NCS -89,000 -10,000 0 A In 0 NWC CFFA -89,000 46,398 53,070 35,286 30,846 16,400 1024

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started