How do I calculate the WACC in ecxel?

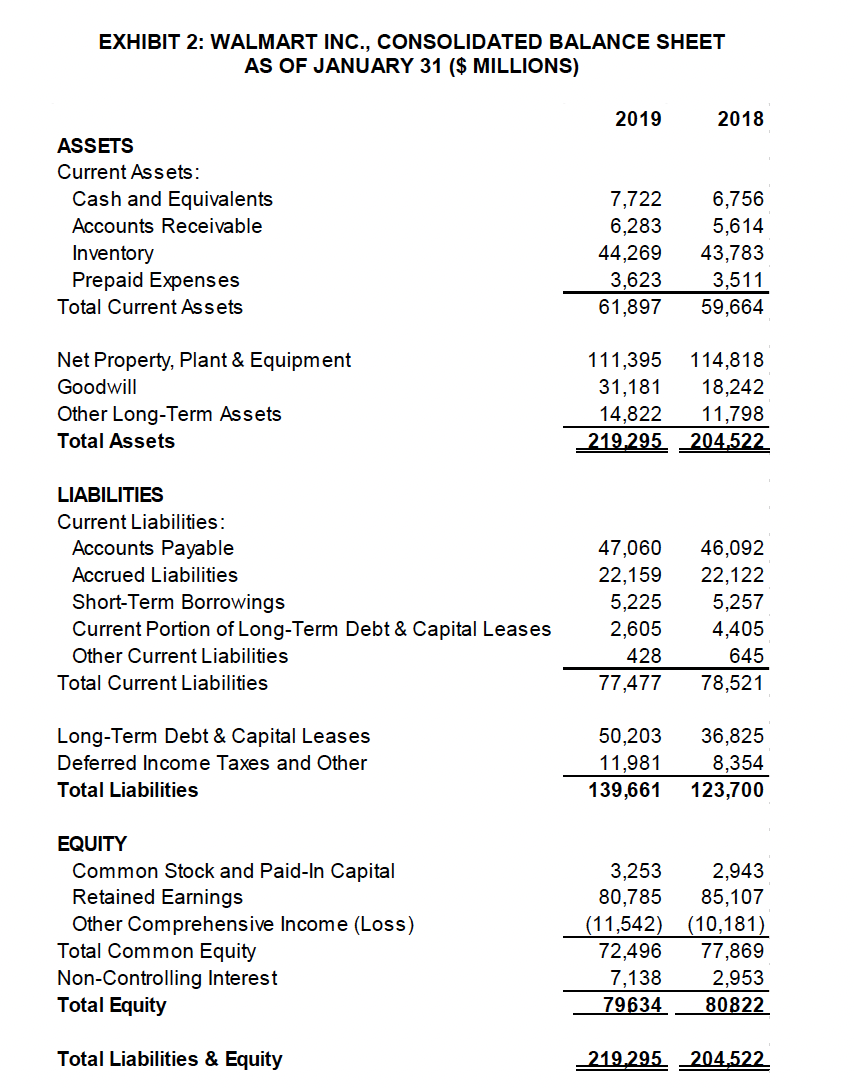

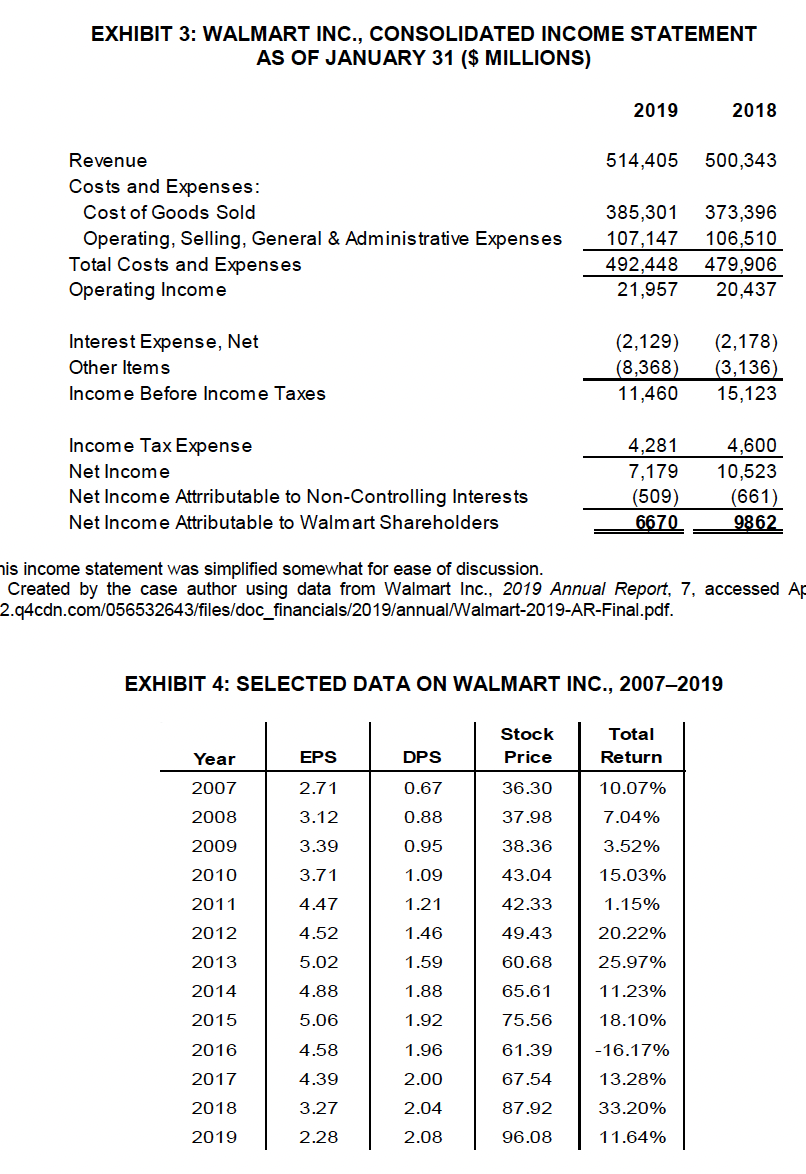

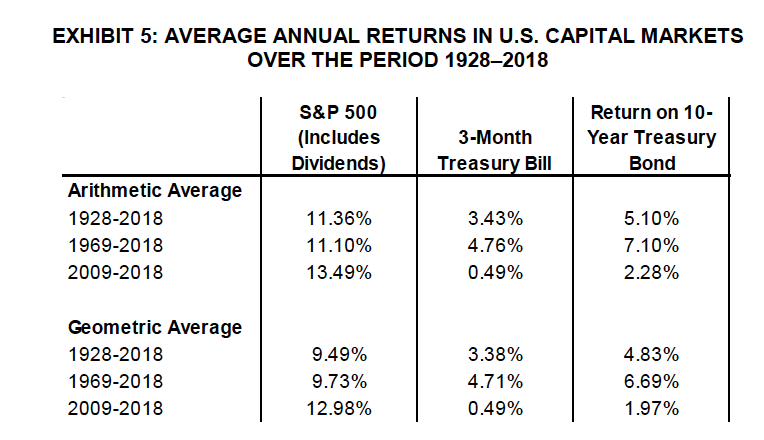

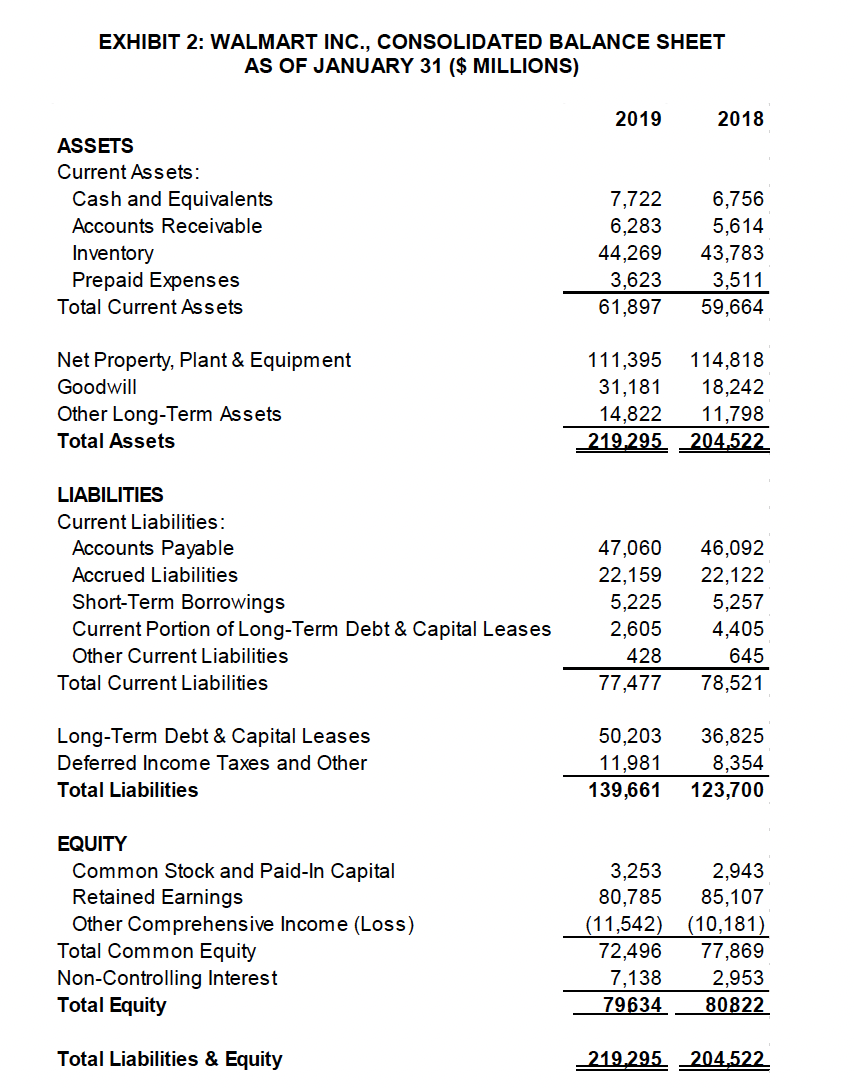

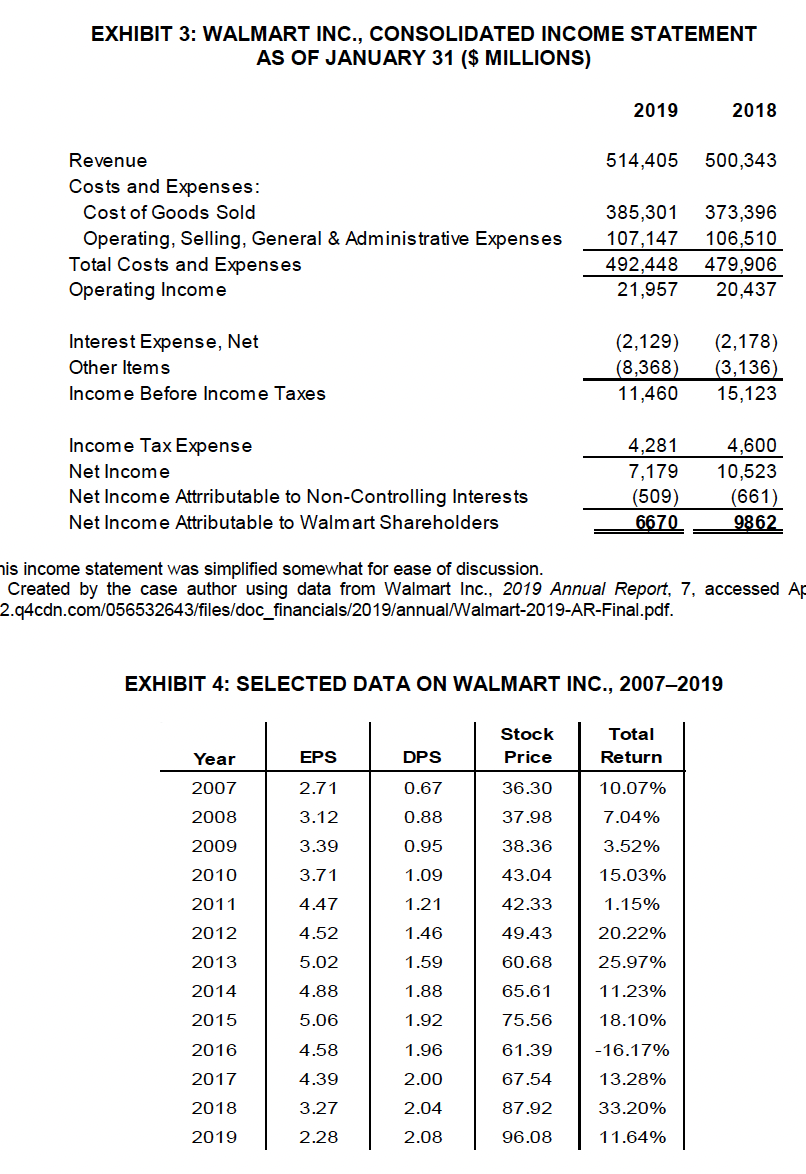

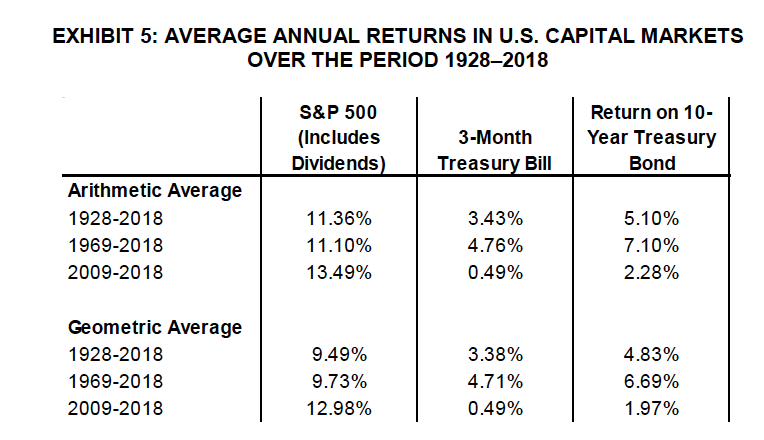

EXHIBIT 2: WALMART INC., CONSOLIDATED BALANCE SHEET AS OF JANUARY 31 (\$ MILLIONS) ASSETSCurrentAssets:CashandEquivalentsAccountsReceivableInventoryPrepaidExpensesTotalCurrentAssetsNetProperty,Plant&EquipmentGoodwillOtherLong-TermAssetsTotalAssets20197,7226,28344,2693,62361,897111,39531,18121,822204,522,20186,7565,61443,7833,51159,664114,81818,24211,798 LIABILITIES Current Liabilities: \begin{tabular}{lrr} Accounts Payable & 47,060 & 46,092 \\ Accrued Liabilities & 22,159 & 22,122 \\ Short-Term Borrowings & 5,225 & 5,257 \\ Current Portion of Long-Term Debt \& Capital Leases & 2,605 & 4,405 \\ Other Current Liabilities & 428 & 645 \\ \cline { 2 - 3 } Total Current Liabilities & 77,477 & 78,521 \\ & & \\ Long-Term Debt \& Capital Leases & 50,203 & 36,825 \\ Deferred Income Taxes and Other & 11,981 & 8,354 \\ \hline Total Liabilities & 139,661 & 123,700 \end{tabular} EQUITY Common Stock and Paid-In Capital Retained Earnings Other Comprehensive Income (Loss) Total Common Equity Non-Controlling Interest Total Equity \begin{tabular}{rr} 3,253 & 2,943 \\ 80,785 & 85,107 \\ (11,542) & (10,181) \\ \hline 72,496 & 77,869 \\ 7,138 & 2,953 \\ \hline 79634 & 80822 \\ \hline \end{tabular} EXHIBIT 3: WALMART INC., CONSOLIDATED INCOME STATEMENT AS OF JANUARY 31 (\$ MILLIONS) nis income statement was simplified somewhat for ease of discussion. Created by the case author using data from Walmart Inc., 2019 Annual Report, 7, accessed A 2.q4cdn.com/056532643/files/doc_financials/2019/annual/Walmart-2019-AR-Final.pdf. EXHIBIT 4: SELECTED DATA ON WALMART INC., 2007-2019 EXHIBIT 5: AVERAGE ANNUAL RETURNS IN U.S. CAPITAL MARKETS OVER THE PERIOD 1928-2018 EXHIBIT 2: WALMART INC., CONSOLIDATED BALANCE SHEET AS OF JANUARY 31 (\$ MILLIONS) ASSETSCurrentAssets:CashandEquivalentsAccountsReceivableInventoryPrepaidExpensesTotalCurrentAssetsNetProperty,Plant&EquipmentGoodwillOtherLong-TermAssetsTotalAssets20197,7226,28344,2693,62361,897111,39531,18121,822204,522,20186,7565,61443,7833,51159,664114,81818,24211,798 LIABILITIES Current Liabilities: \begin{tabular}{lrr} Accounts Payable & 47,060 & 46,092 \\ Accrued Liabilities & 22,159 & 22,122 \\ Short-Term Borrowings & 5,225 & 5,257 \\ Current Portion of Long-Term Debt \& Capital Leases & 2,605 & 4,405 \\ Other Current Liabilities & 428 & 645 \\ \cline { 2 - 3 } Total Current Liabilities & 77,477 & 78,521 \\ & & \\ Long-Term Debt \& Capital Leases & 50,203 & 36,825 \\ Deferred Income Taxes and Other & 11,981 & 8,354 \\ \hline Total Liabilities & 139,661 & 123,700 \end{tabular} EQUITY Common Stock and Paid-In Capital Retained Earnings Other Comprehensive Income (Loss) Total Common Equity Non-Controlling Interest Total Equity \begin{tabular}{rr} 3,253 & 2,943 \\ 80,785 & 85,107 \\ (11,542) & (10,181) \\ \hline 72,496 & 77,869 \\ 7,138 & 2,953 \\ \hline 79634 & 80822 \\ \hline \end{tabular} EXHIBIT 3: WALMART INC., CONSOLIDATED INCOME STATEMENT AS OF JANUARY 31 (\$ MILLIONS) nis income statement was simplified somewhat for ease of discussion. Created by the case author using data from Walmart Inc., 2019 Annual Report, 7, accessed A 2.q4cdn.com/056532643/files/doc_financials/2019/annual/Walmart-2019-AR-Final.pdf. EXHIBIT 4: SELECTED DATA ON WALMART INC., 2007-2019 EXHIBIT 5: AVERAGE ANNUAL RETURNS IN U.S. CAPITAL MARKETS OVER THE PERIOD 1928-2018