Answered step by step

Verified Expert Solution

Question

1 Approved Answer

How do i calculate the *C entry for the initial valuation method? 13. On January 1, 2009, Rand Corp. issued shares of its common stock

How do i calculate the *C entry for the initial valuation method?

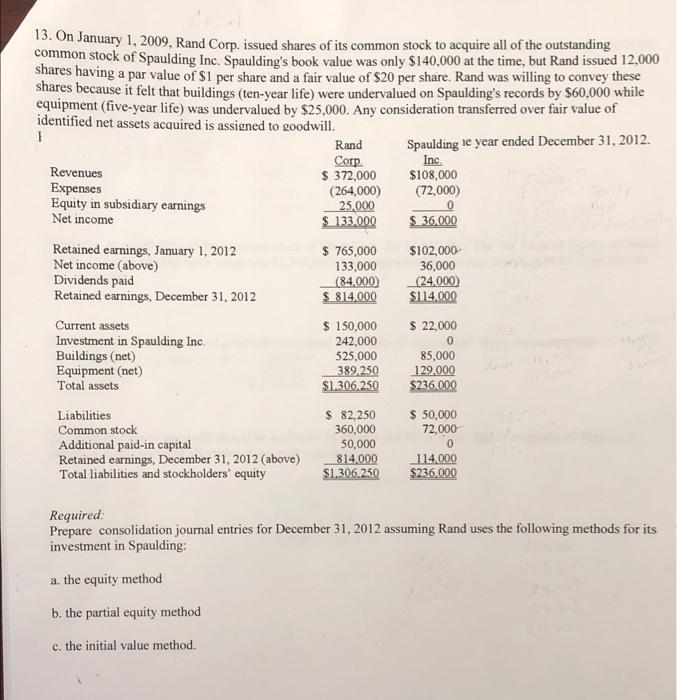

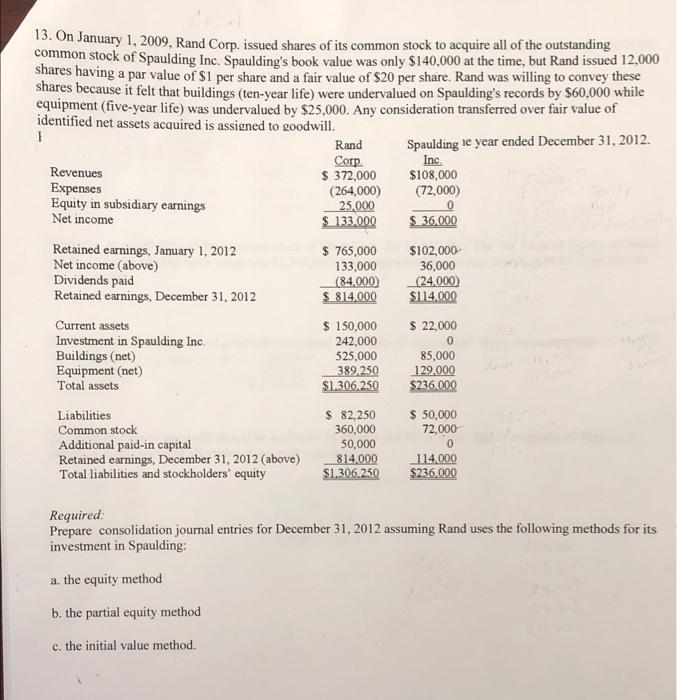

13. On January 1, 2009, Rand Corp. issued shares of its common stock to acquire all of the outstanding common stock of Spaulding Inc. Spaulding's book value was only $140,000 at the time, but Rand issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Rand was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Spaulding's records by $60,000 while equipment (five-year life) was undervalued by $25,000. Any consideration transferred over fair value of identified net assets acquired is assigned to goodwill. 1 Rand Spaulding te year ended December 31, 2012. Corp Inc Revenues $ 372,000 $108,000 Expenses (264,000) (72,000) Equity in subsidiary earnings 25,000 Net income $ 133.000 36.000 Retained earnings, January 1, 2012 $ 765,000 $102,000 Net income (above) 133,000 36,000 Dividends paid (84.000) (24.000) Retained earnings, December 31, 2012 $ 814,000 $114.000 Current assets $ 150,000 $ 22,000 Investment in Spaulding Inc, 242,000 Buildings (net) 525,000 85,000 Equipment (net) 389 250 129.000 Total assets $1.306.250 $236.000 Liabilities $ 82,250 $ 50,000 Common stock 360,000 72,000 Additional paid-in capital 50,000 Retained earnings, December 31, 2012 (above) 814.000 114.000 Total liabilities and stockholders' equity S1.306.250 $236.000 0 0 Required: Prepare consolidation journal entries for December 31, 2012 assuming Rand uses the following methods for its investment in Spaulding: a. the equity method b. the partial equity method c. the initial value method

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started